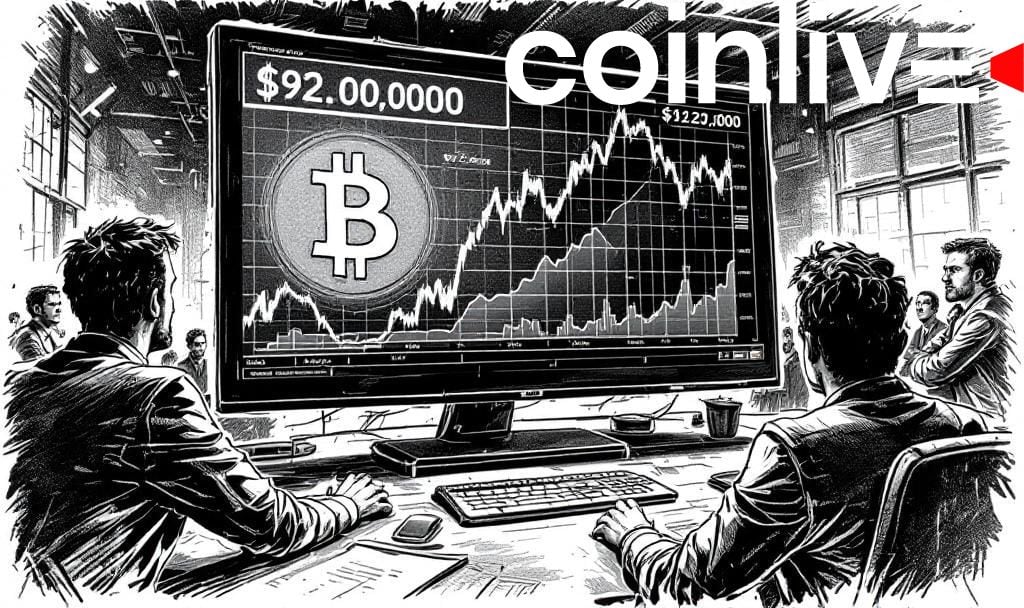

- Bitcoin price declines below $92,000, impacting crypto market.

- $800 million liquidated as panic ensues.

- Market cap reduces by 3%, affecting altcoins.

Bitcoin Price Slips Below $92,000 Impacting Crypto Market

Bitcoin Price Slips Below $92,000 Impacting Crypto Market

Bitcoin’s value fell below $92,000, reaching a low of $91,910 before slightly recovering. This drop affected broader cryptocurrency market movements as well.

The market liquidations exceeded $800 million, including more than $200 million in Bitcoin longs, impacting major digital currencies, including Ethereum and XRP.

Market Impact and Reactions

Bitcoin has slipped below $92,000, a significant figure in the cryptocurrency market. This occurrence has contributed to notable financial shifts worldwide. It marks a period of heightened volatility for stakeholders involved. Market data indicates $800 million in liquidations, primarily affecting Bitcoin long positions. The lack of comments from crypto pioneers or regulatory bodies adds an atmosphere of uncertainty to the situation.

Broader Financial Implications

Immediate repercussions are visible across financial markets with Bitcoin’s decline influencing both individual and institutional investors. The overall market reflects fear and uncertainty, as seen in sentiment metrics. The dip has sparked discussions over crypto’s resilience, with experts analyzing the macroeconomic factors at play. Additionally, institutional confidence appears shaken, amplifying the potential for wider market implications.

Future Outlook and Speculations

Stakeholders are closely monitoring the developments for potential policy or institutional responses. Many assess historical data, noting that past fluctuations did not always lead to prolonged downturns. However, the current dynamics necessitate cautious watchfulness.

Insight remains limited without official data from primary sources, but trends suggest increased scrutiny from regulatory bodies. Social metrics hint at shifting community sentiment, potentially affecting trading dynamics and regulatory outlook in the near term.