Bitcoin Advocate Urges Federal Reserve to Add BTC to Stress Tests

Pierre Rochard, CEO of The Bitcoin Bond Company, has formally requested that the Federal Reserve include Bitcoin as an explicit variable in its 2026 supervisory stress tests, arguing the asset’s extreme volatility and growing institutional adoption warrant standalone treatment in banking risk assessments.

The letter, submitted January 20 to the Federal Reserve Board, challenges the practice of grouping Bitcoin with other cryptocurrencies and proposes quantitative calibration based on the asset’s historical behavior dating back to 2015.

Rochard’s submission arrives as the US government navigates conflicting policies on Bitcoin holdings, amid recent confusion over whether forfeited assets from the Samourai Wallet case violated Executive Order 14233, which requires seized Bitcoin to be transferred to the Strategic Bitcoin Reserve rather than liquidated.

However, the Department of Justice later confirmed, through White House crypto advisor Patrick Witt, that the 57.5 BTC had “not been liquidated and will not be liquidated,” resolving speculation after blockchain analysts flagged a November transfer to a Coinbase Prime address.

Extreme Volatility Demands Separate Treatment

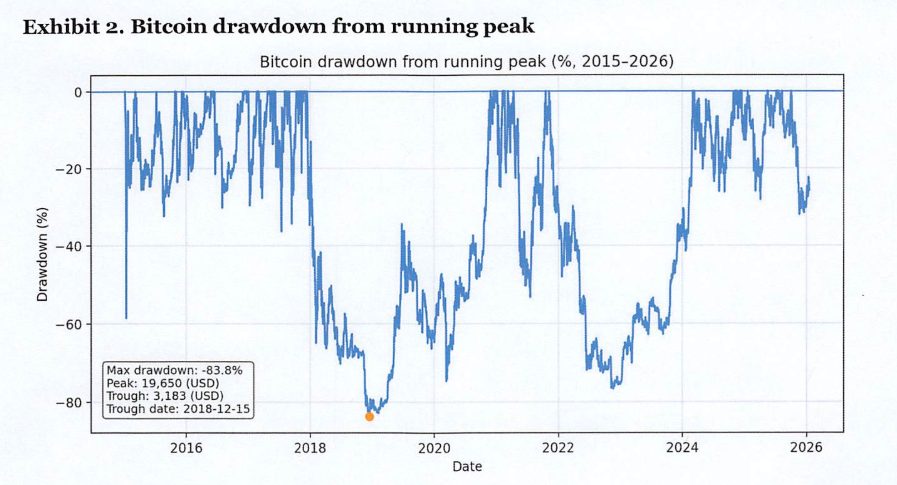

Rochard’s letter presents a detailed analysis showing Bitcoin’s 73.3% annualized realized volatility over the 2015-2026 sample period, compared to just 18.1% for the S&P 500 over the same timeframe.

The analysis documents a maximum drawdown of 83.8% from peak to trough, with daily return tails ranging from -10.0% at the 1st percentile to 10.7% at the 99th percentile, far exceeding typical asset behavior.

Source: X/@BitcoinPierre

Source: X/@BitcoinPierre

“Bitcoin’s risk profile is unusually idiosyncratic and materially non-linear: it has experienced repeated, deep peak-to-trough drawdowns and sustained periods of very high realized volatility,” Rochard wrote.

He argued these properties affect valuations, margin requirements, counterparty exposures, and liquidity demands “in ways that cannot be reliably inferred from other scenario variables.“

The submission includes rolling correlation analysis demonstrating Bitcoin’s unstable dependence structure with macro-financial variables, with correlation between Bitcoin and S&P 500 returns ranging from negative to strongly positive across 90-observation windows.

Rochard warned that “a fixed ‘beta’ mapping from equities (or risk sentiment) to bitcoin will understate risk in some regimes and overstate it in others,” making explicit scenario variables essential for consistent stress testing across banks.

Implementation Would Reduce Model Divergence

Rochard recommends that the Federal Reserve provide quarterly Bitcoin price paths for baseline, adverse, and severely adverse scenarios, with optional daily paths for global-market-shock datasets.

He suggests three calibration methods:

- Historical feature matching tied to peak-to-trough drawdowns and realized-volatility percentiles

- Regime-switching time-series models with different volatilities for bull and bear markets

- Jump-diffusion frameworks with stochastic volatility explicitly representing tail risk

“The calibration goal is not to forecast bitcoin, but to supply a consistent and severe, but plausible, path that stress tests can translate into market and counterparty outcomes,” Rochard explained.

He emphasized that firms without Bitcoin exposure could simply ignore the variable, while those with direct or indirect exposure would gain “transparency, reproducibility, and consistent scenario translation” rather than relying on inconsistent proxy assumptions.

The timing coincides with broader market stress, as Bitcoin plunged to $88,000 amid $1.07 billion in liquidations over 24 hours while gold surged past $4,800 per ounce.

The divergence has renewed debate over Bitcoin’s role as either a risk asset or a strategic reserve, particularly after President Trump’s threats to impose tariffs on Greenland triggered a flight from US assets.

CEO of Galaxy, Mike Novogratz, noted “the gold price is telling us we are losing reserve currency status at an accelerating rate,” adding that Bitcoin “is disappointing as it is still being met with selling.”

The Federal Reserve’s comment period for the 2026 stress test scenarios closes February 21.

Senator Cynthia Lummis, who previously criticized potential government Bitcoin sales as squandering “strategic assets while other nations are accumulating bitcoin,” has proposed legislation to acquire up to 1 million Bitcoin over five years through budget-neutral methods, including tariff revenue and revalued gold reserves.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

QNT Technical Analysis Jan 21