Record Dormant Bitcoin Supply Enters Market — What’s Next?

According to on-chain trackers, a big wave of old Bitcoin has started moving after long dormancy. Coins that sat untouched for more than two years have been transferred in numbers larger than what was seen during past peaks in 2017 and 2021.

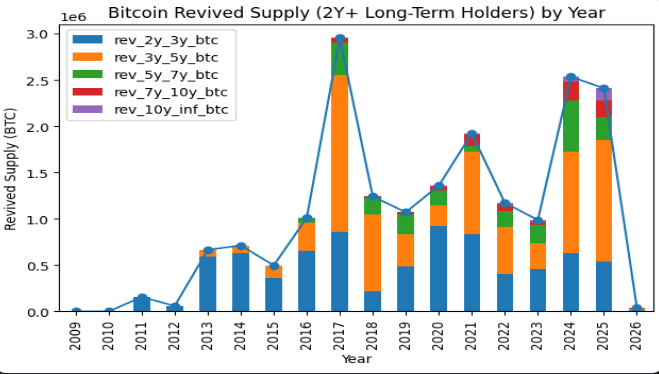

CryptoQuant analyst Kripto Mevsimi said on-chain data shows that 2024 and 2025 marked the largest release of long-held Bitcoin supply ever recorded. He tracks “revived supply,” or coins that stayed dormant for more than two years before being moved.

That kind of movement usually means deep-pocketed holders are changing their plans, not small traders chasing a quick gain.

A Shift Without A Party

Reports say this release of long-held supply arrived with little fanfare. There was no mass retail mania. Prices did not spike in a frenzy. Instead, the transfers came during a stretch when the market has been under steady pressure from broader financial stress.

Some of those older coins were likely sold for profit. Some may have been moved for other reasons — custody upgrades, private trades, or to back financial products. On-chain signals show the coins moved, but they do not write the reasons on the blockchain.

Long-Term Holders Change Course

Based on reports from analysts tracking these flows, the pattern suggests a changing of the guard. Early adopters who held through multiple cycles and pointed to scarcity and self-control have been trimming positions.

New buyers are appearing who watch price swings and macro headlines. Institutions, fresh large accounts, and price-driven traders are now shaping much of the market’s short-term activity.

Global Risk Pressures Risk AssetsReports have linked recent weakness in Bitcoin to rising global risk. Research ties part of the pullback to tariff moves by US President Donald Trump, which have pushed investors away from risky assets.

Tariffs can dent corporate profits, stir up inflation uncertainty, and change how the market views future rates — all of which hits sentiment. When big markets wobble, crypto often follows. That pressure helps explain why long-held coins moved without the usual hype.

New Buyers Step ForwardAccording To on-chain and price data, institutions and new “whales” are stepping into the gaps left by sellers. Bitcoin has been trading near the high $80k range, with recent figures around $89,140 as markets test demand. The old holders may have taken gains, but the market did not collapse. That shows there is still appetite, even if it is different from the past.

This cycle feels different because selling came without euphoria, and buying looks more tactical. That does not mean the story is over. The market might be shifting toward price-sensitive participants and outside financial forces.

Or the recent calm could be a pause before fresh buying. Either way, these on-chain moves matter. They change where the coins sit, and that changes how future price swings may play out.

Featured image from Unsplash, chart from TradingView

You May Also Like

This world-class blunder has even Trump's kingmaker anguished

Gold continues to hit new highs. How to invest in gold in the crypto market?