Iran’s Central Bank Used $507M in USDT to Bypass Sanctions, Elliptic Reports

Iran’s central bank used at least half a billion dollars in USDT to ease a currency crisis and work around sanctions-driven limits on dollar access, according to a new Elliptic report.

The blockchain analytics firm reports that the Central Bank of Iran (CBI) acquired at least $507 million in USDT. Elliptic treats this as a lower estimate based on wallets confidently linked to the institution. Investigators began tracing the digital trail after leaked documents showed two USDT purchases in April and May 2025, paid in Emirati dirhams, leading them to a wider wallet network.

The firm concludes that the pattern reflects a deliberate strategy to build a sizeable dollar-linked reserve outside the conventional banking system. Elliptic links multiple addresses on TRON and other networks to the CBI.

From Nobitex to Bridges: Tracing the USDT Flow

Elliptic’s tracking shows that, until early June 2025, most of the CBI-linked USDT passed through Nobitex, Iran’s biggest crypto exchange, where people could hold USDT, trade it, or convert it to rials. Sending USDT through Nobitex shows the central bank used it to put dollars into Iran’s local markets.

After June 2025, flows shifted from Nobitex to a cross-chain bridge. This bridge moved USDT from TRON to Ethereum, then dispersed funds through decentralized exchanges, other blockchains, and centralized venues through late 2025. Since then, the firm hasn’t been tracking any additional USDT funds related to Iran.

This operational pivot occurred around the same time as the June 18, 2025, hack on Nobitex, when the pro-Israel group Gonjeshke Darande stole around $90 million in crypto and burned the assets by sending them to an unrecoverable address.

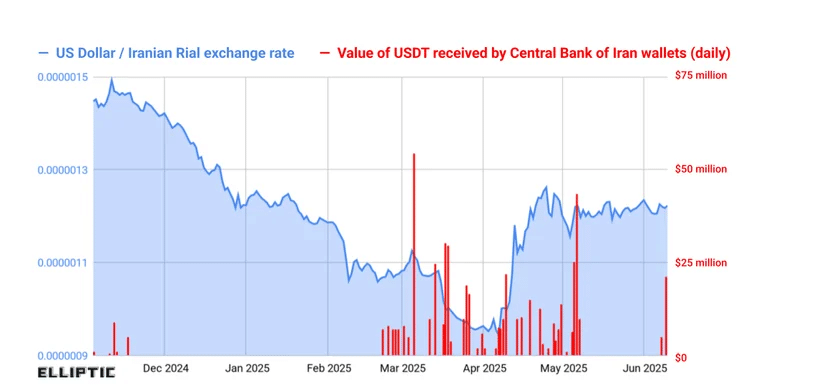

Elliptic links the buildup of USDT reserves to two pressures facing Tehran: a collapsing rial and the challenge of settling cross-border trade under sanctions. The report notes that the rial lost around half its value against the dollar in eight months. This prompted the central bank to seek tools to stabilize the FX market.

Graphic of the US Dollar / Iranian Rial exchange rate | Source: Elliptic

On-chain flows to Nobitex are consistent with the CBI’s use of USDT for open-market operations. The central bank bought rials with stablecoins to support the exchange rate without tapping official foreign reserves, which are constrained by sanctions. This is similar to what Venezuela has done since September 2025, due to dollar scarcity.

Sanctions Risks and Enforcement Response

Elliptic argues that this infrastructure is a sanctions-resistant shadow banking layer, but not an invisible one. Stablecoin transfers occur on public blockchains, leaving a visible trace. The firm stresses that, unlike cash or a traditional money exchange dealer, USDT on TRON and Ethereum leaves an auditable trail that regulators and compliance teams can monitor.

The report highlights how exchanges, custodians, and stablecoin issuers can still enforce sanctions by blocking or freezing high-risk wallets. Tether reportedly blacklisted several wallets linked to the CBI in the past. The company also freezes USDT wallets at the request of enforcement authorities worldwide. This demonstrates that stablecoin controls can be applied directly at the token level.

In addition to these controls and investigations, on January 11, 2026, TRM Labs, a blockchain analytics firm, published a report describing how Iran’s Islamic Revolutionary Guard Corps (IRGC) moved nearly $1 billion in cryptocurrency between 2023 and 2025. This demonstrates the challenges of enforcing sanctions on crypto transactions, even with advanced technology.

nextThe post Iran’s Central Bank Used $507M in USDT to Bypass Sanctions, Elliptic Reports appeared first on Coinspeaker.

You May Also Like

The USDC Treasury burned $50 million worth of USDC on the Ethereum blockchain.

Crossmint Partners with MoneyGram for USDC Remittances in Colombia