Metaplanet files shelf registration for 555 billion yen worth of shares backed by BTC

Metaplanet files a plans to raise 555 billion yen by issuing two separate classes of BTC-backed shares over the next two years. The funds will go to its ambitious 2027 BTC acquisition goal.

- Metaplanet plans to pivot from common shares to preferred shares issuance to raise more funds to buy BTC.

- The Japanese investment company aims to hold 210,000 BTC by 2027.

In a recent company notice, the Japanese investment firm and Bitcoin (BTC) treasury announced plans that it will be raising a considerable number of its authorized shares, more specifically by issuing more preferred shares compared to common shares.

Unlike common shares, preferred shares are not typically linked to voting rights at shareholder meetings. In other instances, the voting rights of preferred shares are limited. According to the clarification document issued by Metaplanet, preferred shares serve a different purpose when held by companies.

“For companies, preferred shares serve as a means of raising capital while minimizing the dilution of common shares,” wrote the company in its notice.

Furthermore, the company stated that in the event of liquidation, preferred shareholders have the right to receive distributions of remaining assets before common shareholders.

The company explained that the issuance of preferred shares will be backed Bitcoin. According to Metaplanet, the goal of issuing preferred shares instead of common shares is to “enhance flexibility in capital policy and diversify financing options.”

The shares will be divided into two classes: Class A “Non-Convertible” Perpetual Preferred Shares and Class B “Convertible” Perpetual Preferred Shares. Each batch will consist of shares worth 277.5 billion yen. The shelf registration gives the company flexibility to issue these shares at any time over the next two years, until August 2027.

Metaplanet’s BTC milestone goal for 2027

So far, the firm has been primarily raising funds through common shares issuance to support their Bitcoin acquisition strategy.

Recently, it stated in a recent QnA file that it has been considering other types of shares issuance other than common shares. However, the issuance of preferred shares still depends on shareholders’ approval at the Annual General Meeting for the proposal.

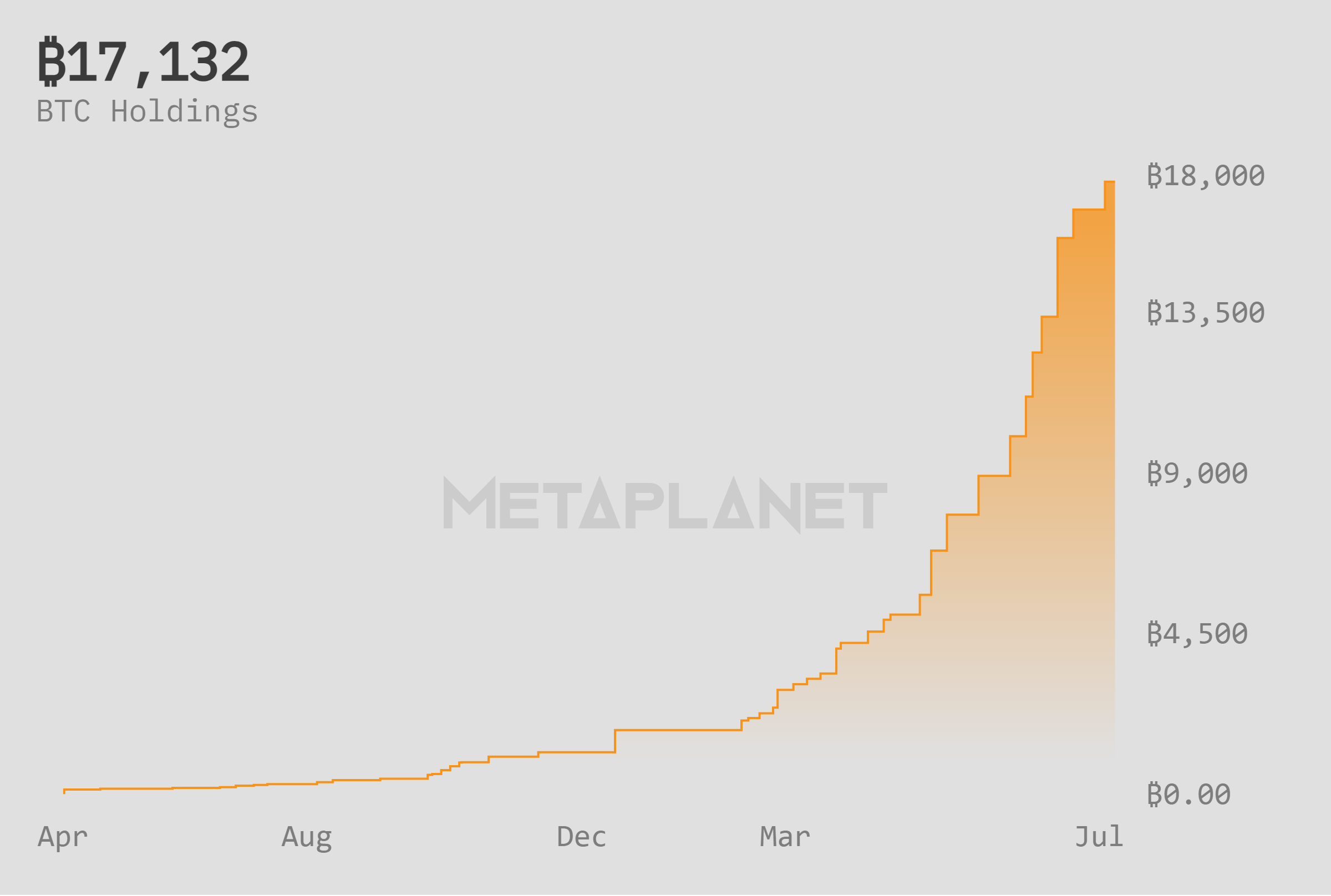

At press time, Metaplanet holds a total of 17,132 BTC in its holdings with each BTC valued at an average price of $114,964, based on data from the firm’s official site. The holdings boast a BTC Yield of 449.7% on a year-to-date basis.

Previously in early June, Metaplanet announced its goal to hold at least 210,000 BTC by the end of 2027. If the firm does manage to own 210,000 BTC by 2027, then it would own 1% out of the total existing Bitcoin supply in the world.

To achieve this goal, the firm has raised its annual target for 2026 from just 21,000 BTC to 100,000 BTC. The leap signifies a nearly five-fold leap from its previous BTC acquisition goal.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push