4 Bearish On-Chain Signals Suggest Bitcoin Price Could Slide Toward $85K Next

The post 4 Bearish On-Chain Signals Suggest Bitcoin Price Could Slide Toward $85K Next appeared first on Coinpedia Fintech News

After the latest pullback, the Bitcoin price is recovering in such a way that traders do not appear to fully trust the bounce. Every push attracts selling, and dips aren’t getting filled with the required volume. When this happens, the BTC price usually drifts until it finds a level where buyers finally step in hard. Currently, a few on-chain indicators by Cryptoquant suggest the bearish momentum is gearing up and here are the 4 top ones.

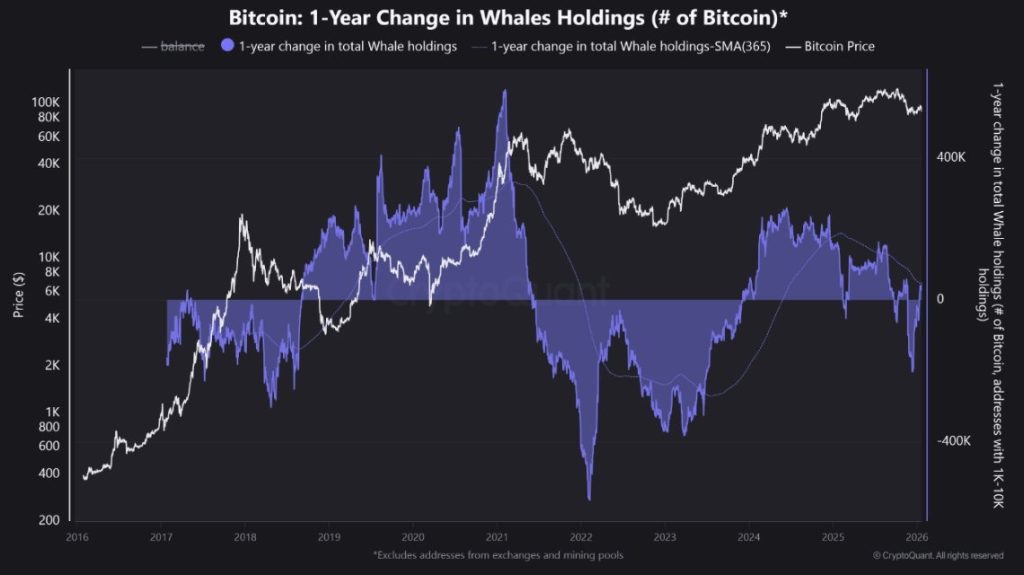

Whales look like they’re distributing

The “1-year change in whale holdings” metric is those addresses holding roughly 1K–10K BTC, showing whales shifting into a net distribution phase. Historically, when this line trends lower, it signals big holders are reducing exposure rather than accumulating. That doesn’t guarantee an immediate crash, but it often caps rallies and increases the odds of BTC revisiting lower liquidity zones because fewer large buyers are stepping in aggressively.

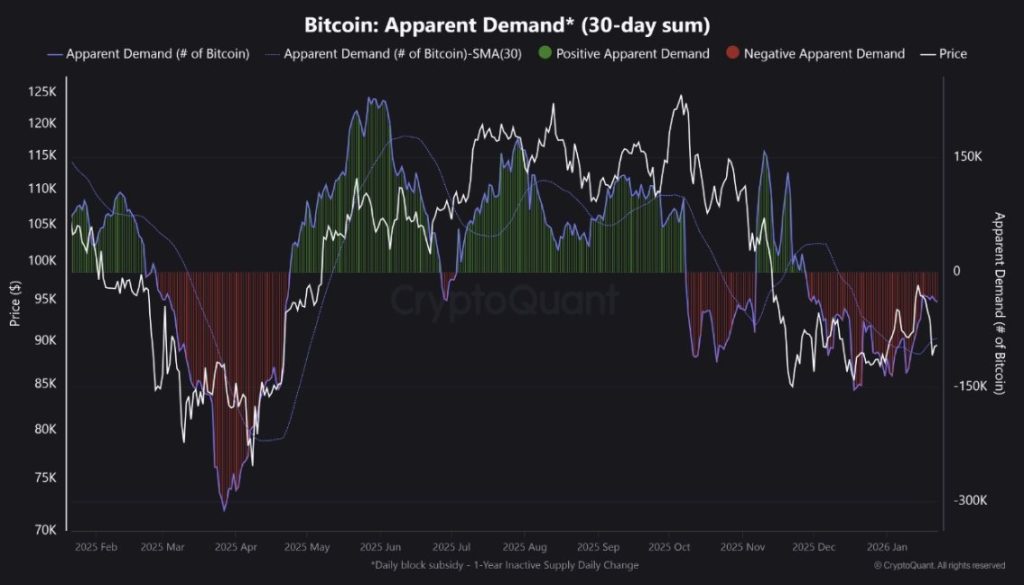

Apparent Demand Turns Negative

The “Apparent Demand (30-day sum)” chart is flashing negative readings, meaning net buyer pressure looks weak versus the supply dynamics tracked in this model. When apparent demand stays negative, BTC typically struggles to sustain recoveries because each bounce faces sell supply that demand cannot absorb. This often leads to a slow bleed—lower highs, weaker rebounds, and repeated tests of support—until demand flips back positive and holds.

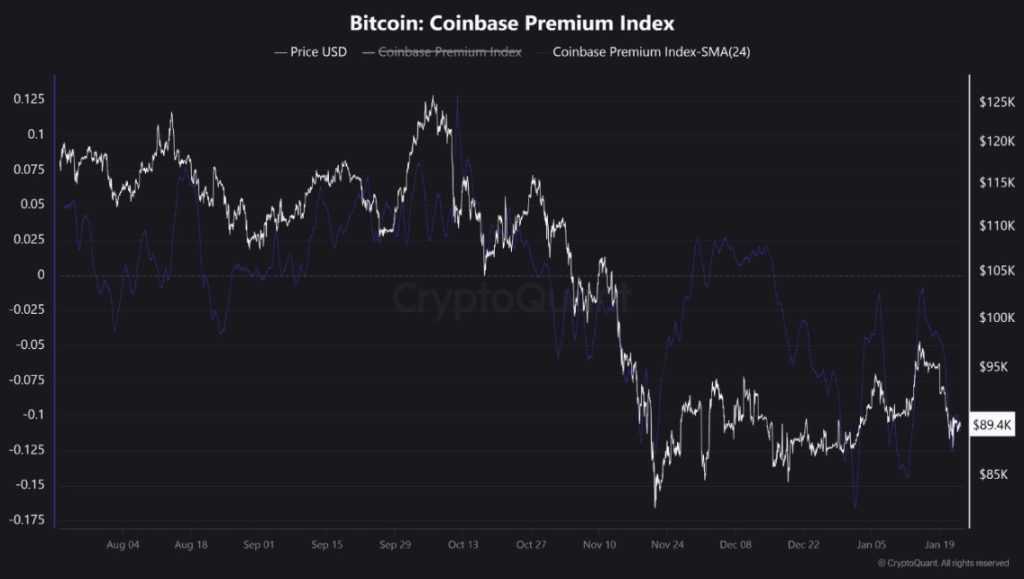

Coinbase Premium Signals Weak US Spot Bid

The Coinbase Premium Index being mostly below zero suggests BTC is not consistently trading at a premium on Coinbase versus offshore venues. That’s a sign the US spot bid appears soft. In risk-on phases, Coinbase’s premium tends to stay positive more often as spot demand leads. When it’s negative, it implies rallies may be driven more by derivatives or short-term flows, moves that can fade fast if spot follow-through is missing.

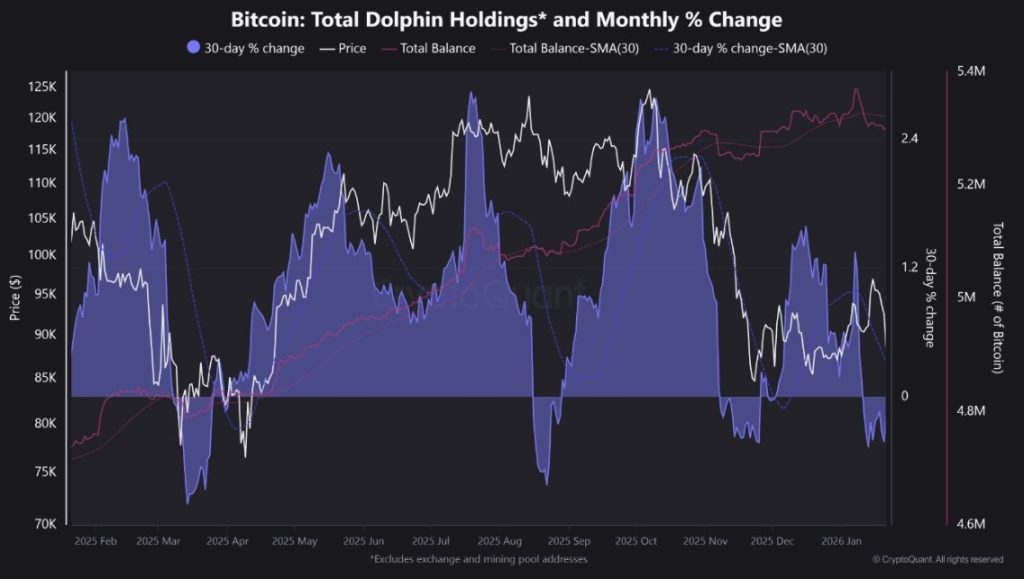

Dolphins are Also Distributing

“Dolphin holdings” (often mid-tier wallets below whales) show a weakening monthly change and a drop toward/under the zero line—another distribution-style signal. When both whales and dolphins reduce exposure at the same time, it suggests selling pressure is broadening rather than being isolated to one cohort. This matters because BTC rallies are strongest when multiple cohorts accumulate together. If whales and dolphins sell while demand is negative, support levels tend to weaken.

What to expect next from BTC price action

These four signals together paint a clear risk: supply is rising while demand is not stepping up. That usually means BTC price remains vulnerable to another leg lower or at least deeper support tests.

What happens next depends on whether demand returns:

- If BTC rebounds, expect a relief rally to face heavy selling unless (1) Coinbase Premium flips positive and holds, and (2) apparent demand turns positive. Without those, bounces can be short-lived.

- If BTC breaks support, the downside can accelerate quickly as liquidity gets swept and dip buyers step aside. BTC typically stabilises only after demand improves and distribution slows.

Collectively, a Bitcoin (BTC) price rally is possible, but it needs spot demand confirmation. Otherwise, the path of least resistance stays down or sideways until buyers prove they’re back.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Weekly Highlights | Gold, US Stocks, and Cryptocurrencies All Fall; Walsh and Epstein are the Celebrities of the Week.