Bitcoin (BTC) Price Drops Below $70,000 as ETF Outflows and Fed Concerns Mount

TLDR

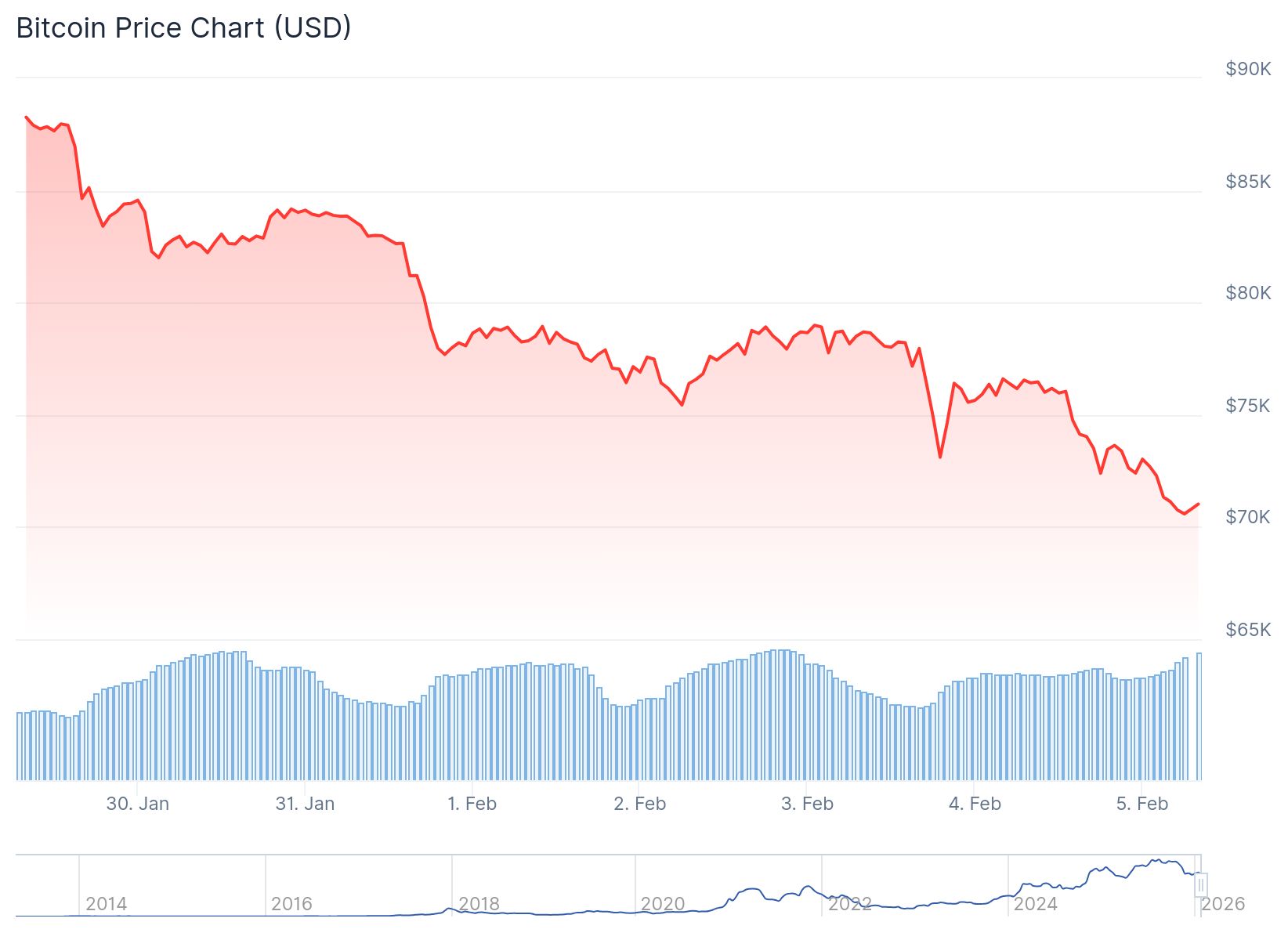

- Bitcoin dropped below $70,000 on Thursday, hitting lows of $69,101 on Bitstamp exchange during Asian trading hours

- The cryptocurrency has fallen nearly 20% year-to-date, with over $800 million liquidated from the crypto market in the last 24 hours

- Kevin Warsh’s nomination as Federal Reserve Chair triggered selling due to expectations he could shrink the Fed’s balance sheet

- U.S. spot Bitcoin ETFs saw outflows exceeding $3 billion in January alone, following $2 billion and $7 billion outflows in December and November

- Rising tensions between the U.S. and Iran after reported collapse of diplomatic talks added pressure to crypto markets

Bitcoin crashed below the key $70,000 level on Thursday morning. The world’s largest cryptocurrency hit a low of $69,101 on Bitstamp exchange during Asian trading hours.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The decline marks Bitcoin’s lowest point since November 2024. Prices on other major exchanges including Coinbase also tested the $70,000 support level, with BTC touching $70,002.

Bitcoin has now fallen nearly 20% year-to-date. The cryptocurrency peaked above $126,000 in early October before entering a sustained downtrend.

Ethereum also suffered losses, dropping nearly 2% to $2,086.11. A move below $2,000 would represent the first time since May of last year for the second-largest cryptocurrency.

The selling accelerated after President Trump nominated Kevin Warsh as the next Federal Reserve Chair. Market participants fear Warsh could push for a smaller Fed balance sheet.

Cryptocurrencies have historically benefited from Fed liquidity. The digital assets tended to rally when the central bank expanded its balance sheet to support markets.

Institutional Money Exits Bitcoin

Deutsche Bank analysts pointed to massive institutional withdrawals as the primary driver of the decline. U.S. spot Bitcoin ETFs witnessed outflows exceeding $3 billion in January.

The funds saw $2 billion leave in December and $7 billion exit in November. The steady selling suggests traditional investors are losing interest in digital assets.

The crypto market saw over $800 million in liquidations over the last 24 hours. Leveraged positions continue getting washed out as prices decline.

Geopolitical Tensions Add Pressure

Rising tensions between the United States and Iran contributed to market weakness. Reports indicated that planned diplomatic talks between the two countries this Friday look unlikely to happen.

President Trump had previously warned of potential military action. The geopolitical uncertainty added to selling pressure across risk assets including cryptocurrencies.

Michael Saylor’s Strategy company faces mounting unrealized losses on its Bitcoin holdings. The firm’s BTC investment shows an unrealized loss exceeding $2.6 billion.

Strategy holds 713,502 Bitcoin acquired at an average price of $76,052 per coin. The company’s stock fell 7% as Bitcoin prices declined.

Some analysts expect further downside ahead. Investment bank Stiffel warned Bitcoin could fall to as low as $38,000 based on past cycles and current market conditions.

Polymarket data shows a 73% probability that Bitcoin will hit $70,000 this month. Traders are increasing bets on continued weakness in the near term.

Bitcoin traded around $73,000 at the time of latest reports after briefly touching $72,000 earlier in the session.

The post Bitcoin (BTC) Price Drops Below $70,000 as ETF Outflows and Fed Concerns Mount appeared first on CoinCentral.

You May Also Like

XRP Price Hits $1.50 As New PayFi Alternative Sees Crypto Wallet Downloaded Over 100,000 Times

Coinbase Joins Ethereum Foundation to Back Open Intents Framework