Bitcoin Price Loses $90K Support Despite Trump’s Softer Greenland Stance: Weekly Crypto Recap

It has been another highly eventful week for global politics and also very volatile for the cryptocurrency market, which tends to feel the impact the most.

It began last weekend. After eight EU countries sent troops to Greenland for a claimed reconnaissance mission following Trump’s continuous remarks that the US needs to annex the island, the POTUS threatened to impose a new set of 10% tariffs against those nations as of February 1 if they don’t back down and allow a deal to be made.

The EU scheduled an emergency meeting, and some reports even claimed that the bloc would use a “trade bazooka” that had never been employed before. The situation continued to escalate in the following days, which only harmed BTC’s price. The asset traded above $95,000 during the weekend and remained calm at first.

However, once Asian and futures markets opened on Monday morning, it quickly broke down to $92,000 and then under $90,000. It dipped below $88,000 on Wednesday morning before rallying to $90,300 after Trump said during his Davos speech that he wouldn’t use force to take over Greenland.

Although that was a fake-out as it quickly dumped to a multi-week low of $87,200, the violent swings continued with another challenge at $90,000. This time, it came after Trump canceled the tariffs against the EU after hinting at reaching a potential deal. As of press time, there are no actual details about the said deal.

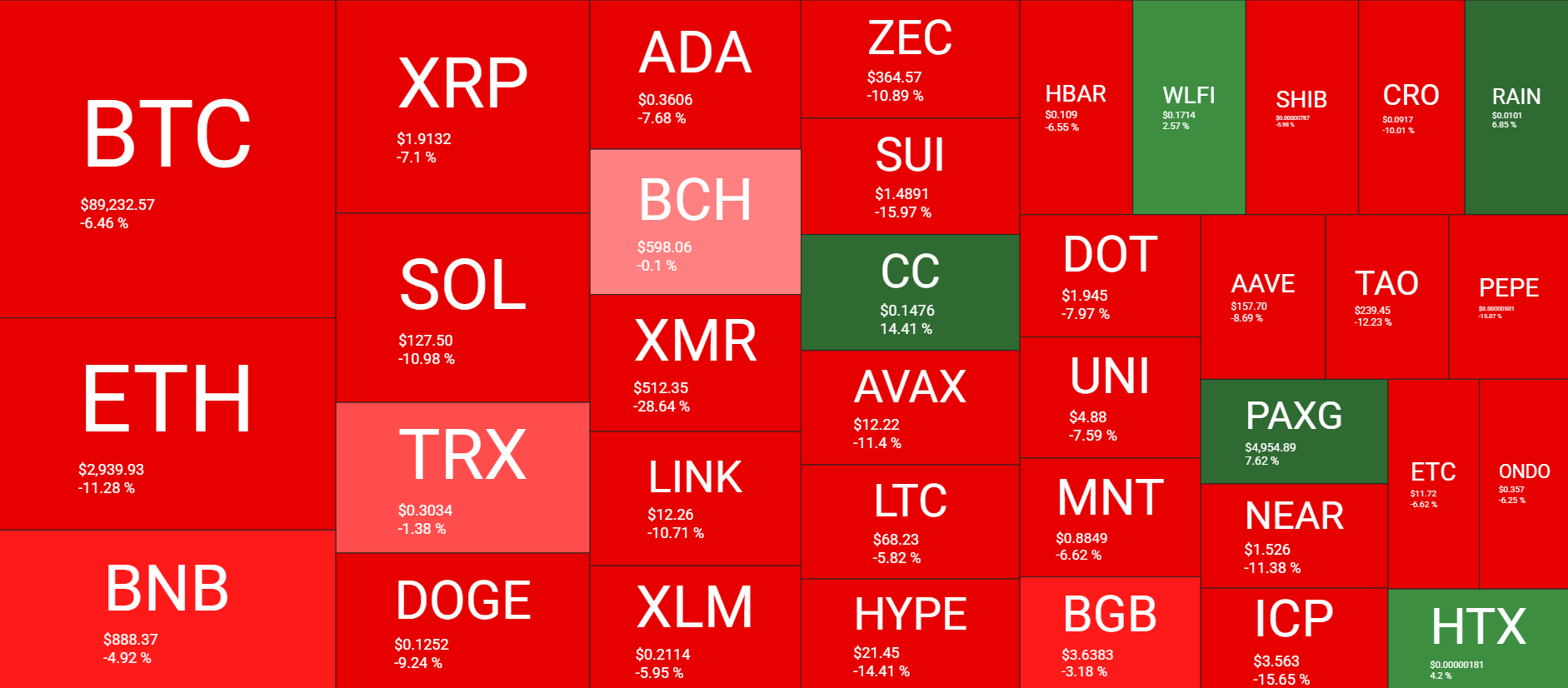

Bitcoin has failed to recapture the $90,000 level and now sits around a grand lower. This means a substantial 6.5% weekly decline, which is relatively modest compared to some alts. ETH, SOL, and LINK are down by 11%, SUI and HYPE have dropped by around 15% each, while XMR has plunged by almost 30%. In contrast, CC, PAXG, and RAIN are well in the green.

Market Data

Cryptocurrency Market Overview Weekly Jan 23. Source: QuantifyCrypto

Cryptocurrency Market Overview Weekly Jan 23. Source: QuantifyCrypto

Market Cap: $3.1T | 24H Vol: $110B | BTC Dominance: 57.5%

BTC: $89,200 (-6.5%) | ETH: $2,930 (-11.3%) | XRP: $1.91 (-7.1%)

This Week’s Crypto Headlines You Can’t Miss

Bitcoin Stumbles, Gold Shines as Trump Agrees to Davos Meeting. In times when BTC’s price struggles, gold has skyrocketed to consecutive all-time highs. The latest peak came earlier today when the precious metal neared $5,000/oz for the first time ever.

XRP ETFs See Biggest Outflows to Date as Ripple Price Dumps Again. The first trading day of the week in the US (Tuesday) led to a massive investor exodus from the spot XRP ETFs. The financial vehicles recorded their worst single-day performance, with more than $50 million leaving the funds on January 20.

One Year of ‘Crypto President’: Bitcoin Down 15%, Altcoins Crushed 70-90%. This week also marked the 1-year anniversary of Donald Trump’s second inauguration. In this article, we reviewed the performance of many cryptocurrencies during his reign, which is somewhat surprising given that he kept calling himself the “crypto president.”

Ethereum’s Vitalik Buterin Says He’s Leaving Centralized Social Media Behind in 2026. Ethereum’s Buterin said he plans to return entirely to fully decentralized social media in 2026, as all his posts published this year have been made public through Firefly – a multi-client platform supporting reading across X, Lens, Farcaster, and Bluesky.

Saylor’s Strategy Buys Over $2 Billion Worth of BTC Despite Growing Geopolitical Tension. Despite the growing political tension and the underwhelming price movements, Strategy’s Saylor continues to accumulate BTC. In its latest purchase announced on Tuesday, the company said it acquired a whopping 22,305 BTC for over $2.1 billion.

Bitcoin Beats S&P 500 Since ETF Launch, Analyst Rebuts Peter Schiff. Staying true to his colors, Peter Schiff blasted BTC yet again, claiming that the cryptocurrency is the worst-performing asset on Wall Street. However, Nate Geraci proved him wrong, showing that bitcoin had gained over 90% since the ETFs debuted two years ago.

The post Bitcoin Price Loses $90K Support Despite Trump’s Softer Greenland Stance: Weekly Crypto Recap appeared first on CryptoPotato.

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Fed Decides On Interest Rates Today—Here’s What To Watch For