Binance Completes Second Bitcoin Purchase for SAFU, Adding 1,315 BTC

- Binance purchased another 1,315 BTC for its SAFU fund this week.

- The acquisition is part of a plan to turn its stablecoin reserves worth up to $1 billion into Bitcoin.

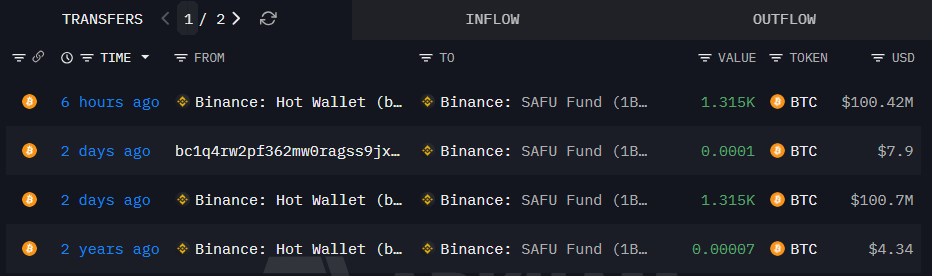

One of the world’s biggest crypto exchanges, Binance, has made additions to its Secure Asset Fund for Users (SAFU) by acquiring 1,315 BTC worth $100 million, according to Arkham data. This is the second acquisition of Bitcoin by Binance as part of its plan to turn up to $1 billion worth of its stablecoin reserves in the SAFU fund into Bitcoin within 30 days.

The SAFU fund is an emergency fund that was established to protect users against extreme hacks or platform failures. The fund was established by allocating a portion of the trading fees to it. SAFU has always maintained stablecoin reserves to ensure liquidity. Now, Binance has announced its intention to turn these reserves into Bitcoin. This will be a significant component of the reserve to protect users.

Second BTC Purchase Boosts SAFU Reserves

The purchase of 1,315 BTC raises the total SAFU reserves of Bitcoin to 2,630 BTC, valued at $201 million at the current market rate. Binance has confirmed the completion of this second round of conversions. It also reaffirmed its commitment to its earlier strategy. The exchange has updated its X that it is on course to complete the entire conversion of the fund to BTC. And it said this would happen in 30 days following launch.

The data from the blockchain analytics confirmed the transfer of Bitcoin from Binance-controlled accounts to the SAFU fund address. Thus, this ensures a transparent on-chain record of reserve accumulation. Analysts have highlighted this move is in line with Binance’s plan to accumulate wallet reserves while providing a safety net.

Binance has adopted this plan during high volatility, with Bitcoin prices remaining above key levels but under pressure. The SAFU fund’s restructured reserves are now directly correlated with Bitcoin price movements. This links the user protection reserves with the cryptocurrency market dynamics. This is a major departure from the stablecoin reserves, which have traditionally maintained a predictable valuation irrespective of Bitcoin price movements.

However, Binance’s decision to utilize its large reserves of Bitcoin may pose a risk to the exchange. But it also ensures that the reserves at SAFU are now in line with what Binance perceives as a basic asset in the crypto world. The clever conversion on the blockchain shows how large exchanges are handling the custody. And the transparency of the transactions shows the risk posed by the current market conditions.

Binance’s purchase of an additional 1,315 BTC for the SAFU fund shows that Binance is committed to its strategy. It is diversifying its emergency reserves from stable assets to Bitcoin. With the current SAFU reserve at 2,630 BTC, Binance is also on track with its 30-day conversion plan. As this aims to restructure the reserves while meeting the user protection requirement.

Highlighted Crypto News:

TRM Labs: U.S. Treasury Probing Crypto Exchanges Over Iran Sanctions Evasion

You May Also Like

CME Group to Launch Solana and XRP Futures Options

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus