Crypto Funds Record $1.73B Outflows, Largest Since November 2025

This article was first published on The Bit Journal.

A sharp wave of crypto ETP outflows just snapped a two-week stretch of optimism, with investors pulling roughly $1.73 billion from digital asset exchange-traded products in a single week. It was one of the heaviest redemptions since mid-November 2025, and it landed with the kind of weight that tends to change the mood fast.

The week before, those same products attracted about $2.2 billion in net inflows, a sign that large allocators were willing to add exposure again. This reversal is not simply “profit-taking.” It reads more like a reset in expectations, where macro reality starts tapping the brakes on risk assets.

Behind the scenes, the same trio of forces kept showing up in desk chatter: softer hopes for rate cuts, fading price momentum, and a broader disappointment that crypto has not “acted like the hedge” some buyers expected when inflation and currency-debasement narratives re-entered the conversation.

Why Crypto ETP Outflows Are Suddenly the Market’s Loudest Signal

In practical terms, crypto ETP outflows are one of the cleanest ways to spot what bigger money is doing, because they reflect allocation decisions made through regulated wrappers. When flows turn sharply negative, it often means institutions are not just trading a dip. They are reducing exposure size, tightening risk, and waiting for a clearer setup.

This is also why the number stands out. A $1.73B weekly exit is not a retail scare. It is the type of move that usually comes from portfolio managers responding to a changing rate path, a broken trend, or both.

Bitcoin and Ether Drove Almost the Entire Sell-Off

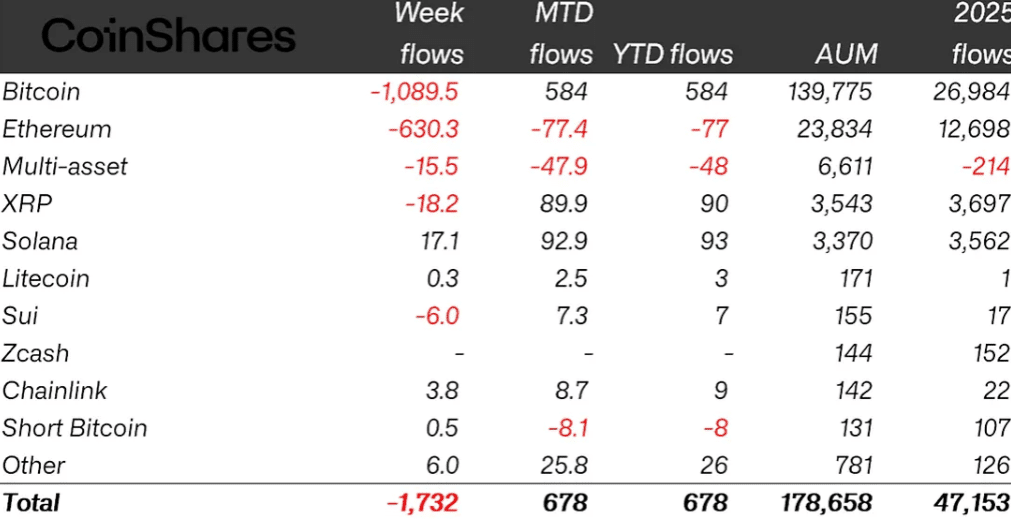

The withdrawals were heavily concentrated in the two assets that typically dominate institutional portfolios. Bitcoin saw around $1.09B in outflows, while Ether recorded roughly $630M in redemptions. Together, that is about $1.72B, essentially the whole week’s net drawdown on its own.

Source: CoinShares

Source: CoinShares

That concentration is important because it explains the shape of the selling. When the largest products bleed first, it usually signals a de-risking phase rather than a rotation into smaller tokens. Still, not everything moved in lockstep. Solana funds posted about $17.1M in inflows, while XRP and Sui saw smaller outflows of $18.2M and $6M respectively, with Chainlink taking in around $3.8M.

Even more telling, “short Bitcoin” products picked up around $0.5M. That number is not massive, but it adds texture: some traders still wanted downside protection while broader sentiment remained heavy.

Big Issuers Felt the Pressure as Risk-Off Took Over

The week’s redemptions were spread across multiple providers, but the largest names absorbed the biggest hit. One major issuer led with about $951M in outflows, followed by roughly $469M from another, and around $270M from a third.

There were a couple of bright spots, though. A smaller set of providers posted inflows, including one firm that added about $83M, and another that took in around $37M.

This split supports a familiar pattern: while the broad market de-risks, certain strategies still attract capital, especially those designed for volatility management or tactical exposure. It is another reminder that crypto ETP outflows can reflect positioning changes inside the same asset class, not only a full exit.

The US Led the Exit, and AUM Dropped Fast

Regionally, the selling was concentrated in the United States, which accounted for about $1.8B of the weekly outflows. On top of that, total assets under management across crypto funds fell to roughly $178B, down from $193B the previous week.

That AUM drop is not just about flows, it is also about price pressure. When redemptions and falling prices land together, the result looks harsher than either factor alone. It is also why crypto ETP outflows tend to amplify market narratives: shrinking AUM can reduce liquidity and dampen the “buy the dip” tone across desks.

What Traders Watch Next: Rates, Momentum, and Re-Entry Timing

After a week like this, markets typically look for two things: stabilization in price momentum, and calmer rate expectations. If both show up, flows can swing back quickly. If neither appears, investors may stay patient, waiting for a clearer trend and better macro alignment.

For crypto specifically, the next phase often hinges on whether Bitcoin can regain its footing and whether Ether can hold key support levels. When they do, confidence spreads. When they wobble, crypto ETP outflows can stay elevated, and sentiment around altcoins usually cools as well.

Conclusion

This week’s crypto ETP outflows are not just a statistic. They are a snapshot of investors stepping back at the same time, largely through Bitcoin and Ether products, while the macro backdrop remains uncertain. If rate-cut expectations stabilize and momentum returns, the flow picture can improve fast. Until then, the market is likely to treat every bounce with caution, and every rally as something that has to prove itself.

Frequently Asked Questions (FAQs)

What do crypto ETP outflows indicate?

Crypto ETP outflows often signal that investors are reducing exposure through regulated investment vehicles, usually when risk appetite fades or macro conditions tighten.

Why did Bitcoin and Ether lead the withdrawals?

Large allocators tend to hold Bitcoin and Ether as core positions, so when portfolios de-risk, those products often see the largest redemptions first.

Do outflows always mean the market will crash?

No. Flows are a strong sentiment gauge, but price can stabilize even during outflows if buyers step in elsewhere or macro conditions improve.

Glossary of Key Terms

ETP (Exchange-Traded Product): A tradable investment product that tracks an underlying asset or index and trades on an exchange.

Net Outflows: The total amount withdrawn from a fund after subtracting inflows during the same period.

AUM (Assets Under Management): The total value of assets held across funds or products.

Price Momentum: The speed and strength of a price trend over time, often used to assess market direction.

Rate-Cut Expectations: Market forecasts about whether central banks will lower interest rates, which can affect risk appetite.

References

Cointelegraph

Read More: Crypto Funds Record $1.73B Outflows, Largest Since November 2025">Crypto Funds Record $1.73B Outflows, Largest Since November 2025

You May Also Like

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future

SEC approves new listing standards paving way for crypto ETFs on Nasdaq, Cboe, and NYSE