Hopes of Strong Altcoin Season Ignite Again as Russell 2000 Hits All-Time High

The broader crypto market is showing renewed strength, with the Bitcoin BTC $95 435 24h volatility: 1.2% Market cap: $1.91 T Vol. 24h: $52.29 B price surging past $97,000 earlier this week.

There is growing market chatter around a strong altcoin season in Q1 2026, as the Russell 2000 index hits record highs this month in January.

On-chain data suggests traders are increasingly willing to take on more risk while positioning for a potential altcoin recovery.

Altcoin Season Brewing up for Q1 2026

Altcoins have been showing strength recently, with top assets like Ethereum ETH $3 309 24h volatility: 1.1% Market cap: $399.37 B Vol. 24h: $25.97 B , BNB BNB $935.5 24h volatility: 0.2% Market cap: $127.56 B Vol. 24h: $1.43 B , Solana SOL $143.7 24h volatility: 0.6% Market cap: $81.20 B Vol. 24h: $4.38 B , showing strong gains on the weekly chart.

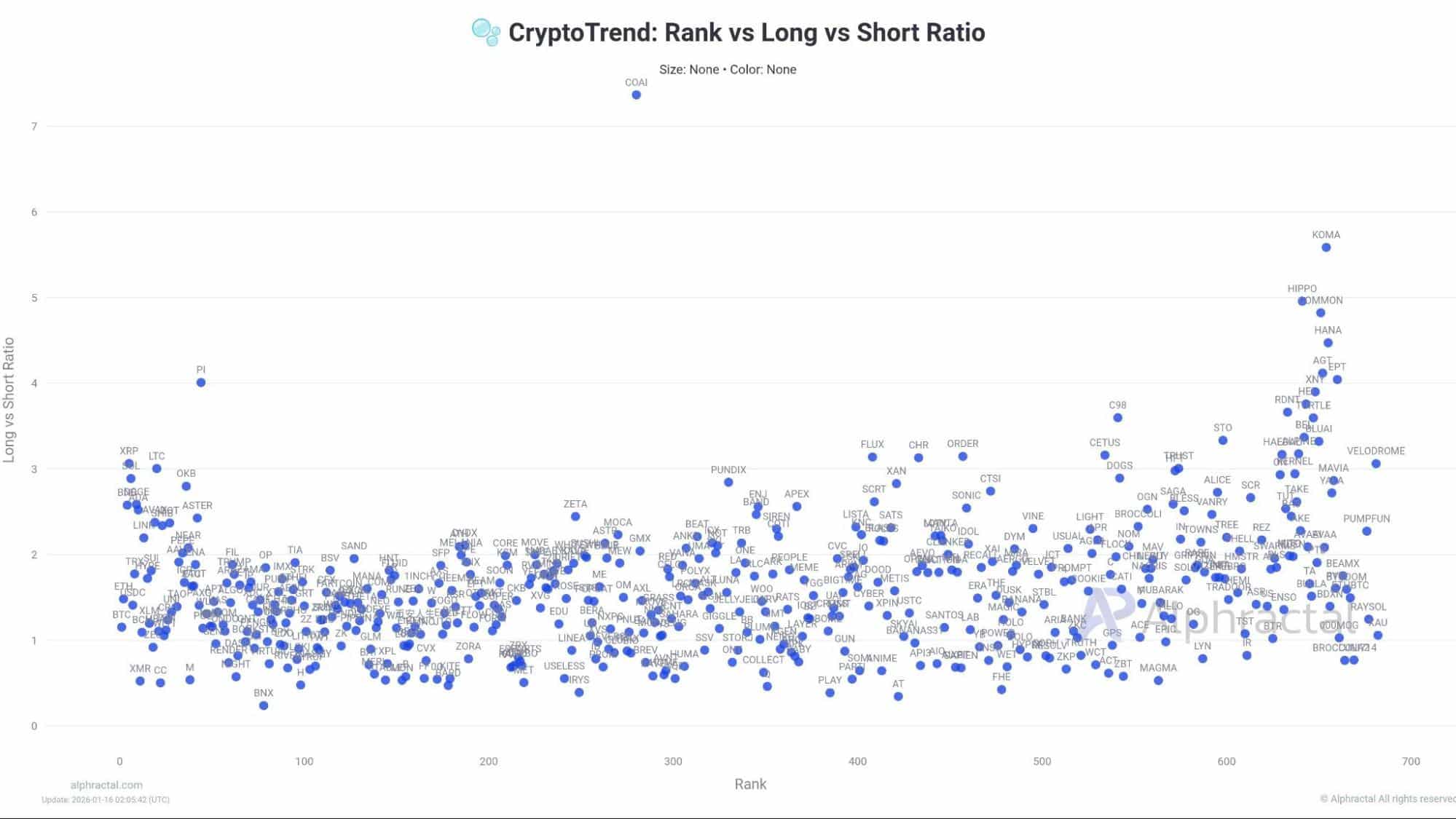

On-chain indicators confirm strength in the altcoin space, with most assets showing a long-to-short ratio above 1. Privacy coins, led by Monero (XMR), have also been drawing increased attention recently.

Crypto analytics platform Alphractel noted that the long positions are currently dominating over the short positions.

The chart below shows that higher-ranked altcoins, with smaller market capitalizations, are posting even stronger ratios.

The trend points to increasing risk appetite among traders, signaling rising confidence in a broader altcoin recovery.

Altcoins long vs. short ratio. | Source: Alphractel

From an investor psychology perspective, many altcoins have corrected by 80%-90%.

As a result, investors who are already facing significant losses have little incentive to sell and are instead choosing to hold their positions.

Another popular crypto market analyst, Crypto Patel, noted that the altcoins vs Bitcoin chart is showing signs of a bottom formation.

He expects the next “altseason” in 2026 to be larger than the 2017 and 2021 cycles combined, citing a key technical setup in the OTHERS/BTC chart.

According to Patel, OTHERS/BTC has returned to a major support level that previously occurred before every major altcoin cycle.

He highlighted that similar conditions led to rallies of roughly 423% in 2017 and 503% in 2021.

If the historical pattern repeats, Patel expects a move of 702% in 2026.

Russell 2000 Index Shows Major Strength

The Russell 2000 index, reflecting small-cap stocks, is showing major strength after hitting a fresh all-time high in January. This highlights renewed strength in U.S. small-cap stocks, setting up a strong backdrop for risk assets.

In just the first 15 days of 2026, the index has risen 7%, adding $220 billion to its market cap.

Veteran trader Peter Brandt noted that the index has broken out from an inverse head-and-shoulders pattern, prompting him to take a long position.

nextThe post Hopes of Strong Altcoin Season Ignite Again as Russell 2000 Hits All-Time High appeared first on Coinspeaker.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Ripple Concludes 700 Million XRP Escrow Lock for March