World Liberty Financial bets $10m on Falcon’s cross-chain stablecoin play

WLFI’s capital injection into Falcon Finance marks a new phase in stablecoin evolution, one focused on back-end interoperability rather than token proliferation. The $10 million will fund tools that enable dollar assets to move seamlessly across ecosystems.

- World Liberty Financial has invested $10 million in Falcon Finance to advance cross-chain stablecoin infrastructure.

- The deal bridges WLFI’s fiat-backed USD1 and Falcon’s crypto-collateralized USDf to enable seamless interoperability.

According to a press release dated July 30, World Liberty Financial (WLFI) has committed $10 million to Falcon Finance, a universal collateralization protocol specializing in cross-chain liquidity.

The investment will accelerate development of shared liquidity pools, multi-chain smart contract modules, and frictionless conversions between Falcon’s USDf and WLFI’s USD1 stablecoin. The move comes just weeks after Falcon surpassed $1 billion in circulating supply, signaling growing institutional demand for alternatives to traditional fiat-pegged tokens.

Bridging two visions of digital dollars

The partnership between Falcon Finance and World Liberty Financial represents a convergence of two distinct approaches to stablecoins. Falcon’s model relies on a dynamic, overcollateralized system where crypto assets back its synthetic dollar, USDf. This allows for flexibility in volatile markets while maintaining stability through risk-adjusted reserves.

WLFI, on the other hand, brings USD1, a fully fiat-backed stablecoin redeemable 1:1 with traditional cash reserves. By integrating these systems, the two protocols are effectively creating a hybrid infrastructure that combines the capital efficiency of crypto collateral with the trust and stability of fiat reserves.

This synergy addresses the critical pain point of liquidity silos in DeFi: liquidity silos. Most stablecoins today are either chain-bound or require cumbersome bridging mechanisms, creating inefficiencies for traders and institutions. Falcon’s multi-chain smart contract modules, now turbocharged by WLFI’s $10 million investment, aim to dissolve those barriers.

The collaboration also signals a maturation in stablecoin design. For years, the space has been divided between purists advocating for full fiat backing and DeFi maximalists pushing for decentralized, crypto-native alternatives.

Falcon and WLFI are betting that the future lies in coexistence, leveraging the strengths of both models to serve different use cases. Retail users might prefer the familiarity of USD1’s direct dollar peg, while institutions could opt for USDf’s capital efficiency in leveraged strategies.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

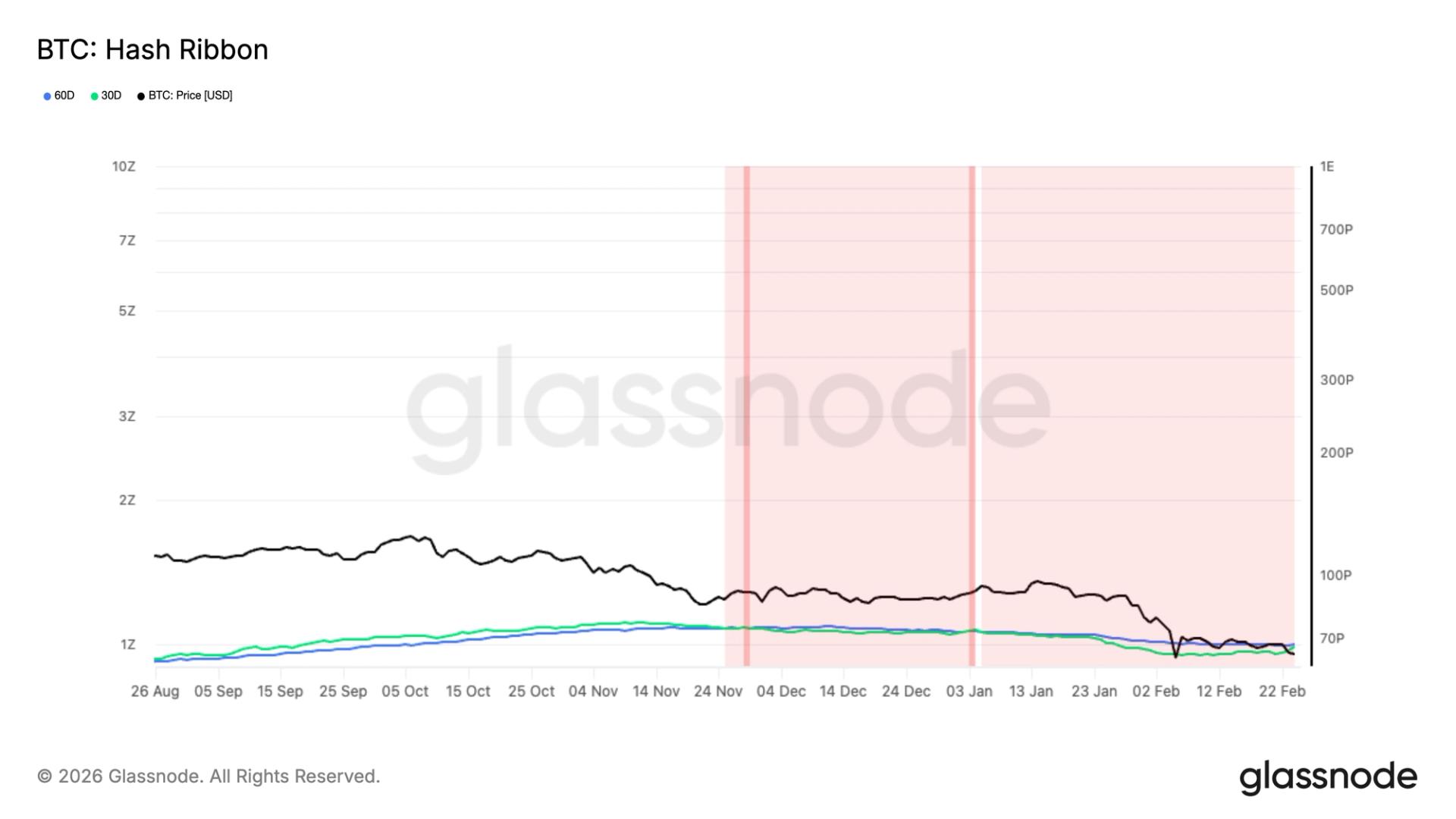

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail