Stablecoin and Bitcoin Exchange Outflows Signal Caution Amid Rising Geopolitical Risk

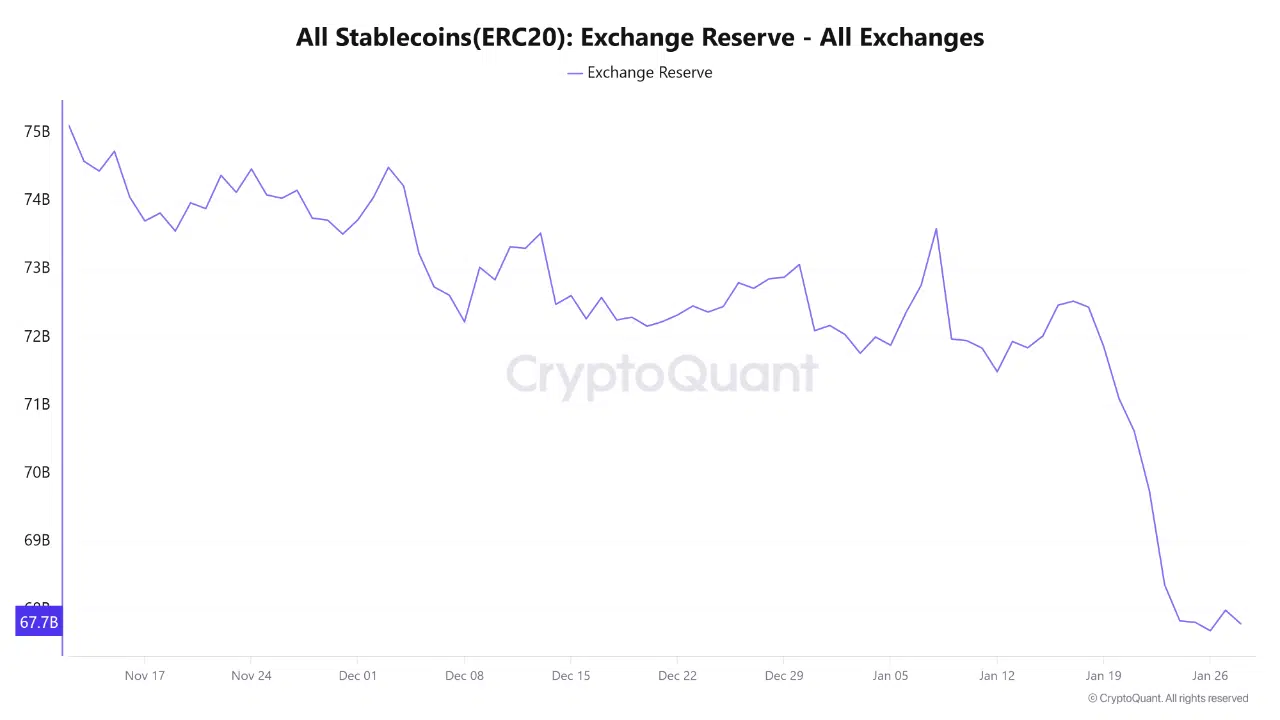

On-chain data shows a clear contraction in ERC-20 stablecoin and Bitcoin exchange reserves between January 18 and January 24, marking one of the sharper short-term liquidity declines seen this month.

While exchange outflows are often interpreted as a constructive signal for crypto markets, the broader macro environment suggests a more nuanced reading.

According to CryptoQuant data, all ERC-20 stablecoin exchange reserves across all exchanges fell from approximately $72.5 billion to $67.8 billion during this period. The decline was even more pronounced on Binance, where ERC-20 stablecoin reserves dropped from $48.5 billion to $44.4 billion, reflecting a sizable withdrawal of deployable liquidity from the largest centralized trading venue.

Why the Usual Bullish Interpretation May Not Apply

Under typical market conditions, simultaneous outflows of Bitcoin and stablecoins from exchanges imply reduced short-term sell pressure, improving supply-side dynamics and increasing the probability of price stabilization or recovery. Coins leaving exchanges are generally associated with holding behavior rather than imminent distribution.

However, the current macro backdrop complicates that interpretation.

During the same window in which crypto exchange reserves declined, precious metals experienced historic rallies. Gold surged to a new all-time high near $5,300, while silver spiked to a record above $117. These moves coincided with a sharp deterioration in global risk sentiment, driven by escalating geopolitical tensions, including rising concerns around potential U.S.–Iran military conflict.

Capital Rotation, Not Pure Crypto Accumulation

In a risk-off environment, capital tends to seek traditional safe havens rather than rotating internally within crypto markets. Against that backdrop, a portion of the observed stablecoin outflows, particularly from Binance, may reflect capital exiting crypto venues altogether, rather than stablecoins being positioned for spot purchases.

This interpretation aligns with broader defensive positioning already visible across multiple asset classes. Instead of being redeployed into crypto spot markets, liquidity may be shifting toward metals and other perceived stores of value as geopolitical uncertainty intensifies.

What the Data Really Signals

The decline in exchange reserves remains structurally supportive for crypto over the medium term, as it reduces readily available supply on centralized venues. However, in the current environment, it does not yet confirm a bullish inflection.

For that signal to strengthen, additional confirmation is needed, including:

- Sustained recovery in spot trading volumes

- Evidence of cross-market capital rotation back into crypto

- Improvement in global risk sentiment indicators

Until those conditions materialize, the recent exchange outflows should be viewed less as a bullish catalyst and more as a reflection of defensive capital behavior in response to elevated geopolitical risk.

In short, the data points to liquidity leaving exchanges, but not necessarily re-entering crypto markets, a critical distinction in the current macro regime.

The post Stablecoin and Bitcoin Exchange Outflows Signal Caution Amid Rising Geopolitical Risk appeared first on ETHNews.

You May Also Like

Sygnum’s new bitcoin fund pulls in $65 million from investors looking for steady yield

Copy linkX (Twitter)LinkedInFacebookEmail

The State of TRON H2 2025: Stablecoin Settlement at Scale Amid Rising Competition