Strategy Bets Big: $4.2B STRC Offering Targets Massive Bitcoin Purchase

Bitcoin heavyweight Strategy has launched a fresh $4.2 billion at-the-market (ATM) equity program for its STRC preferred shares, deepening its commitment to an aggressive equity-to-Bitcoin acquisition strategy.

The filing, submitted to the SEC and announced late Thursday, follows the company’s strongest quarterly performance on record and comes amid a sharp expansion of its Bitcoin treasury.

The STRC program, designed for Variable Rate Series A Perpetual Stretch Preferred Stock, provides Strategy with the flexibility to raise capital over time, depending on market conditions. Proceeds from the offering are expected to be channeled into general corporate purposes, including working capital and dividends on previously issued preferred shares.

However, consistent with Strategy’s stated objectives, a major portion is anticipated to be allocated directly to purchasing additional Bitcoin.

The move builds on the momentum of four other ATM programs already in operation. Each has allowed Strategy to convert investor capital into digital assets, reinforcing CEO Michael Saylor’s long-standing belief in Bitcoin as a superior corporate treasury asset.

The firm’s filing indicates its intent to continue leveraging equity markets to support its expanding crypto strategy, which now spans multiple asset classes and preferred share structures.

Saylor’s Strategy: Profits, BTC, and Scalable Capital Programs Amid Soaring Equity Demand

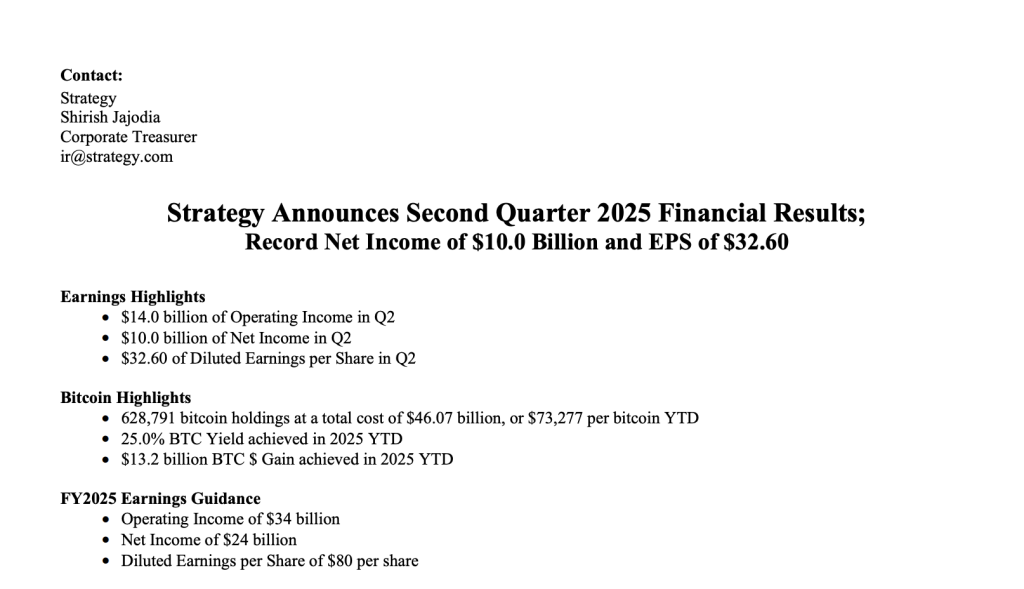

Strategy’s second-quarter earnings report, released just after the STRC announcement, showed a sharp rise in profitability. Net income surged to over $2.3 billion, driven by unrealized gains on Bitcoin holdings during a quarter when the price of BTC soared above $110,000. This represented a nearly 140% increase from Q1, indicating the material impact of the company’s digital asset position on its bottom line.

Source: Strategy

Source: Strategy

Its Bitcoin holdings, which stood at 628,212 BTC as of July 29, are currently valued at roughly $69.4 billion. This includes a recent purchase of 14,620 BTC disclosed earlier this week, acquired using proceeds raised through existing ATM equity programs.

SEC filings show that between July 14 and July 20, Strategy raised over $740 million by selling multiple classes of shares, a mix of common and preferred.

Strategy’s momentum is also visible in its capital markets activity, which has generated more than $10.5 billion in gross proceeds in just the last four months. Between April and the end of June, the company secured $6.8 billion through multiple stock issuance programs.

An additional $3.7 billion was raised between July 1 and July 29 across both public offerings and ATM facilities. A sizable portion of that capital is already being recycled into Bitcoin.

The largest tranche came from Strategy’s Common Stock ATM Program, which brought in over $6.3 billion during that time frame through the issuance of nearly 16.7 million shares. Even after those sales, $17 billion remains authorized under its May 2025 common equity program.

In addition to common equity, Strategy is leveraging preferred shares across several new products. Its STRK ATM program generated over $518 million during the same period, while the STRF ATM program raised approximately $219 million. The company’s May IPO of STRD stock added $979 million, and its follow-up STRD ATM launch in July has raised $17.9 million so far, with $4.2 billion still available.

STRC itself also saw a strong cash infusion even before the ATM program was announced. Strategy raised $2.5 billion in its initial STRC stock offering, selling over 28 million shares at $90 each.

The preferred stock includes a variable monthly dividend, with the first $0.80 payout declared on July 31 and scheduled to be paid on August 31 to shareholders of record as of August 15.

You May Also Like

Adam Wainwright Takes The Mound Again Honor Darryl Kile

Gold firms on reports Khamenei killed in Israeli strikes