Bitcoin Price Analysis: Expert Highlights 3 Key Price Zones That Could Decide Its Fate

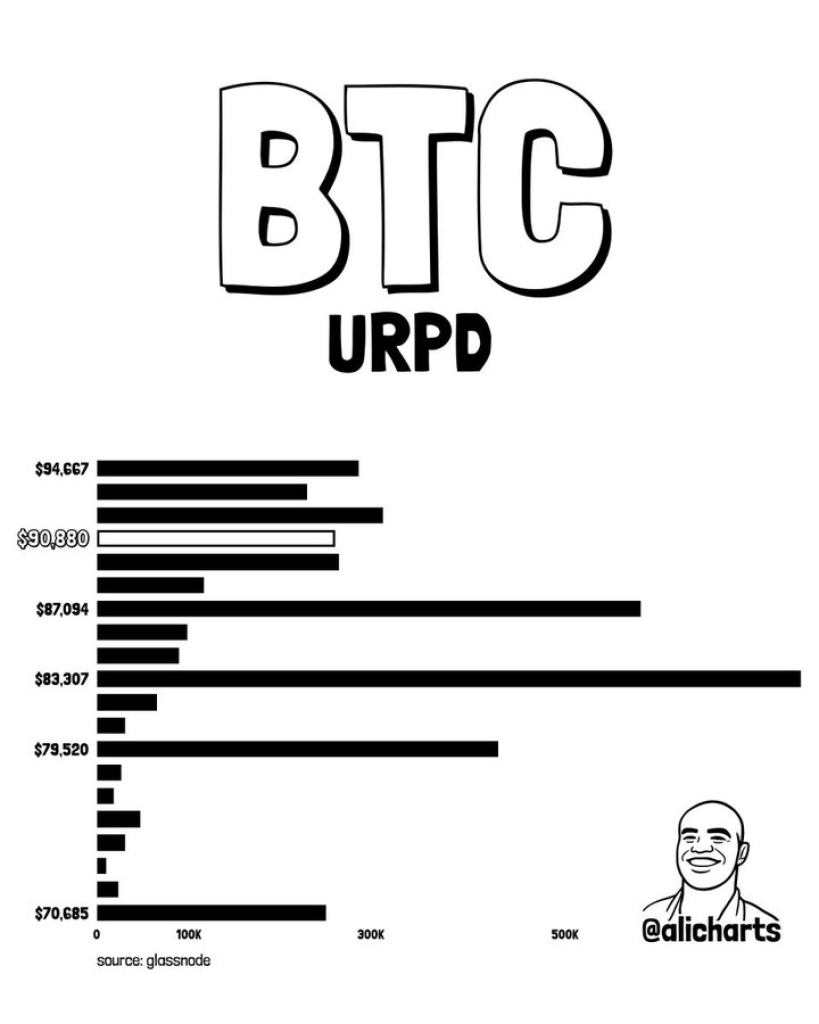

The Bitcoin price has been on edge, and recent analysis has identified key areas every holder should note. Specifically, prominent market watcher Ali Martinez highlighted these crucial support zones in his recent X analysis using the BTC URPD.

Key Levels to Watch

For the uninitiated, the Bitcoin UTXO Realized Price Distribution (URPD) metric shows at what price Bitcoin supply was last moved, helping to identify areas of strong support and resistance.

Martinez highlighted the $87,094, $83,307, and $79,520 support levels as the three major demand levels using the BTC URPD indicator. An accompanying chart shows that users moved large amounts of the coin in this area, suggesting it is a potential area of buying pressure.

Source X

Source X

Meanwhile, Bitcoin has steadied around $90,000, losing its earlier bullish momentum. It has looked bearish recently amid macroeconomic uncertainty, forcing analysts to closely monitor its price trend.

Should the consolidatory energy persist, Martinez believes that these areas are where Bitcoin could potentially retest. The support zones also offer a good buying opportunity for those looking for a good entry or DCA point. However, a momentum shift could see Bitcoin target higher resistance areas.

Has Bitcoin Bottomed?

As Bitcoin hovers around $88K-$90K, market participants are beginning to analyze if it could be a short-term base or price bottom. One of those fronting this narrative is Ark Invest CEO Cathie Wood, who said on CNBC live that Bitcoin is around its price bottom.

According to her, Bitcoin will experience the shallowest decline in its history, citing its underperformance during the bullish phase of its four-year cycle relative to historical standards.

“We think we are pretty well through the down cycle,” Wood insisted.

Why You Should Hold This Better Bitcoin Alternative

With Bitcoin’s trajectory hanging in the balance, market attention is shifting beyond large caps to other low-cap altcoins for better portfolio diversification. While not all of them will surge by the same amount, promising ones like Minotaurus (MTAUR) will surely deliver massive upside.

For the uninitiated, MTAUR is a highly sought-after token that powers the Minotaurus ecosystem. The project leverages the low-cost, high-scalability features of the BNB Chain, offering users an exciting yet beneficial gaming experience.

Why the casual gaming niche? Data from Statista shows that the sector would surge to $29 billion by 2029, and Minotaurus is positioning itself as a leader in the space. This could make MTAUR the next billion-dollar project, benefiting those who buy more.

At the current price of 0.00012642 USDT, one can acquire 79,000 MTAUR for less than 10 USDT. Let’s assume that MTAUR hypothetically rallies to 0.01 USDT; that would boost the capital by over 1,000%.

Learn more at minotaurus.io.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Bitcoin Price Analysis: Expert Highlights 3 Key Price Zones That Could Decide Its Fate appeared first on CaptainAltcoin.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Trump's border chief insists Americans support ICE – and is shut down by host: 'Come on!'