Federal Reserve Holds Rates Steady as Dollar Weakens to Four-Year Low

TLDR

- The Federal Reserve held interest rates steady at 3.5% to 3.75% on Wednesday, marking the first pause since July

- Two Fed officials dissented and voted for a 25-basis-point rate cut instead

- The US dollar hit four-year lows this week after its worst annual performance since 2017

- Bitcoin remained near $89,500 following the decision, while gold reached record levels near $5,300 per ounce

- Markets now price the probability of rate cuts at below 50% for the next two Fed meetings

The Federal Reserve kept interest rates unchanged on Wednesday, leaving the federal funds rate between 3.5% and 3.75%. The Federal Open Market Committee voted to pause rate cuts for the first time since July.

The decision was widely expected by investors. Markets priced in no change at nearly 99% heading into the meeting.

The Fed cited inflation concerns in its policy statement. Officials said job gains have remained low and unemployment has shown signs of stabilization. The statement also noted that inflation remains “somewhat elevated.”

Two officials broke from the majority decision. Recent Trump appointee Stephen Miran and Chris Waller both voted in favor of a 25-basis-point rate cut.

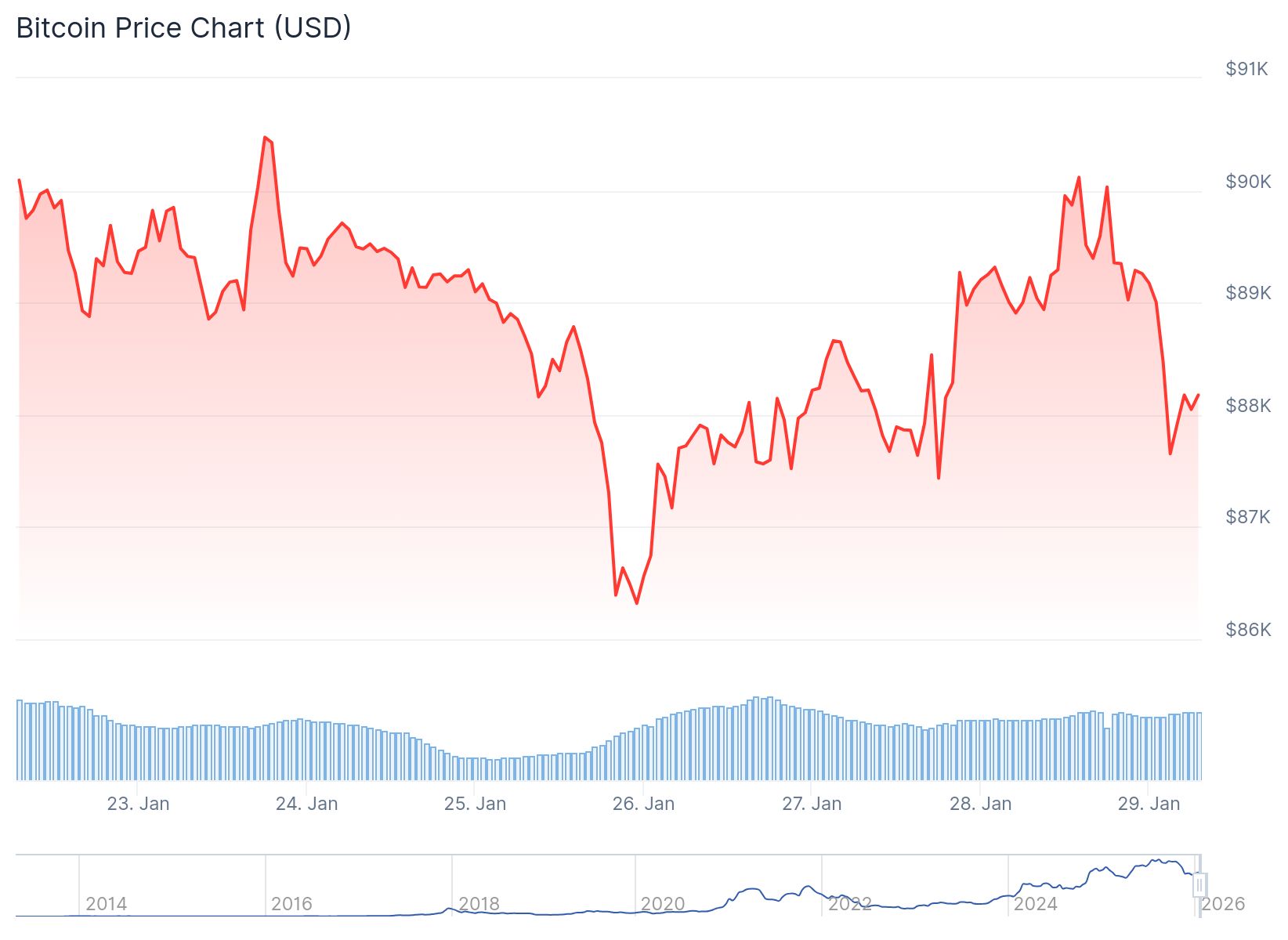

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Bitcoin traded just under $89,500 after the announcement. US stocks showed little change following the decision. Gold continued climbing, reaching near record levels at $5,300 per ounce.

The US dollar has weakened in recent days. The Bloomberg Spot Dollar Index fell to four-year lows this week. The dollar posted its worst annual performance since 2017.

Dollar Weakness and Market Impact

Some analysts believe the dollar’s slide could effectively ease financial conditions. Market commentator The Kobeissi Letter called it “a clear signal that President Trump is willing to tolerate a weaker Dollar to push rates lower and boost US exports.”

David Ingles from Bloomberg TV APAC agreed. He said President Trump may be “cutting rates on the Fed’s behalf by letting the dollar slide.”

The cryptocurrency market has shown mixed reactions. Bitcoin and other digital assets have been volatile as traders debate the impact of future rate decisions.

Analysts point to an inverse relationship between Bitcoin and the US Dollar Index. A stronger dollar typically weighs on cryptocurrencies and other risk assets.

Rate Cut Expectations Fade

Market expectations for rate cuts have changed drastically. In mid-November, prediction markets put the odds of a January cut above 40%. Those odds fell to nearly zero by this week’s meeting.

Markets are not expecting rate cuts at the March meeting. CME FedWatch places those odds at just 16%. The probability rises to about 30% for the April meeting.

Nick Ruck from LVRG Research commented on the decision. He said the Fed’s hold reflects persistent inflation concerns and a stabilizing economy. This could result in near-term volatility for crypto markets.

Jerome Powell held a press conference at 2:30 pm ET following the announcement. Investors watched for clues about the central bank’s future plans.

The post Federal Reserve Holds Rates Steady as Dollar Weakens to Four-Year Low appeared first on CoinCentral.

You May Also Like

USD Weakness Reveals Surprising Relief: Dollar’s Decline Lowers Global Risk Scores, Says DBS Analysis

White House bitcoin regulation debate intensifies with new crypto market structure meeting