JIM’s 2025 Generosity Index Reveals How Americans Have Become More Selective With Their Tipping

A nationwide analysis of tipping transactions highlights key trends in tipping, including the top five states for highest tips and the industries with the largest tipping rates.

SUNNYVALE, Calif.--(BUSINESS WIRE)--JIM.com, the real-time payment app powered by an AI business assistant, today released the 2025 JIM Generosity Index, a new report breaking down the economics of gratitude of modern tipping for small businesses and the top states in the U.S. Based on proprietary transaction data from JIM’s customers throughout 2025, the report analyzes 89,068 verified tipping transactions from 6,214 active merchants across 177 business categories in all 50 states.

Tipping still plays a significant role in how many service workers earn income, even as consumer attitudes toward gratuity show signs of strain. Nearly 63% of Americans hold at least one negative view toward tipping, with many indicating annoyance at frequent digital tipping prompts and evolving expectations, a trend often described as tip fatigue. However, data from JIM’s Generosity Index shows that most Americans are continuing to tip, but are being more selective about where and how gratuity is applied.

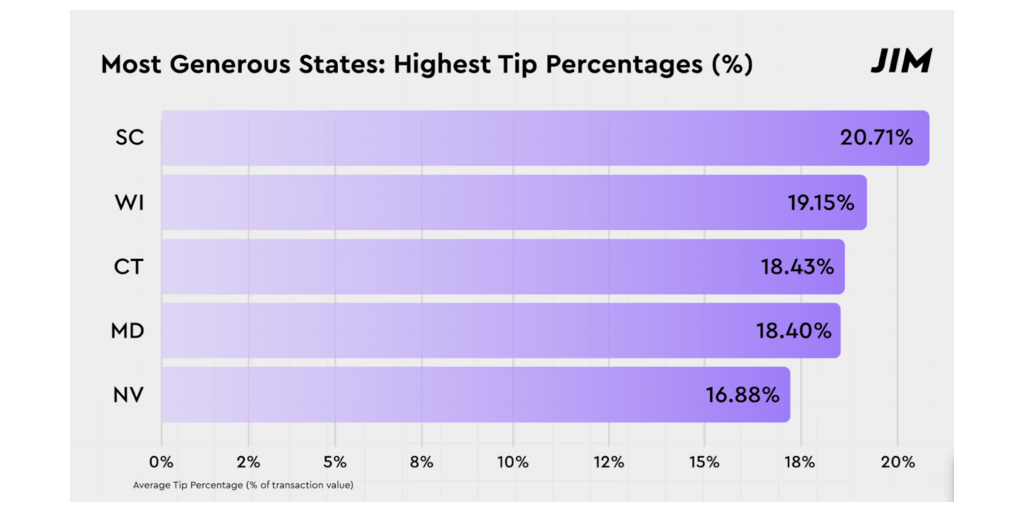

Where you live shapes how you tip. In a nationwide analysis of merchant tipping transactions, only one state clears a 20% average tip rate, while the five states below emerge as the country’s most generous by percentage.

- South Carolina leads the nation at 20.71%, the only state to exceed the 20% mark.

- Wisconsin follows with an average tip rate of 19.15%

- Connecticut ranks third at 18.43%

- Maryland closely trails at 18.40%

- Nevada rounds out the top five at 16.88%, reflecting its hospitality and tourism culture.

While the highest-ranking states push tip percentages well above the national norm, the data also shows a clear bottom tier. The five states below rank lowest nationally for average tip percentage, highlighting how tipping culture can vary dramatically by region.

Bottom Five States (Lowest Average Tip %):

- Oregon ranks as the least generous state at 13.10%, the lowest average tip percentage among the bottom five.

- Virginia closely trails at 13.58%.

- New York ranks third lowest at 13.72%, placing it near the bottom nationally.

- Alaska follows closely with an average tip rate of 14.11%.

- Illinois rounds out the bottom five at 14.37%.

Key National Findings:

- 15.46% is the average tip percentage: Even with new payment experiences and service models, gratuity between 15% to 20% is the cultural standard in the U.S.

- $12.44 is the average tip value: Tipping is increasingly showing up in higher-ticket services of auto repair, transportation and specialized personal services, and expanding beyond traditional restaurants and fast food.

- Barber and beauty shops rank among the highest for tip percentage at 17%: Tip rates are strongest in relationship-driven services with an average tip between 16% to 19% with loyal customers being more generous.

- Automotive and specialized services see average tips exceeding $20 per interaction: These higher-dollar categories tend to drive the largest tip amounts, highlighting how ticket size can outweigh tip rate in total tip dollars.

- Tip percentages are between 14% and 16% for everyday tipping categories: Core segments like restaurants, fast food, and transportation remain consistent, with select personal services (i.e. Tattoo & Piercing, Petcare Services, and Home Repair Services) trending higher.

“Tipping behavior is evolving, but one thing is consistent that Americans still gravitate toward the 15% to 20% standard, regardless of industry,” said Ricardo Cici, Chief of Growth of CloudWalk, the fintech company behind JIM.com. “What is changing is where tipping shows up and what it means economically. We are seeing meaningful tip dollars flowing into higher-value services beyond restaurants, which has real implications for small operators who rely on fast, fair access to their earnings.”

For the smallest merchants, tipping is only one part of the story. JIM is built for the entrepreneurs many legacy payment providers have moved past, including food truck owners, rideshare drivers, mobile beauticians, immigrant entrepreneurs, and solo operators who need simple, affordable ways to run and grow their businesses.

Beyond accepting payments, JIM acts as an AI-powered business assistant, helping merchants track sales in real time, understand performance, adjust pricing, and create promotions and campaigns directly from their phone. By simplifying daily operations and decision-making, JIM removes barriers to entrepreneurship and helps merchants keep more of what they earn.

JIM also offers instant settlement, allowing small businesses to reinvest, pay suppliers, and cover expenses immediately — not days later.

METHODOLOGY: JIM.com’s Generosity Index is based on proprietary transaction data from JIM’s customers throughout 2025. It is based on 89,068 verified tipping transactions from 6,214 active merchants that make approximately $100,000 or less in annual gross sales across 177 business categories in all 50 states.

About JIM

JIM.com is a real-time payments app powered by an AI business assistant that turns any smartphone into a point-of-sale terminal, allowing merchants to accept credit card payments instantly with no additional hardware. Built for underserved micro-businesses, JIM instant settles the sales and a simple flat 1.99% transaction fee with no monthly subscriptions, helping small merchants cash flow and making professional payment processing accessible and affordable.

JIM is backed by CloudWalk, a Brazilian fintech founded in 2013, which combines artificial intelligence, blockchain, and advanced infrastructure to power global payment solutions. Its flagship brand, InfinitePay, serves more than 6 million micro and small businesses in Brazil.

To learn more, visit JIM.com.

Contacts

Media Contact:

BAM for JIM

cloudwalk@bambybig.agency

The post JIM’s 2025 Generosity Index Reveals How Americans Have Become More Selective With Their Tipping appeared first on Crypto Reporter.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Trump's border chief insists Americans support ICE – and is shut down by host: 'Come on!'