Financing Weekly Report | 8 public financing events; AlloyX, a stablecoin aggregation sales infrastructure platform, completed a $10 million Pre-A round of financing

Highlights of this issue

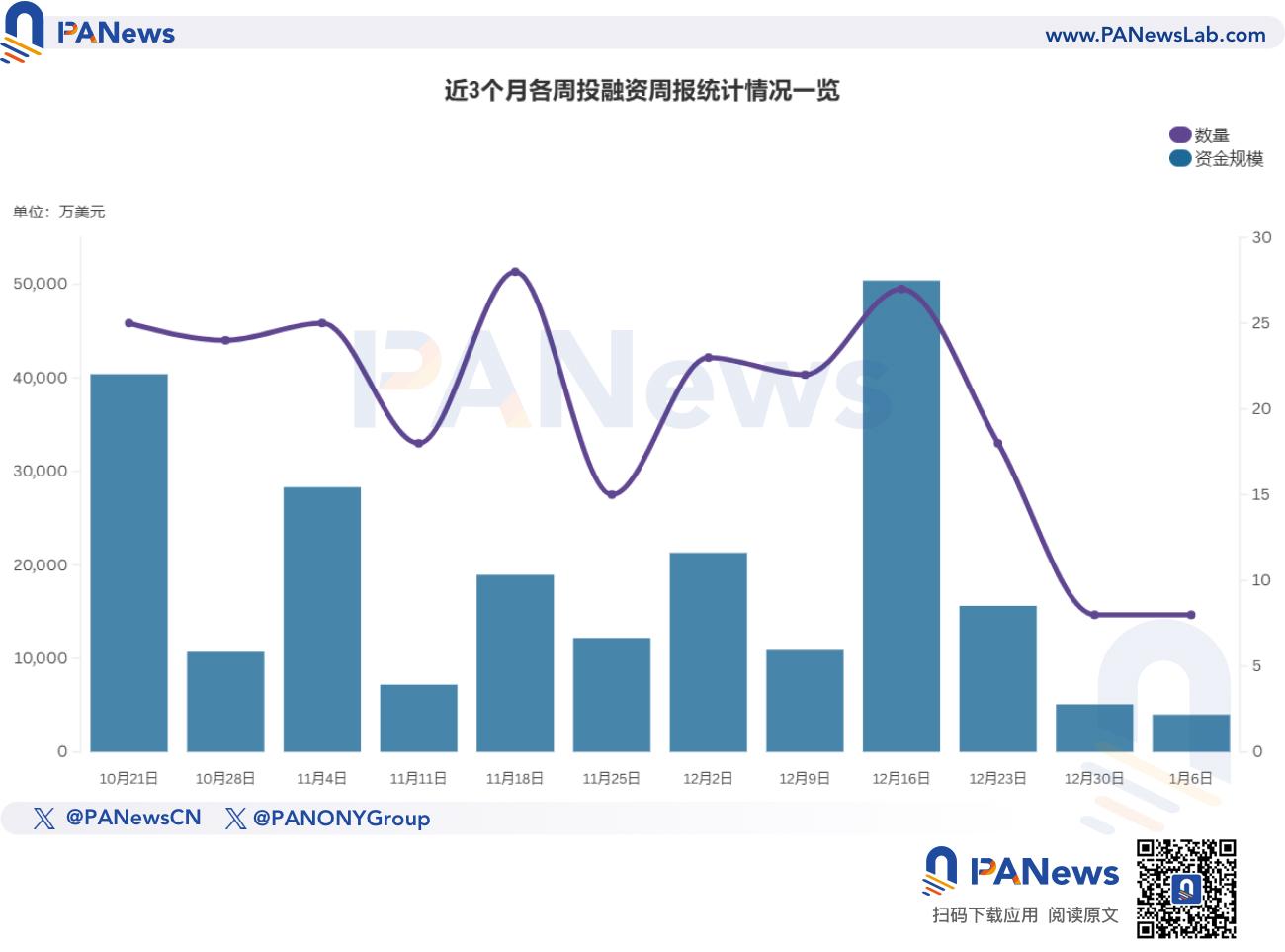

According to incomplete statistics from PANews, there were 8 investment and financing events in the global blockchain last week (December 30-January 5), with a total funding amount of over US$40 million. The funding amount has decreased compared with the previous week. The overview is as follows:

- DeFi announced four investment and financing events, among which AlloyX announced the completion of a $10 million Pre-A round of financing, with participation from Arbitrum Foundation and others;

- The DePIN track announced one investment and financing event. The decentralized GPU network Inferix announced that it received $2.6 million in investment from DePIN X Capital;

- The Infrastructure & Tools sector announced two investment and financing events, among which Bitcoin staking protocol Babylon received $5.3 million in investment from BingX Labs;

- Centralized finance announced one investment and financing event. Bitcoin financial services company Fold announced that it has completed $20 million in convertible bond financing provided by ATW Partners.

DeFi

AlloyX, a stablecoin aggregation sales infrastructure platform, completes $10 million in Pre-A round of financing

AlloyX, an Asia-based aggregation sales infrastructure platform, announced the completion of a $10 million Pre-A round of financing to expand global stablecoin infrastructure construction and plans to expand its business in the UAE, ASEAN and Africa. It is reported that investors in this round of financing include Solomon Fund, Arbitrum Foundation, Offchain Labs, PMT Capital, Ming Capital, Fern Win Capital, Whitecove Capital and Kiln SAS. This financing follows major developments in the stablecoin payment field, including Stripe's acquisition of Bridge for $1.1 billion and BVNK's $50 million Series B financing at a valuation of $750 million.

Binance Labs announces investment in THENA

Binance Labs announced an investment in THENA, a decentralized exchange (DEX) and liquidity protocol based on BNB Chain. The financing will be used to accelerate the development and expansion of the THENA platform, enhance security measures, expand user growth, strengthen partnerships within the BNB Chain ecosystem, and promote DeFi innovation. Founded in January 2023, THENA adopts an innovative ve(3,3) token economic model and is committed to building a comprehensive liquidity layer that integrates the best features of leading DeFi protocols into one platform to improve security, scalability and user experience, and promote the popularity of decentralized finance (DeFi).

Sui Ecosystem Liquidity Staking Agreement Haedal Protocol Completes Seed Round Financing, with Hashed, Animoca Ventures and Others Participating

Haedal Protocol, the liquidity pledge agreement of Sui ecosystem, announced the completion of its seed round of financing, and the specific amount was not disclosed. Investors participating in this round of financing include Hashed, Comma3 Ventures, OKX Ventures, Animoca Ventures, Sui Foundation, Flow Traders, Dewhales Capital, Cetus, Scallop, etc. Haedal will use this financing and new resources to support the further development of its liquidity pledge infrastructure and on-chain income products focused on the Sui ecosystem. According to reports, Haedal aims to provide a way to maximize DeFi returns in the Sui ecosystem. Its mission is to simplify various income generation solutions in the financial world into one-click income products and lower the entry threshold for users. Haedal is about to release a series of new products and modules.

Aptos Ecosystem DEX Hyperfluid Completes Pre-Seed Round of Financing, BlockBooster and Others Participate in the Investment

Hyperfluid, a hybrid DEX and automated market maker on the Aptos ecosystem chain, announced the completion of its Pre-Seed round of financing, with participation from BlockBooster and Web3 incubator Ankaa. The specific amount has not been disclosed. The new funds are intended to be used to support its construction of order book transactions to realize asset swaps and transactions on the Aptos chain.

DePIN

Decentralized GPU network Inferix announces $2.6 million investment

Decentralized GPU network Inferix announced that it has received $2.6 million in investment from DePIN X Capital, which is supported by Hashkey Capital, FBG, Waterdrip Capital and IoTeX through the SuperNode program. According to reports, Inferix is a decentralized GPU visual computing platform dedicated to 3D/AR/VR rendering and AI inference. Its technical deployment plan is about to be completed and will be ready for testing soon. SuperNode GPU Staking Mining Testnet 1 is scheduled to be launched on IoTeX on January 2, 2025, and will focus on training AI models using NVIDIA H100 and high-end GPUs.

Infrastructure & Tools

JAN3 Completes $5 Million Seed Round, Tether Participates

Stablecoin issuer Tether forwarded financing information on the X platform, showing that Bitcoin technology company JAN3 has completed a $5 million seed round of financing, led by Fulgur Ventures, with participation from Grupo Salinas, Tether, Lightning Ventures, East Ventures, Plan B Fund, Bitcoin Opportunity Fund and NYDIG. As part of the current seed financing, JAN will allocate $1 million in funds to build a Bitcoin vault, including 12 BTC, with an average cost of $83,333.33 per BTC.

On-chain credit analysis company Accountable completes $2.3 million seed round of financing

Accountable, an on-chain credit analysis startup powered by ZK technology, has completed a $2.3 million seed round of financing, led by MitonC and Zee Prime Capital, with participation from angel investors such as Darius Rugys of Maven 11 and DCBuilder of Worldcoin Foundation. This round of financing will be used to pay employee salaries, and a new round of financing is planned for the second quarter of 2025. Accountable is committed to building a privacy-preserving data platform that provides borrowers with real-time verification of assets, liabilities, and transaction exposure through technologies such as zero-knowledge proofs and homomorphic encryption. Users can connect to custodial accounts, exchanges, etc. to generate credit risk reports and decide on the scope of sharing. The company aims to rebuild the uncollateralized loan ecosystem affected by the collapse of the crypto credit market in 2022 while ensuring privacy and data security. Accountable's technology can also be applied to scenarios such as proof of assets and liabilities to provide institutions and users with real-time and confidential financial information verification.

Centralized Finance

Fold Completes $20 Million Convertible Note Financing to Support Planned Merger with FTAC Emerald

Fold, a Bitcoin financial services company, announced that it has completed $20 million in convertible bond financing provided by ATW Partners, and plans to raise another $10 million at the discretion of both parties after completing the business merger with FTAC Emerald Acquisition Corp. The note is secured by Fold's assets (including some Bitcoin) and will mature three years after the company goes public. The conversion price is $11.50 per share, a premium over the merger valuation.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For