High Roller Technologies Stock Surges 500% on Crypto.com Partnership

Crypto.com and online casino operator High Roller Inc. have entered into a binding strategic partnership to launch an event-based prediction market service in the US.

According to a Jan. 14 press release, the partnership will focus on developing and serving trade event contracts across markets including finance, entertainment, and sports with contracts offered via Crypto.com Derivatives North America (CDNA), an affiliate of Crypto.com and CFTC-registered contract market and derivatives clearing organization.

ROLR Stock Lifts on Ambitious Expansion Efforts

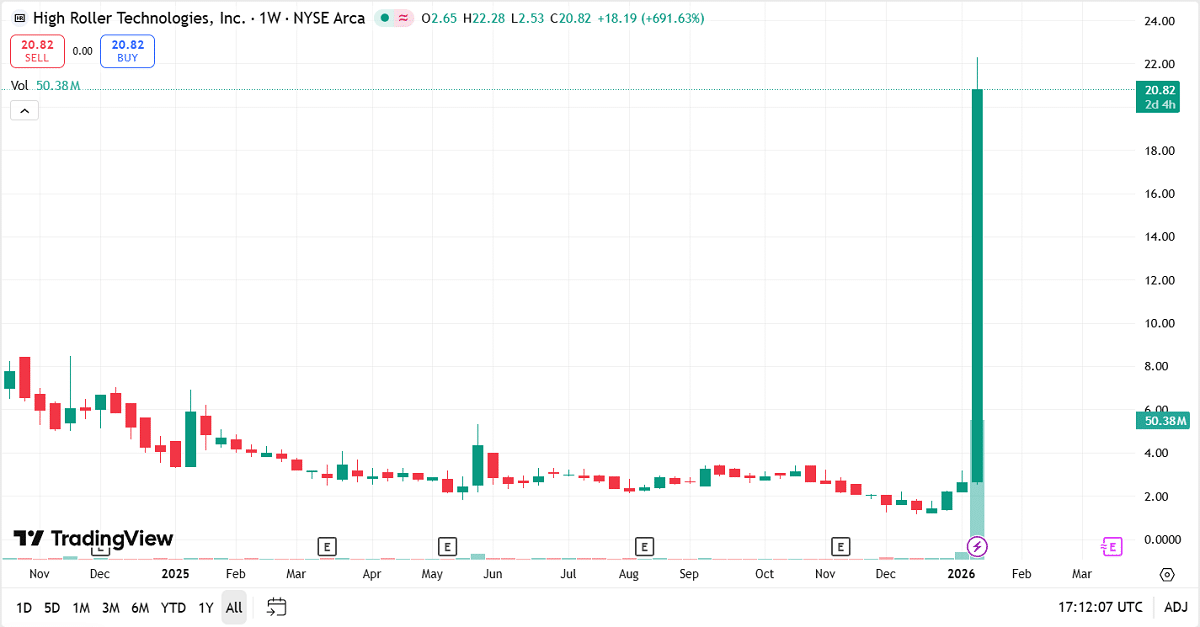

High Roller’s ROLR stock surged more than 500% to $21, as of the time of this article’s publication, on the partnership news. This reflects bullish sentiment for the firm’s entry into the US market.

This breakout represents an all-time high for ROLR. High Roller’s previous ATH of about $8.60 occurred shortly after the company filed for IPO and went public in October 2024. After a rolling decline into 2025, ROLR capitulated between $2.00 and $3.00 through most of the year.

ROLR stock reached a new all-time high near $21.00 | Source: TradingView

High Roller posted its first profitable quarter as a publicly traded company in the third quarter of 2025 with $6.3 million in revenue. This growth stage marked the next leg of the company’s planned North American expansion which began in 2022 with the establishment of an office in Las Vegas and includes a planned location in Canada.

Crypto.com Bolsters Its Presence in the Prediction Markets Space

The partnership demonstrates the formalization of Crypto.com’s strategy to serve as a backbone provider for prediction markets. Essentially, Crypto.com is leveraging its US registrations to serve as a conduit for High Roller’s customers.

This allows Crypto.com to function as an underpinning facilitator to the US prediction markets sector, shifting its business model toward enterprise services and positioning it as a primary B2B service provider.

nextThe post High Roller Technologies Stock Surges 500% on Crypto.com Partnership appeared first on Coinspeaker.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

QNT Technical Analysis Jan 21