Kuda MFB to expand experience centres after national licence upgrade

Kuda Microfinance Bank plans to open more experience centres for customer support and community engagement after it received a licence from the Central Bank of Nigeria (CBN) to operate as a National Microfinance Bank, an upgrade that comes with an expectation of nationwide physical presence.

The move lifts the geographic restrictions that came with Kuda’s former unit microfinance bank licence, which, despite the borderless nature of its digital banking, limited its physical operations to a specific location. With a national licence, Kuda must expand its physical footprint, giving customers more options for in-person support while keeping digital banking as its core.

“Securing a national microfinance banking licence is an important step for us as a regulated institution,” said Musty Mustapha, MD/CEO of Kuda MFB, in a statement.

Kuda’s new licence reflects a broader effort by the CBN to align licencing structures with the real operational footprints of fast-growing fintechs. But the shift also pulls fintechs closer to the cost structure of traditional institutions: branches, staff, and heavier compliance, testing the low-overhead advantage that made digital banking cheaper and more agile.

On January 26, 2025, local media reported that the CBN had upgraded the MFB licences of major players, including Moniepoint and Opay, to a national one.

The apex bank said it upgraded these fintechs’ licences to match the scale of their operations, and to ensure their largely informal-sector customers can walk into offices nationwide to resolve complaints. In 2023, Moniepoint, with more than two million business accounts, averaged 433 million monthly transactions, with an annual transaction value of over $150 billion. In Q1 2025, OPay, with over 10 million daily active users, alongside PalmPa,y helped push Nigeria’s mobile money transactions to ₦20.71 trillion ($14.79 billion).

While the CBN’s licencing guidelines do not explicitly outline a direct path for unit MFBs to become national MFBs, they do for state MFBs. State MFBs seeking to upgrade to national status are expected to operate at least five branches, solidifying Kuda’s intention to roll out multiple offices in the coming months.

Beyond physical expansion, the licence also puts Kuda under stricter regulatory and disclosure requirements. National MFBs, for instance, must publish their annual accounts in a national daily newspaper for accountability.

The upgrade also significantly increases Kuda’s capital requirement. The expected minimum paid-up capital rises from ₦200 million ($142,808) as a tier-one unit MFB to ₦5 billion ($3.57 million) as a national MFB. In 2024, the company raised $20 million at a $500 million valuation.

Kuda said it will continue to lead with digital banking services, including transfers, payments, savings, and instant credit, while expanding physical touchpoints where needed.

“While we remain digital at our core, this licence gives us the flexibility to create more physical touchpoints where customers want in-person support or engagement, allowing us to serve Nigerians across the country in whichever ways are most convenient for them,” Mustapha said.

In Q1 2025, Kuda processed over 300 million transactions totalling ₦14.3 trillion ($10.21 billion) across its retail and business banking arms. The fintech also issued ₦16.4 billion ($11.71 million) in overdrafts in Q1 2025 (a 43% growth compared to the previous quarter).

Kuda added that its physical expansions are subject to regulatory approval. Opening a branch without the CBN’s approval comes with a ₦2 million ($1,428) fine from the CBN.

You May Also Like

Sygnum’s new bitcoin fund pulls in $65 million from investors looking for steady yield

Copy linkX (Twitter)LinkedInFacebookEmail

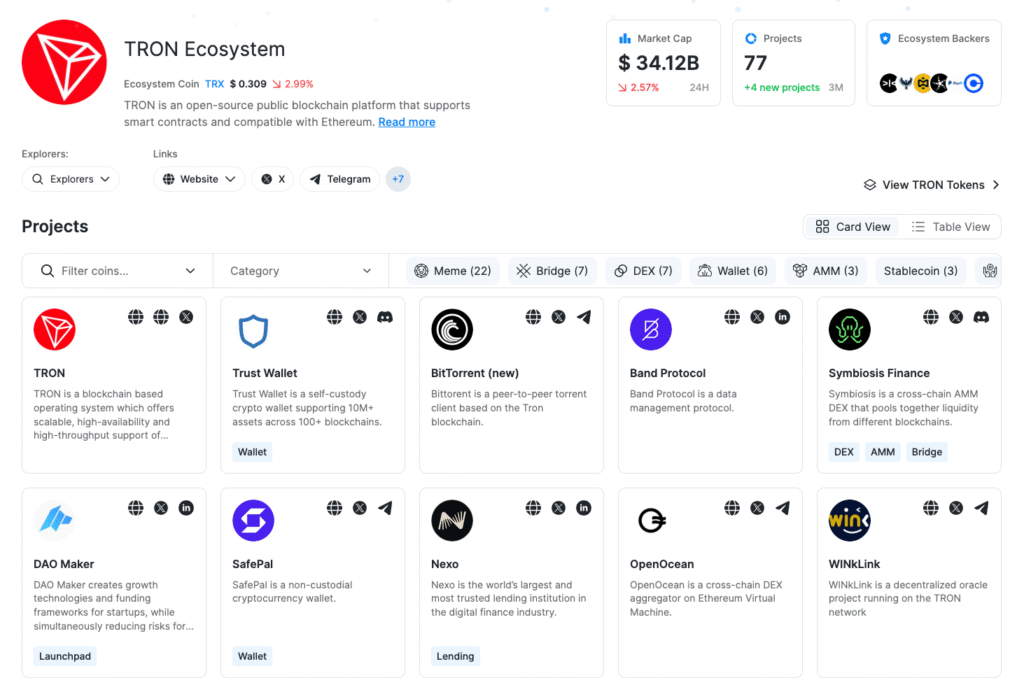

The State of TRON H2 2025: Stablecoin Settlement at Scale Amid Rising Competition