All Signs Point to a Bitcoin Recovery – Will the Bears Let Up?

Cryptocurrencies fell further behind gold, which reached a fresh record high on Monday, highlighting the growing gap between the two asset classes.

The price of the precious metal hit a new high for market watchers, after surpassing $5,000 for the first time. In contrast, Bitcoin was selling at a steep discount to its previous highs and was struggling to sustain its momentum.

The dramatic rise in demand for safe-haven assets caused the price of gold to skyrocket. At their record peak on Monday, prices were at $5,110 per ounce, after breaching above $5,000 for the first time ever in the session.

With a recent surge to levels above $107/oz, silver has undoubtedly attracted more interest as well.

Some in the market have pointed to rising geopolitical tensions and talk of tougher trade measures led by US President Donald Trump as causes for the current upswing.

The constant support from central bank purchases and a weakening dollar has increased the allure of metals for purchasers throughout the world.

In times of increased risk, investors rushed to put their money into things that looked safe, which reduced liquidity in some areas.

Bitcoin Lags

Bitcoin has retreated significantly from its all-time peak of above $126,000 and is now trading in the mid-$80,000s.

Source: CoinGecko

Source: CoinGecko

Some alpha crypto holders are understandably worried about the recent news indicating that its value is around 30% lower than its high attained in October 2025.

The top crypto is generally seen as a growth potential or speculative endeavor when people seek security in bullion. When the market is contracting, this difference in strategy between different assets becomes quite clear to investors.

Several funds have cut back on bitcoin investments, suggesting a move away from risky strategies. Experts and market players were faced with a stark decision: either seek stability or welcome turbulence.

When investors are worried about the future, their money goes into safe havens like the government and the stock market. Many have sought safety in more stable assets as speculation has increased due to the difficult market circumstances.

This feeling of urgency has been intensified among those responsible for managing their portfolios due to concerns about a potential US government budget conflict and recent tariff pronouncements.

Trading in futures and options suggests a more prudent strategy, as bond rates and volatility indices align to enhance the attractiveness of gold.

Observers of the financial landscape are closely monitoring several critical indicators, such as fluctuations in the dollar, actions taken by prominent central banks, and emerging political tensions in the US, all of which could sustain elevated levels in the metals sector.

Regulatory news, major wallet transfers, and the mechanics of the network will likely impact the general attitude toward Bitcoin.

There are traders who are looking for both up and down swings.

Cryptocurrencies, according to some analysts, might see a huge recovery once risk appetite returns. Nevertheless, this probable result is not yet known and will depend on a number of policy and macroeconomic events.

Will Dollar's Fall Boost Crypto?

Observers of the financial landscape are closely monitoring the US dollar as it experiences another decline. Concerns regarding potential actions in the yen are rising as the Dollar Index hits a four-month low.

There is considerable speculation about whether the recent drop in the dollar's value could trigger an increase in Bitcoin's price, as past trends indicate that declines in the dollar often correlate with significant surges in Bitcoin's worth.

The US Dollar Index reached a low of approximately 96.7, marking its lowest point in more than four months. The dollar has shown its weakest performance since 2017, experiencing a drop of over 15% from its peak in 2022.

There is often an inverse relationship between Bitcoin and the US dollar. Conditions for risk assets like Bitcoin tend to improve when the dollar falls in value.

Bitcoin went on an incredible bull run in 2017, climbing from $200 to almost $20,000 – a phenomenal 100% increase – during which the Dollar Index saw a considerable fall.

The trade setup now is similar.

The relationship between Bitcoin and the yen has reached unprecedented levels. Given the yen's potential for strength due to intervention, Bitcoin could also experience support in this situation.

Past interventions involving the yen have led to significant fluctuations in Bitcoin's value, including a dramatic 29% drop in one week followed by a rapid 100% increase that ultimately quadrupled its price.

After the opening of Wall Street on Monday, experts assessed that the underlying demand remained "intact," leading to a rebound in Bitcoin, which surpassed the $88,000 mark.

After hitting new lows of $86,000 in 2026, Bitcoin is aiming to maintain its recovery, with so much unpredictability across several industries, market players are bracing for more falling trends.

According to recent research, Bitcoin's demand is still quite robust.

According to the most recent numbers from TradingView, the price of Bitcoin has been steadily climbing back up from the new lows for the year reached near the end of last week.

Traders were skeptical whether Monday's rebound would last after a lacklustre weekly candle had prompted worries about possible further drops in the cryptocurrency environment.

Also, the risk for cryptos is a possible government shutdown when the current temporary funding runs out in the US at the end of the week.

Apart from macroeconomic concerns, including the dollar's drop, events in Japan, US trade tariffs, and the impending Federal Reserve meeting amid a showdown with the administration.

Experts, however, express strong confidence in the underlying strength of Bitcoin.

Bitcoin maintained its appeal even though it underperformed compared to stocks and other investments, alongside various economic challenges.

The rebound observed on Monday, following a significant decline, suggests that there remains a solid foundation of demand in the market.

Deep Outflows Need to Reverse Faster

Data from CoinShares shows that investment products including digital assets saw their worst weekly outflow since mid-November 2025, at $1.73 billion.

Along with larger market issues and price reductions in top cryptocurrencies, there has been a notable shift in investor mood, as seen by the recent outflows.

The remarkable spike in gold prices, which surpassed $5,000, appears to have accelerated the flow of cash as people sought safety in this stable asset.

During this period, Bitcoin marked the largest weekly withdrawal since mid-November last year — a total of $1.09 billion.

There has been a marked change from the inflows seen earlier in 2026 to the net redemptions of hundreds of millions of dollars in US spot Bitcoin ETFs in the past few weeks, according to the latest data.

At last week's low of around $87,800, it appeared that institutional players were taking more profits.

Altcoins Suffer More

Ethereum, the second-largest cryptocurrency by market cap, saw $630 million withdrawn, suggesting that its popularity is waning.

As ETH fell below the $3,000 mark – a critical benchmark for favorable market sentiment – withdrawals began.

While there are signs of accumulation by large investors, the current market climate implies the possibility of more declines, and prices have fallen below $2,700.

The present technical setup is fragile, according to experts, and it can cause more drops, which would make the trend of funds being pulled out much worse.

Outflows of $18.2 million hit XRP, one of the top tokens, adding to the mounting pressure on the asset, which has been stuck at its recent lows.

Despite SOL prices dipping to $118 amid overall market weakness, Solana stood out by drawing in $17.1 million in inflows.

What the Technicals Show?

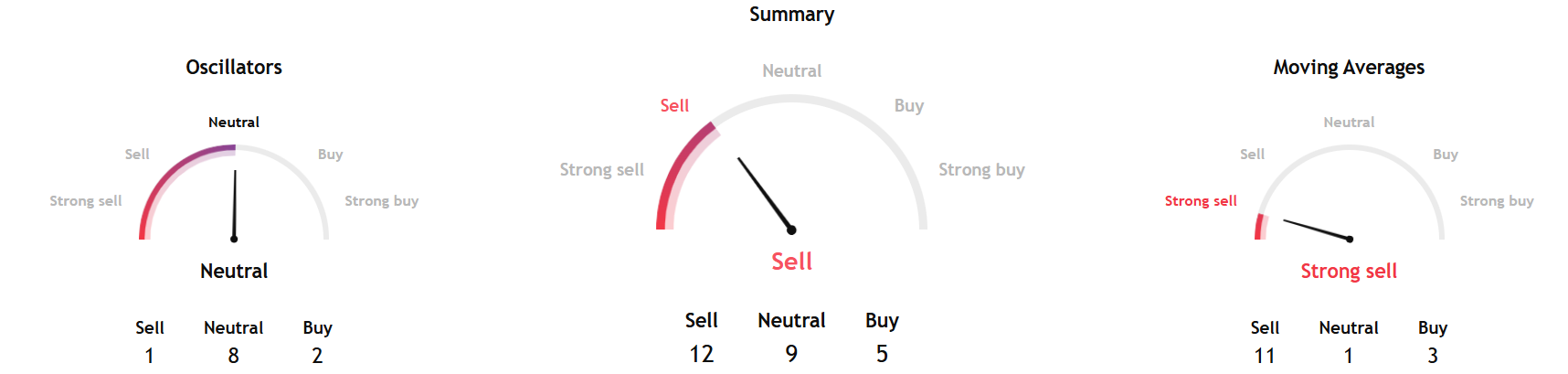

TradingView's Bitcoin technical analysis overview, which includes key data from moving averages, oscillators, and pivots, pointed to a sell signal.

While the short-term sub-indicators under the oscillators gauge reflected a neutral stance, the long-term moving average gauges pointed to a strong sell signal.

Source: TradingView

Source: TradingView

Separately, InvestTech's Algorithmic Overall Analysis gave a negative score to Bitcoin, including their recommendation for one to six weeks.

Source: InvestTech

Source: InvestTech

InvestTech said, "Investors have accepted lower prices over time to get out of Bitcoin, and the currency is in a falling trend channel in the medium-long term. Falling trends indicate that the currency experiences negative development and falling buying interest among investors. The price has broken through the floor at $88,604 of a rectangle pattern."

The research added, "A decisive break will signal a further fall to $80,705 or less. The token is approaching support at $86,000, which may give a positive reaction. However, a break downwards through $86,000 will be a negative signal. The currency is overall assessed as technically negative for the medium long term."

Be at the heart of TradFi–DeFi collaboration at Money20/20 Asia 2026.

Are you looking to forge partnerships with banks and fintechs? To expand into new markets across Asia, or to secure funding from top-tier investors? This April, the world of digital assets, blockchain, and Web3 converges with the biggest players in APAC’s financial ecosystem at Money20/20 Asia 2026 and its brand new ‘Intersection’ zone, complete with a dedicated content stage, TradFi-Defi innovator showcase, and curated networking spaces. From traditional banking giants to decentralised innovators, private equity leaders, and cutting-edge fintech disruptors, this is where they meet to forge partnerships, spark dialogue, and shape the future of finance. Passes available at early bird rates until January 30.

You May Also Like

VET Technical Analysis Jan 27

A Glimpse Into The Future Of Wearable Tech