Hyperliquid Foundation makes second-largest donation to ZachXBT with 10K HYPE

The Hyperliquid Foundation has donated 10,000 HYPE tokens to blockchain investigator ZachXBT. The contribution, valued at approximately $254,000, ranks as his second-largest donation from any single entity.

- Hyperliquid donated 10,000 HYPE worth $254K, ZachXBT’s second-largest single contribution.

- ZachXBT confirmed the donation on Jan. 18 and updated his public contributor leaderboard.

- The donation followed his exposure of a $282M hardware wallet social engineering theft.

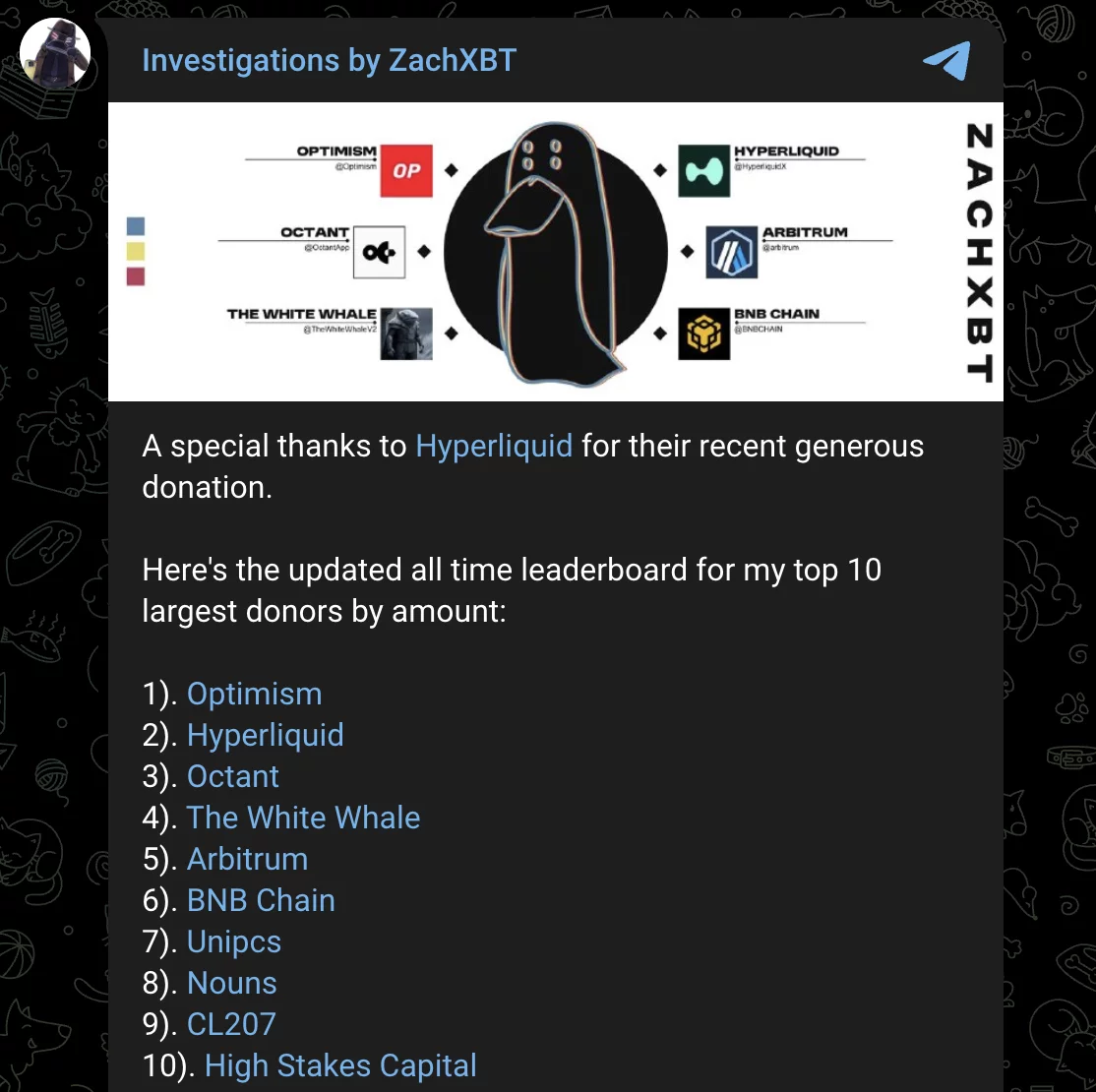

ZachXBT confirmed the receipt of funds on January 18, 2026, and shared an updated leaderboard of his top 10 contributors.

The list includes Optimism at the top, followed by Hyperliquid, Octant, The White Whale, Arbitrum, BNB Chain, Unipcs, Nouns, CL207, and High Stakes Capital at tenth place.

Announcement by ZachXBT

ZachXBT posted the update on his Telegram channel, thanking Hyperliquid for the donation. The investigator maintains transparency about his funding sources, regularly publishing details about contributors who support his work tracking crypto crimes and scams.

His investigations have helped recover millions in stolen funds and exposed numerous fraudulent operations across the crypto industry.

The donations allow him to continue working independently without relying on traditional funding models that might compromise his objectivity.

The timing of Hyperliquid’s contribution comes shortly after ZachXBT’s latest high-profile investigation into a major theft.

$282 million hardware wallet theft investigation

On January 10, 2026, ZachXBT exposed a theft involving 2.05 million LTC and 1,459 BTC stolen from a single victim’s hardware wallet. The total value reached $282 million, making it the largest individual crypto theft of 2026.

The attack occurred around 11 PM UTC through what appears to be supply chain manipulation or social engineering tactics. The hackers bypassed the cold storage security measures that hardware wallets typically provide.

ZachXBT tracked the stolen funds as they moved through multiple exchanges. The attacker converted the Bitcoin and Litecoin into Monero to hide the trail. This conversion caused a temporary price spike in Monero as large volumes entered the privacy coin.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

WTI drifts higher above $59.50 on Kazakh supply disruptions