Bitcoin Miner Canaan Receives Nasdaq Delisting Warning Over Sub-$1 Share Price

Canaan Inc. (NasdaqGM:CAN) has received a fresh warning from Nasdaq over its sub-$1 share price. The company has kept its listing for now and can avoid delisting, while its stock trades under the threshold in Friday’s session.

Singapore-based crypto mining hardware maker Canaan Inc. said it received a written notice from Nasdaq on Jan. 14, 2026. The notice stated that its American depositary shares (ADSs) no longer meet the minimum bid requirement under Listing Rule 5550(a)(2).

The company ADSs have closed below $1 for 30 straight business days, triggering the deficiency notification, according to their press release.

Canaan Has a Second Chance to Avoid the Delisting

Based on Nasdaq Listing Rule 5810(c)(3)(A), Canaan now has 180 calendar days, until July 13, 2026, to restore compliance. The company must raise its ADS closing bid to at least $1 for 10 consecutive trading sessions. The notice does not immediately affect the listing or trading of Canaan’s securities on Nasdaq. The shares will continue to trade under the ticker CAN during the grace period.

If the company fails to reach the 1 dollar level by July 13, it may still qualify for a second 180-day compliance window, subject to Nasdaq staff review. To obtain that extension, the company would need to apply for a transfer and pay a $5,000 fee. It must also satisfy other initial listing standards beyond the bid price and confirm it plans to fix the issue, including through a potential reverse stock split.

Canaan says it will monitor its share performance and take steps to regain compliance with the bid rule.

Canaan Stock Keeps Trading Below the Threshold After Notice

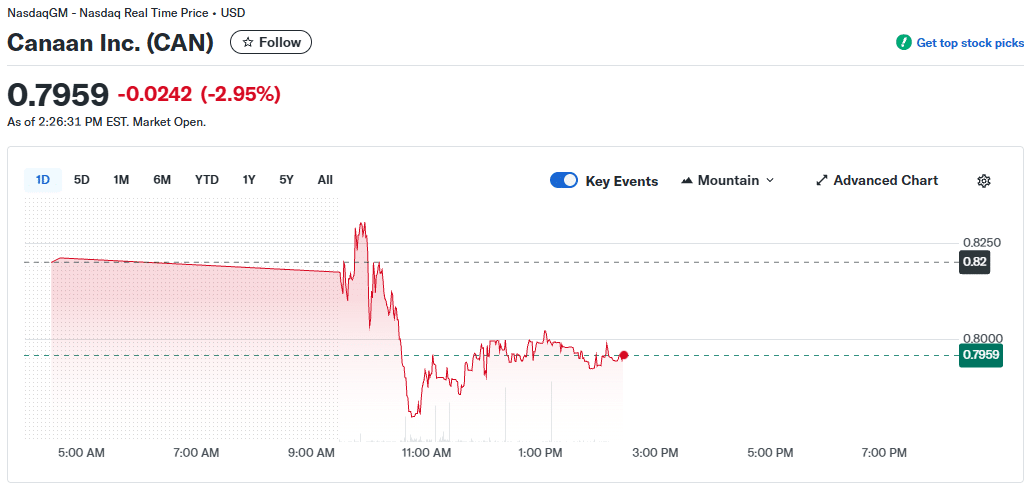

Canaan’s stock continued to trade below the 1 dollar mark on Friday, despite the notification becoming public, and even dropped 3%. The ADSs changed hands around 0.80 dollars. The last quoted price was 0.798 dollars as of early afternoon on Jan. 16, 2026. This shows the bid remains well below the required level, according to Yahoo! Finance.

Canaan Inc. Stock Price | Source: Yahoo! Finance

The data show the stock has remained below $1 in recent days, matching the 30-day stretch mentioned in Nasdaq’s notice. The last time it was above $1 was October 2025, when the company announced a 4.5 MW contract to connect its Bitcoin BTC $95 145 24h volatility: 0.1% Market cap: $1.90 T Vol. 24h: $37.08 B miners in Japan.

The analysts’ average price target for CAN remains in the multi-dollar zone, but this does not affect Nasdaq’s minimum bid rule. The target may reflect Canaan’s Bitcoin Treasury, ranked #38 on BitcoinTreasuries, and its strong correlation with Bitcoin prices.

Canaan’s results remain tied to demand for bitcoin mining machines and broader market conditions in the crypto industry. The company again highlighted these factors in the forward-looking statements section of its latest announcement. Their executives also pointed to macroeconomic and regulatory risks that could influence its ability to execute its strategy while it works to resolve the listing deficiency.

nextThe post Bitcoin Miner Canaan Receives Nasdaq Delisting Warning Over Sub-$1 Share Price appeared first on Coinspeaker.

You May Also Like

Traders Watch Snorter Token’s $3.9M Presale

Saylor Defends Bitcoin Treasury Firms Amid Rising Criticism