Bitcoin Price Tops $95K After Donald Trump Said He Wants The Markets To Go Up

Bitcoin price crossed above the $94,000 psychological resistance to top $95,000 with an intraday high of around $95,804, just shy of $96,000. BTC is up 3.5% in the last 24 hours to trade at $95,014 as of 1:33 a.m. EST, as President Donald Trump said that he wants the market to go up.

Speaking at the Detroit Economic Club, Donald Trump told business leaders that “inflation is defeated” as new economic data shows consumer prices rose 2.7% from a year ago, above the Federal Reserve’s 2% target.

Trump said that he wants new Fed Chair Jerome Powell to lower interest rates as markets are strong.

“That’s the right way. Today, if you announce great numbers, they raise interest rates to try and kill it, so you can never really have the kind of rally you should have,” he said.

He forecasted that “we’re going to have a lot of great months, a lot of great quarters” and added that he wants the market “to go up”.

Trump Pushes Fed Rate Cuts as Legal and Trade Uncertainty Builds

Trump’s push for lower interest rates comes as the US Department of Justice (DOJ) launched a criminal investigation into the Fed Chair. Powell has called the investigation unprecedented and says he believes it was opened because of Trump’s anger over the Fed’s interest rate actions.

In other news, after postponing a Friday rule on Friday, the Supreme Court is set to make a decision today on whether Trump’s tariffs are legal.

Data from Polymarket shows that the odds of the Supreme Court ruling in favor of the tariffs have risen to 29%.

Bitcoin Price Breaks Out – Investors Push For A Sustained Rally

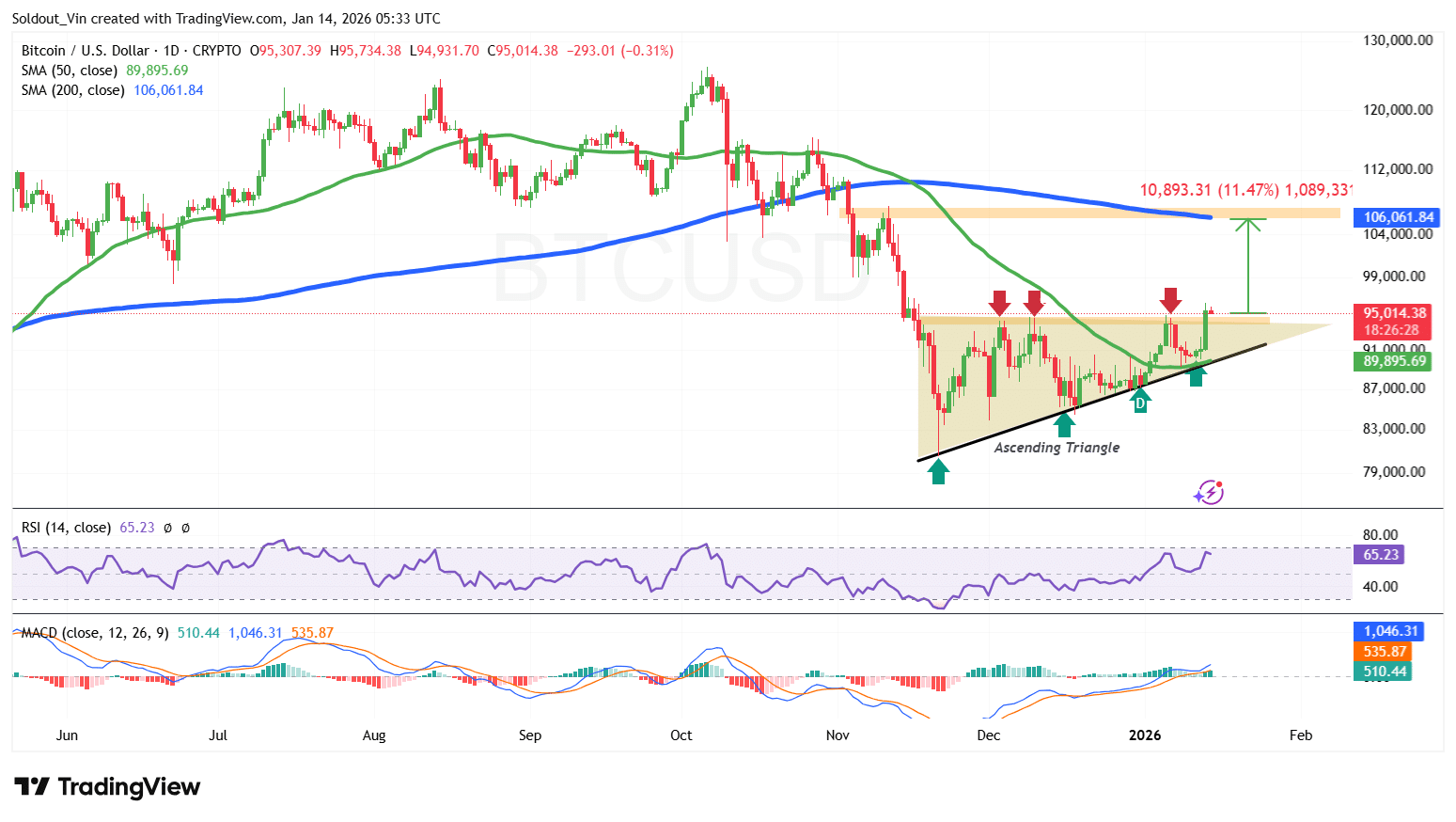

The Bitcoin price has broken out of an ascending triangle, a bullish signal of an upcoming rally. The BTC price has crossed the $94,000 level and the resistance area, which is being pushed by previous supply zones at $80,500, $85,300, and $87,200, and is now being pushed by the $90,000 zone.

Bitcoin has now traded consistently above the 50-day Simple Moving Average (SMA) on the daily chart, further bolstering the bullish outlook and the breakout’s strength.

Meanwhile, the Relative Strength Index (RSI) at 65 and climbing signals that investors are entering the market, which could translate into a price push.

Bitcoin’s Moving Average Convergence Divergence (MACD) has also turned positive, with the blue MACD line crossing above the orange signal line, confirming that sentiment has turned positive.

BTC/USD Chart Analysis: TradingView

BTC/USD Chart Analysis: TradingView

If the rally picks up and momentum continues to build, the price of Bitcoin could surge towards the $99,600 psychological resistance. If this level is breached, the next likely target will be the previous demand area at $106,061, which lies within the 200-day SMA.

Conversely, if the bears act on BTC at this level, the key support around $89,000 would hold.

Related News:

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip