Bitwise Says Crypto Has Until 2029 to Prove Its Worth – Can It Deliver?

Crypto markets face a critical three-year window to demonstrate real-world utility as legislative uncertainty threatens to derail industry momentum, according to Bitwise Chief Investment Officer Matt Hougan.

The stark timeline emerged as the CLARITY Act’s passage odds tumbled from 80% to roughly 50% following recent setbacks, including public criticism from Coinbase CEO Brian Armstrong, who called provisions in the current draft “catastrophic.”

Hougan warned that failure to pass comprehensive regulation would force digital assets into what he described as a “show me” period.

Crypto would need to become indispensable to everyday Americans and traditional finance by 2029 or risk punitive legislation under future administrations.

Three Years to Prove Crypto’s Real-World Value

The urgency stems from crypto’s fragile regulatory foundation, which Hougan said could crumble without legislative protection.

He pointed to historical precedents in which disruptive technologies bent regulations through mass adoption, citing Uber and Airbnb as examples that became so popular that lawmakers could not block them.

“If, at the end of three years, we’re all using stablecoins and trading tokenized stocks, we’ll get positive crypto legislation regardless of who is in charge,” Hougan wrote in Monday’s client note.

“But if crypto is instead still operating on the edges, a change in Washington could be a huge setback.“

The warning carries weight as Congressional momentum has stalled across multiple committees.

Senate Banking postponed its CLARITY Act markup indefinitely after Armstrong withdrew Coinbase’s support, pivoting instead to housing legislation following President Trump’s affordability push.

Meanwhile, Senate Agriculture pressed forward with alternative legislation despite failing to secure Democratic backing, scheduling a markup for Thursday that now faces disruption from Washington’s looming government shutdown deadline.

Senator Roger Marshall agreed not to offer a controversial amendment to the credit card swipe fee during Thursday’s Senate Agriculture Committee markup, removing a threat that had jeopardized Republican support for the underlying crypto bill.

The Kansas Republican had filed an amendment seeking to force payment networks to compete on swipe fees, pitting the finance industry against major retailers.

White House officials became directly involved in preventing the amendment’s consideration, with sources confirming it would have “jeopardized” passage of legislation the administration is pressing to advance.

Gold’s Surge Signals Deeper Shift in Institutional Trust

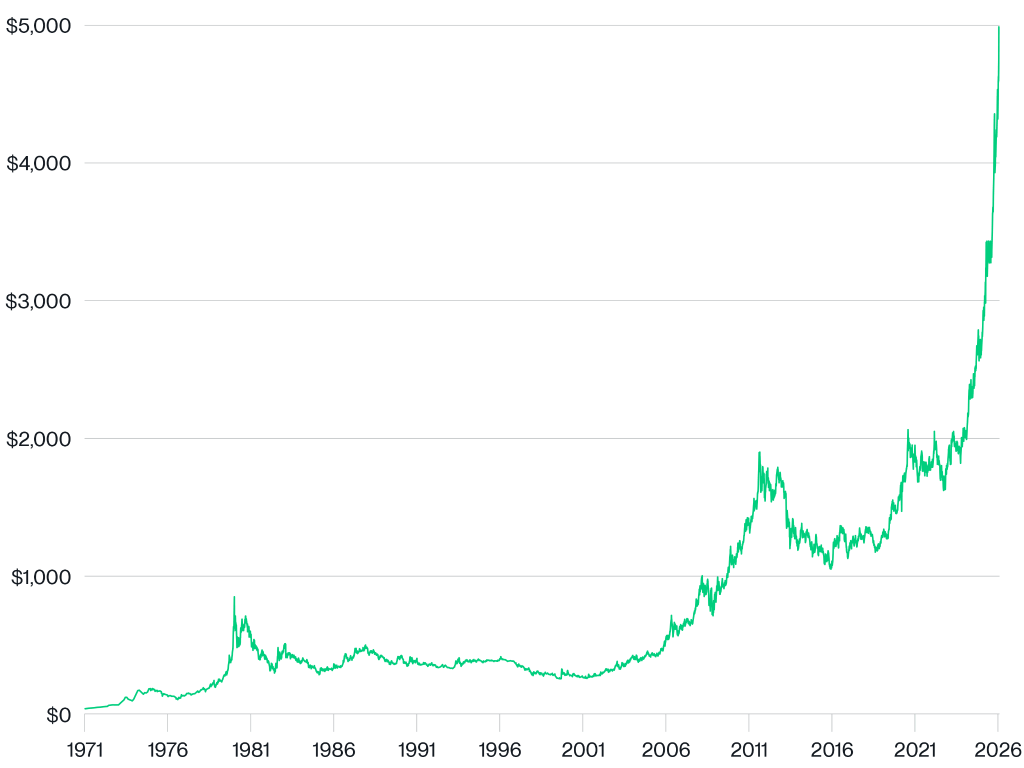

Hougan linked crypto’s regulatory challenges to gold’s stunning rally past $5,000 per ounce, arguing both reflect eroding confidence in centralized institutions.

Gold gained 65% in 2025 and another 16% in 2026, with roughly half its dollar value created in just 20 months despite thousands of years as a store of value.

Source: Bitwise

Source: Bitwise

“It shows that people no longer want to keep all of their wealth in a format that relies on the good graces of others,” Hougan wrote, noting central banks doubled annual gold purchases after the US froze Russia’s treasury assets in 2022.

German economists recently urged repatriation of gold held at the New York Federal Reserve, while a Norwegian government panel warned sovereign wealth funds face “increased taxation, regulatory intervention and even confiscation” in the current geopolitical climate.

Crypto’s core features could become increasingly valuable as institutional trust declines.

Assets like Bitcoin enable ownership without centralized intermediaries, while networks like Ethereum and Solana operate under rules no single authority can alter.

If CLARITY passes, Hougan expects markets to rally sharply as investors price in guaranteed growth for stablecoins and tokenization.

Failure would trigger a “wait and see” market where optimism wrestles with prolonged regulatory uncertainty.

Just like many others, Investment bank TD Cowen has warned legislation could slip to 2027 as lawmakers position for midterm elections, with full implementation potentially delayed until 2029.

Despite legislative turbulence, market fundamentals appear solid. Bitwise’s Q4 2025 report identified signs of a bear-market bottom, citing record Ethereum transaction volumes, surging stablecoin market capitalization above $300 billion, and Uniswap processing more volume than Coinbase.

A Coinbase-Glassnode survey also found 70% of institutions view Bitcoin as undervalued despite fourth-quarter volatility that erased nearly a third of its value from peaks above $125,000.

You May Also Like

Let insiders trade – Blockworks

Morning Crypto Report: 'I Am Capitulating': What's Vitalik Buterin Talking About? Bitcoin Quantum Threat Drama Gets 20,000 BTC Twist, Cardano out of Top 10 as Bitcoin Cash Wins Back 25% of BCH Price