Solana Slowly Surges Toward $150: Is $200 Next for SOL Price?

The post Solana Slowly Surges Toward $150: Is $200 Next for SOL Price? appeared first on Coinpedia Fintech News

The crypto market sentiment has been positive for over the past few days as Bitcoin surges above $95K. Recent reports on CPI hint at cooling inflation, triggering strong buying demand across the market. As a result, several altcoins posted strong gains with the Solana price now heading toward resistance channels. However, analysts believe Solana could extend its gains due to strong ETF inflows in recent days and upcoming Alpenglow upgrade.

Solana Sees Strong ETF Inflows

SOL price has done well in the past few weeks, and this trend could continue in the coming months as investors focus on the upcoming Alpenglow upgrade. Additionally, recent strong ETF inflows have strengthened Solana’s support levels, potentially pushing SOL price toward a bullish channel.

However, as sellers took control, Solana faced strong liquidation among buyers, as revealed by Coinglass data. Over the last 24 hours, Solana faced a total liquidation of $10.5 million. Of this, buyers liquidated significantly, amounting to nearly $7.7 million worth of position.

Despite this minor pullback, analysts believe Solana could be preparing for a bullish setup as investors accumulate due to strong ETF inflows. U.S. spot Solana ETFs brought in $23.57 million yesterday, marking the biggest inflow in the past four weeks, according to SoSoValue.

Also read: Solana (SOL) Price Tests $145 Resistance as Network Growth Signals a Shift—What Comes Next?

Additionally, the upcoming Alpenglow upgrade is fueling accumulation around recent dips. Alpenglow will be the biggest upgrade since the network was created, replacing the Proof-of-History and TowerBFT systems. This change will cut transaction finality from 12.8 seconds to about 100–150 milliseconds, making the network one of the fastest in crypto.

As a result, Solana’s open interest has seen a sharp increase over the last 30 days. The OI metric jumped from the low of $6.8 billion to a recent high of $8.8 billion. This surge in OI suggests that buyers are taking positions around Solana’s dips, strengthening the potential for a $200 bull run in the coming days.

What’s Next for SOL Price?

Solana climbed to $147, a level where sellers defended an upward push strongly. As a result, SOL price is now losing bullish momentum and is heading toward EMA trend lines. As of writing, SOL price trades at $142, declining over 3% in the last 24 hours.

SOL/USDT Chart

SOL/USDT Chart

The rising 20-day EMA at $143 and an RSI close to the midline suggest momentum is still leaning upward, and a break above $147 could drive the SOL/USDT pair toward $173 or even $200.

On the downside, the moving averages are the key support levels to watch. If the price falls below them, it would signal weakening buying pressure and could keep Solana trading between $117 and $147 for a while longer.

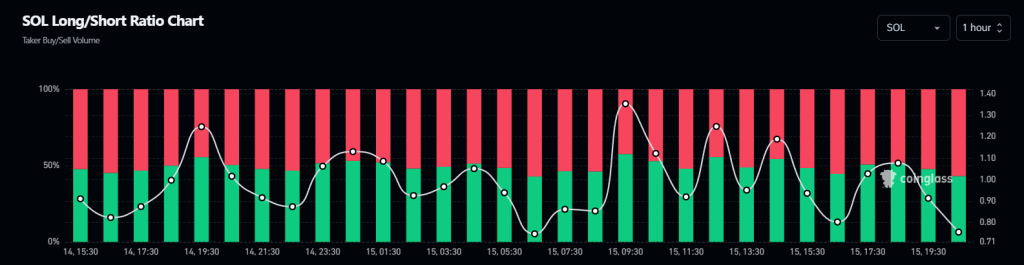

Solana Long/Short Ratio

Solana Long/Short Ratio

However, the current momentum is bearish and sellers are controlling the price trend. The long/short ratio has dropped significantly below the ratio of 1. Currently, it is at 0.7569, suggesting that traders are increasingly leaning toward short positions.

You May Also Like

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

This U.S. politician’s suspicious stock trade just returned over 200% in weeks