2025 Crypto Lawsuits Nearly Match Entire 2024 Total in Just Six Months, Cornerstone Research Reports

Crypto-related lawsuits in the United States have surged dramatically in 2025, with six cases filed during the first half of the year approaching the total of seven lawsuits recorded throughout all of 2024, a new report from Cornerstone Research indicates.

According to Cornerstone’s July 30 “Securities Class Action” report, the six cryptocurrency-related legal filings in the first half of 2025 targeted various industry participants.

Three cases were directed at cryptocurrency issuers, while one targeted a digital asset mining operation.

The remaining two lawsuits focused on what the research firm categorized as “cryptocurrency-adjacent entities”, companies involved in activities such as manufacturing mining equipment, attempting market entry into digital assets, or establishing partnerships with crypto firms.

114 Securities Lawsuits Filed As Crypto Leads Multi-Sector Legal Surge

Notably, the law firm Burwick Law initiated three of the six crypto-related complaints filed this year, representing 50% of all such cases.

Source: Cornerstone Research

Source: Cornerstone Research

Among their high-profile actions were legal challenges against the meme coin platform Pump.fun and parties connected to the shady LIBRA memecoin project.

The research shows that private investors continue pursuing civil remedies against cryptocurrency companies despite reduced enforcement activity from federal agencies, including the Department of Justice (DOJ) and Securities and Exchange Commission (SEC), following policy shifts under the Trump administration.

The cryptocurrency sector represents part of a larger securities litigation trend.

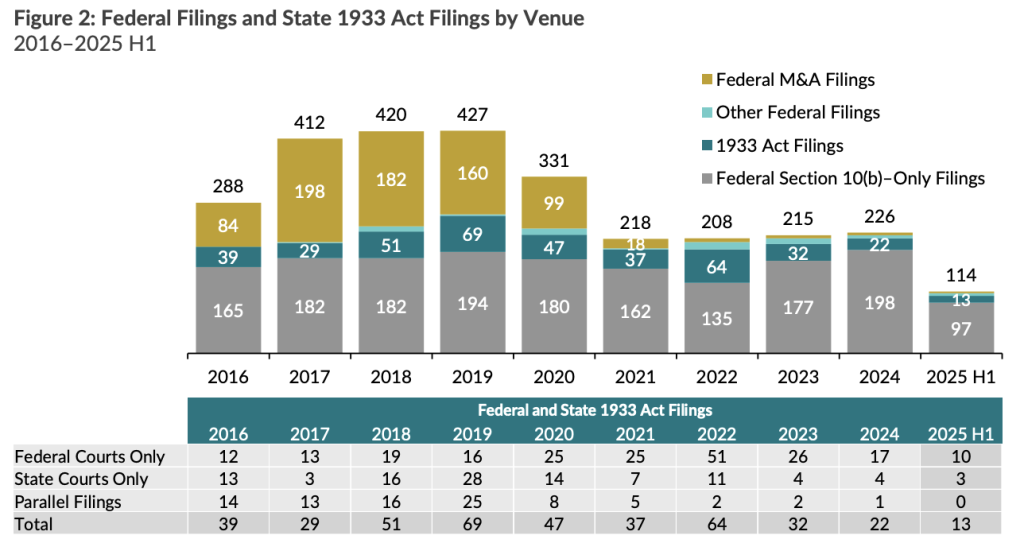

During the first six months of 2025, plaintiffs filed 114 securities class-action lawsuits claiming financial damages across multiple sectors, including cryptocurrency, artificial intelligence, cybersecurity, COVID-19-related businesses, and special purpose acquisition companies (SPACs).

This figure aligns closely with the historical six-month average of 113 cases and the 115 filings recorded in the second half of 2024.

Legal activity showed significant quarterly variation, with 67 cases filed in Q1 2025 compared to 47 in Q2 2025, indicating front-loaded litigation activity.

Recent High-Profile Crypto Lawsuits

The upward trajectory in crypto-related litigation has materialized through several significant cases targeting major industry players.

In May, cryptocurrency exchange Coinbase faced a shareholder class-action suit alleging the company failed to provide timely disclosure of a substantial data breach and regulatory compliance violation.

The complaint asserts that investors experienced considerable financial harm due to these alleged disclosure failures.

That same month, on May 19, MicroStrategy (now known as Strategy), a bitcoin treasury corporation, became the subject of class-action litigation over purportedly misleading communications regarding its bitcoin investment approach.

The legal filing alleged that the company concealed associated investment risks, pointing to a $5.9 billion unrealized first-quarter loss that prompted an 8.67% decline in MSTR stock price, negatively impacting shareholder value

Several ongoing legal disputes involve Burwick Law, the New York-based firm specializing in cryptocurrency investor advocacy.

In February, the meme coin creation platform Pump.fun encountered legal challenges when Burwick Law, in partnership with Wolf Popper LLP, issued a cease and desist notice alleging unauthorized intellectual property usage and unregistered securities violations related to the Peanut the Squirrel (PNUT) token.

April saw Burwick Law questioning the business practices of NFT infrastructure platform Metaplex, characterizing the company’s activities as ethically problematic and potentially unlawful.

The lawsuit targeted the primary protocol supporting Solana’s NFT ecosystem and alleged that Metaplex attempted to transfer over 54,000 unclaimed SOL tokens, valued at approximately $7.3 million, into its decentralized autonomous organization treasury.

You May Also Like

FCA, crackdown on crypto

Bitcoin struggles at $113K as Fed's Bowman hints at faster rate cuts

Bitcoin traders revealed new BTC price bottom targets as BTC price action wobbles, while a dovish Fed speech offered bulls little relief. Key points:Bitcoin faces problems recovering from its dip to $112,000 as traders agree on the odds of a fresh dip.Nasdaq Performance is on the radar as overheated RSI conditions raise concerns over a crypto knock-on effect. Read more