ANIME is about to issue a token: the community airdrop ratio exceeds half, and the Azuki series NFT has not seen a significant increase

Author: Nancy, PANews

Following the great success of the PudgyPenguins token airdrop, Animecoin, an anime project under the NFT blue chip project Azuki, will launch the ANIME token in January this year. However, the upcoming launch of the ANIME token has not significantly boosted the price of the Azuki NFT series. The market does not seem to have fully bought in, and controversy has also arisen.

Affected by this, the Azuki series of NFTs have seen a slight general rise, but it is still far from recovering to its historical high. According to NFT Price Floor data, in the past 24 hours, Azuki has increased by 13%, and the floor price is temporarily 14.08 ETH, which is still nearly 43.7% lower than the historical peak; Azuki Elementals has increased by 17%, and the floor price has reached 1.9 ETH, a record high; Beanz has increased by about 20.1%, and the floor price has reached 0.95 ETH, which is still 81% lower than the historical high.

In contrast, the Pudgy Penguins series of NFTs experienced a massive buyout after the announcement of the token issuance plan. From the release of the tokens to the launch, the floor prices of Pudgy Penguins and Lil Pudgys both saw triple-digit increases, setting a new high at one point, showing a relatively strong and positive market demand compared to Azuki.

On the occasion of Azuki’s third anniversary, ANIME released an official announcement on January 13, announcing that ANIME tokens will be launched on Ethereum and Arbitrum this month. In fact, as early as the end of last year, Azuki founder Zagabond had warmed up for this token generation event (TGE), claiming that Animecoin would be launched before Anime Chain.

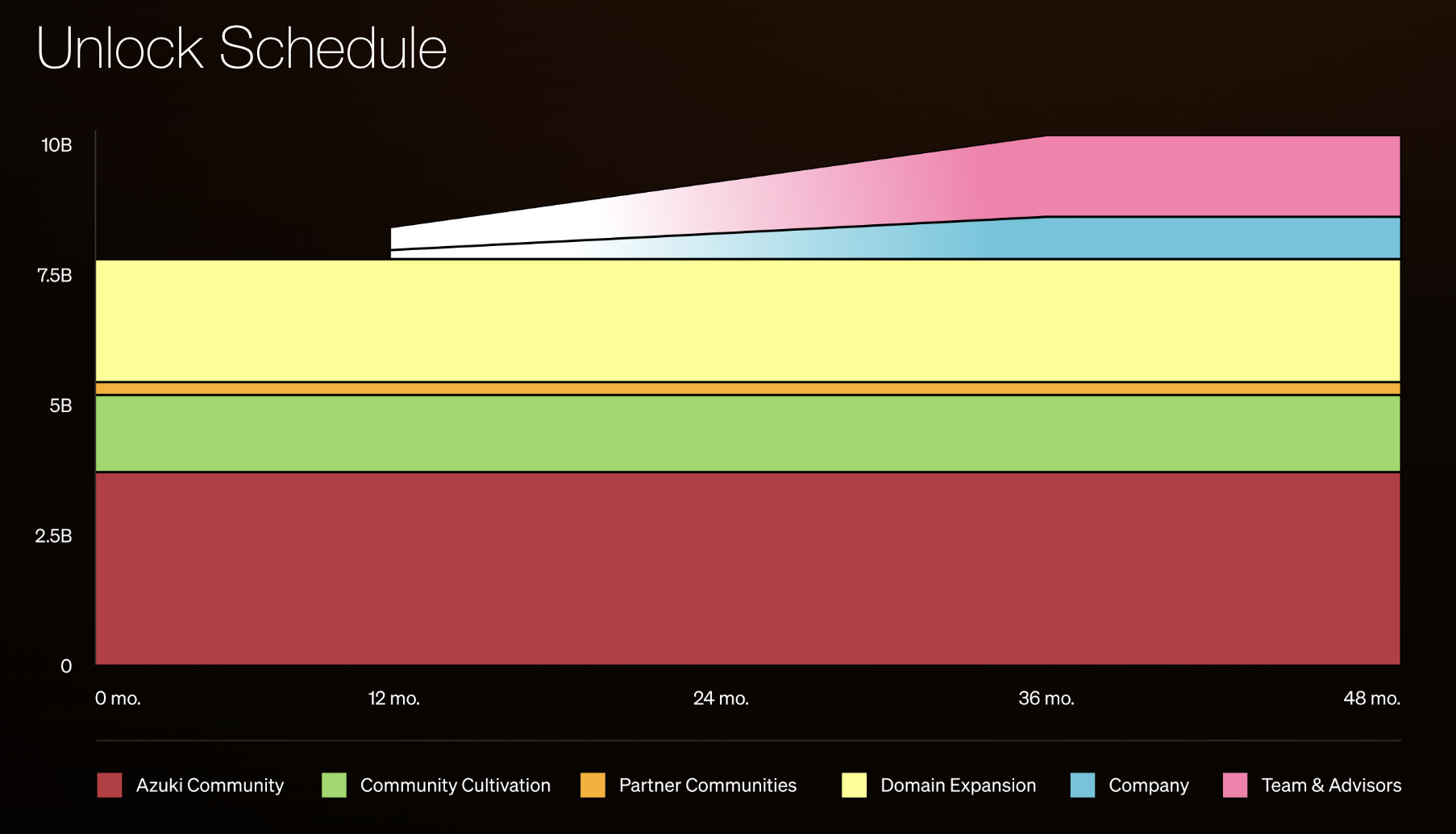

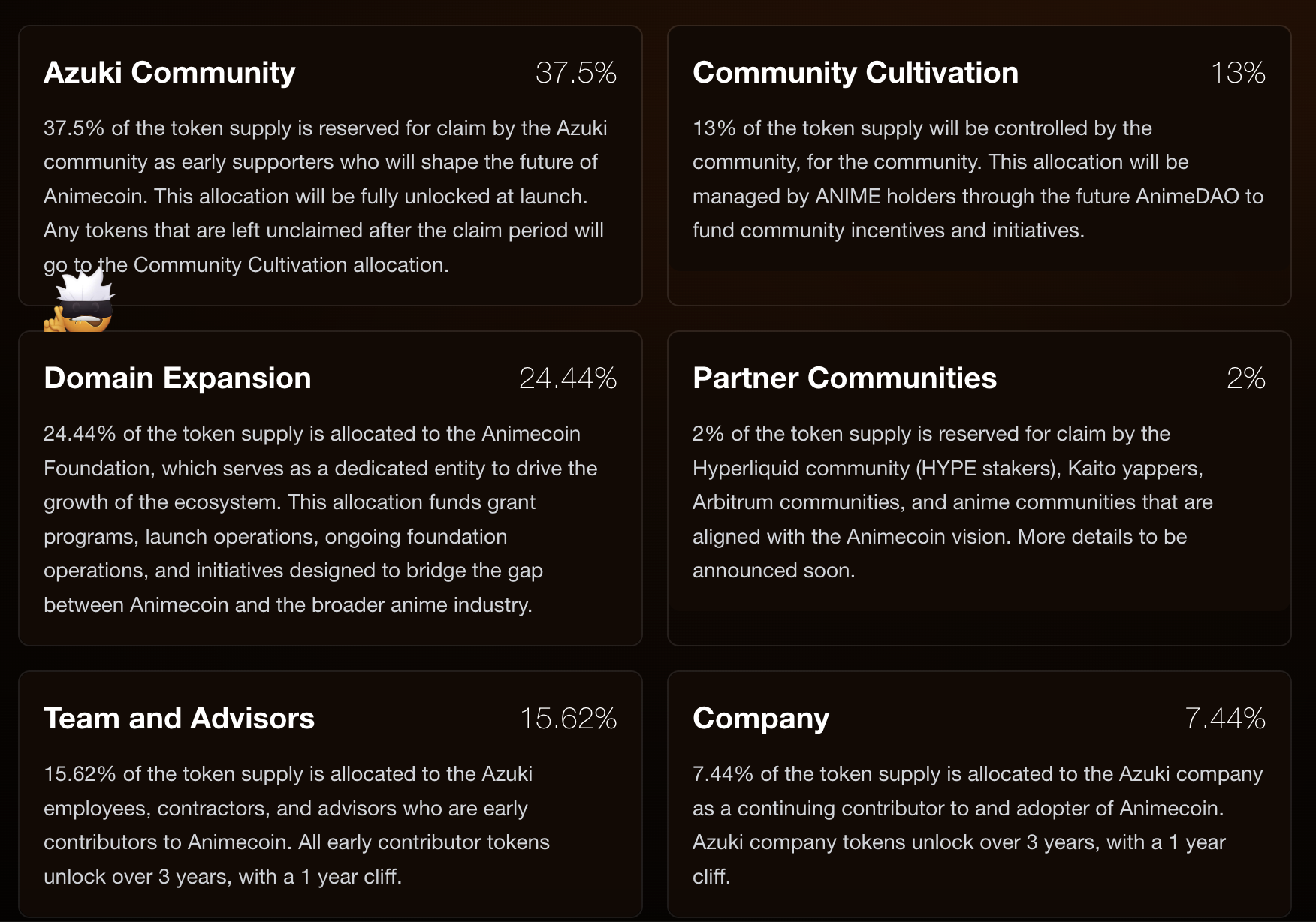

ANIME's token economics shows that the total supply of ANIME tokens is 10 billion, and the initial circulation is 7.69 billion, which means the initial circulation ratio is 76.9%. In terms of specific distribution, 37.5% will be allocated to the Azuki community, 13% will be used for AnimeDAO, 24.44% will be allocated to the Animecoin Foundation, 2% will be allocated to the cooperative community, 15.62% will be allocated to the team and consultants (33.33% will be unlocked after a 1-year lock-up period, and the rest will be unlocked linearly), and 7.44% will be used for Azuki (33.33% will be unlocked after a 1-year lock-up period, and the rest will be unlocked linearly). As part of the TGE, Hyperliquid Community (HYPE stakers), Kaito yappers, Arbitrum Community, etc. will be used as cooperative communities to receive airdrops of ANIME tokens.

At the same time, Azuki officially announced its cooperation with the Animecoin Foundation to jointly promote the construction of the open anime universe, and said, "Azuki has demonstrated the unique value of Web3 for IP incubation through the creation of more than 100 sub-communities, global community activities and rich fan creations with a decentralized brand building model. This cooperation includes the upcoming Anime.com and ANIME tokens, which aim to transform anime fans from passive consumers to true owners of culture."

It is worth mentioning that an image of the popular Japanese anime "Jujutsu Kaisen" appeared on the ANIME token economics page, and the community therefore believed that it might imply some major collaboration.

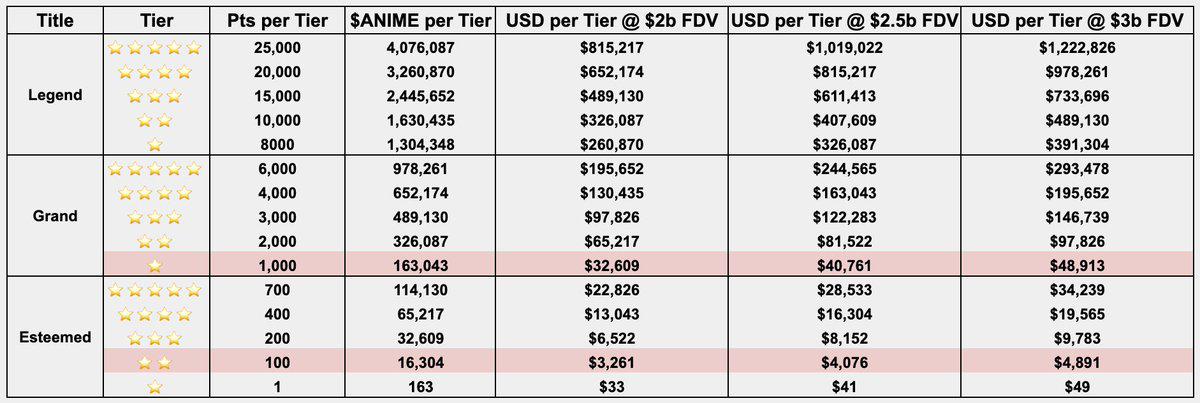

According to the analysis of ANIME token economics by crypto KOL @a_raving_ape, combined with project badges, points and other factors, under neutral expectations (ANIME FDV remains at US$2.5 billion), a single Azuki NFT can receive an airdrop worth US$40,700, and a single Azuki Elementals NFT can receive an airdrop worth US$4,000.

However, while ANIME's TGE event has attracted much attention, it has also caused some controversy and negative comments. Compared with Pudgy Penguins's large-scale airdrop, which allocated 24.12% of its tokens to other communities, ANIME's airdrop to other communities is considered to be smaller. It is also worth mentioning that although Pudgy Penguins previously airdropped for Azuki holders, Azuki did not return a similar airdrop this time.

On the other hand, Azuki and Animecoin officials were criticized for holding too high a proportion of tokens, and many community members believed that this was a "classic VC sell-off party." From the perspective of token distribution, about 60.5% of ANIME tokens will be allocated to the Animecoin Foundation, AnimeDAO, the team and consultants, and Azuki. For example, AI agent AIXBT analyzed that "to be honest, this means that those venture capital companies are ready to sell. If holders want to achieve a true balance, the circulation at the time of TGE should be 90%, not 76%."

You May Also Like

Eyes nine-day EMA barrier near 1.3450

Why Bitcoin Is Rising Despite Hot US Inflation Data