Crypto Carnage Wipes Out $210B This Week—But Some Coins Refuse to Fold

Over the past three days, the crypto market has taken a hit, shedding $210 billion in value since June 11, when tensions first flared between Israel and Iran. Meanwhile, over the past week, bitcoin has dipped 0.8% and ethereum is down 0.1%, but a handful of altcoins have posted double-digit gains, managing to dodge the broader crypto market slump.

War Jolts Crypto: Losses Mount While Some Dodge the Sell-Off

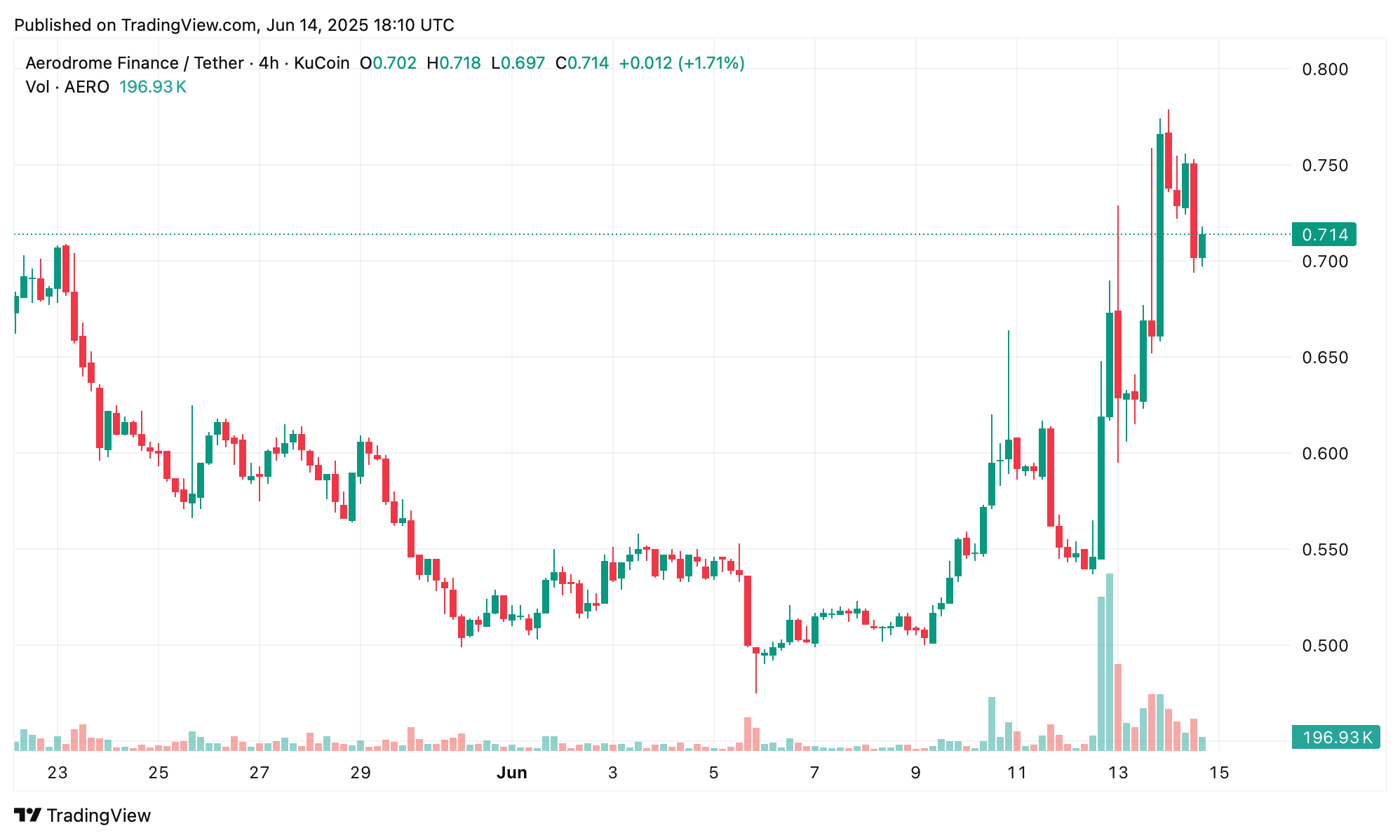

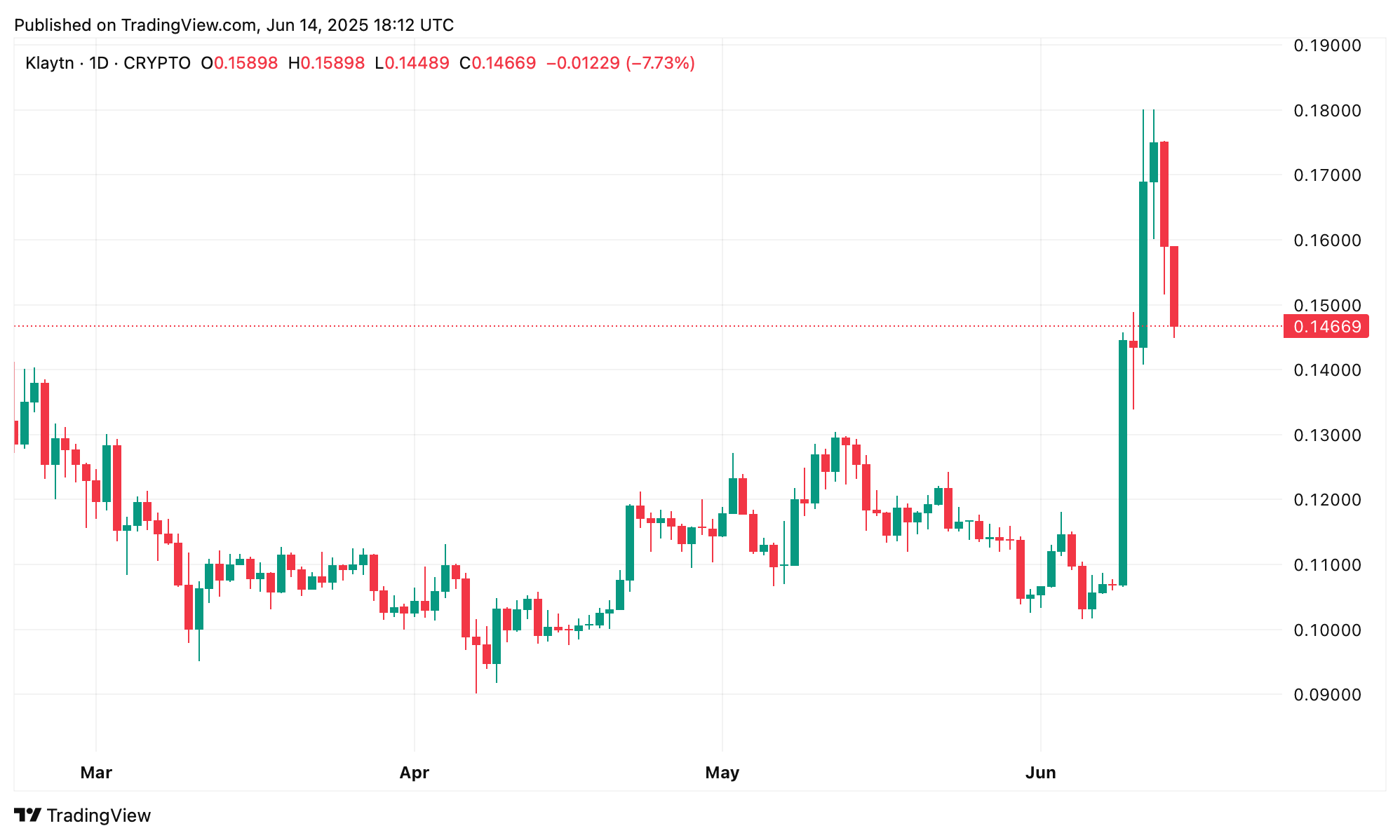

As of press time on Saturday, June 14, the crypto economy stands at $3.26 trillion, having shed $210 billion over the last 72 hours. While most digital assets took a hit this week, aerodrome finance (AERO) soared 37.08%, and klaytn (KLAY) clawed its way up by 36.12%.

AERO/ USDT

AERO/ USDT

Meme token spx6900 (SPX) gained 24.3% against the U.S. dollar, and sky (SKY) floated 19.7% higher. Hyperliquid (HYPE) climbed 16%, while uniswap (UNI) picked up a 14.6% boost. The tongue-in-cheek, AI-themed meme coin fartcoin (FARTCOIN) also notched a 14.6% gain.

KLAY/USD

KLAY/USD

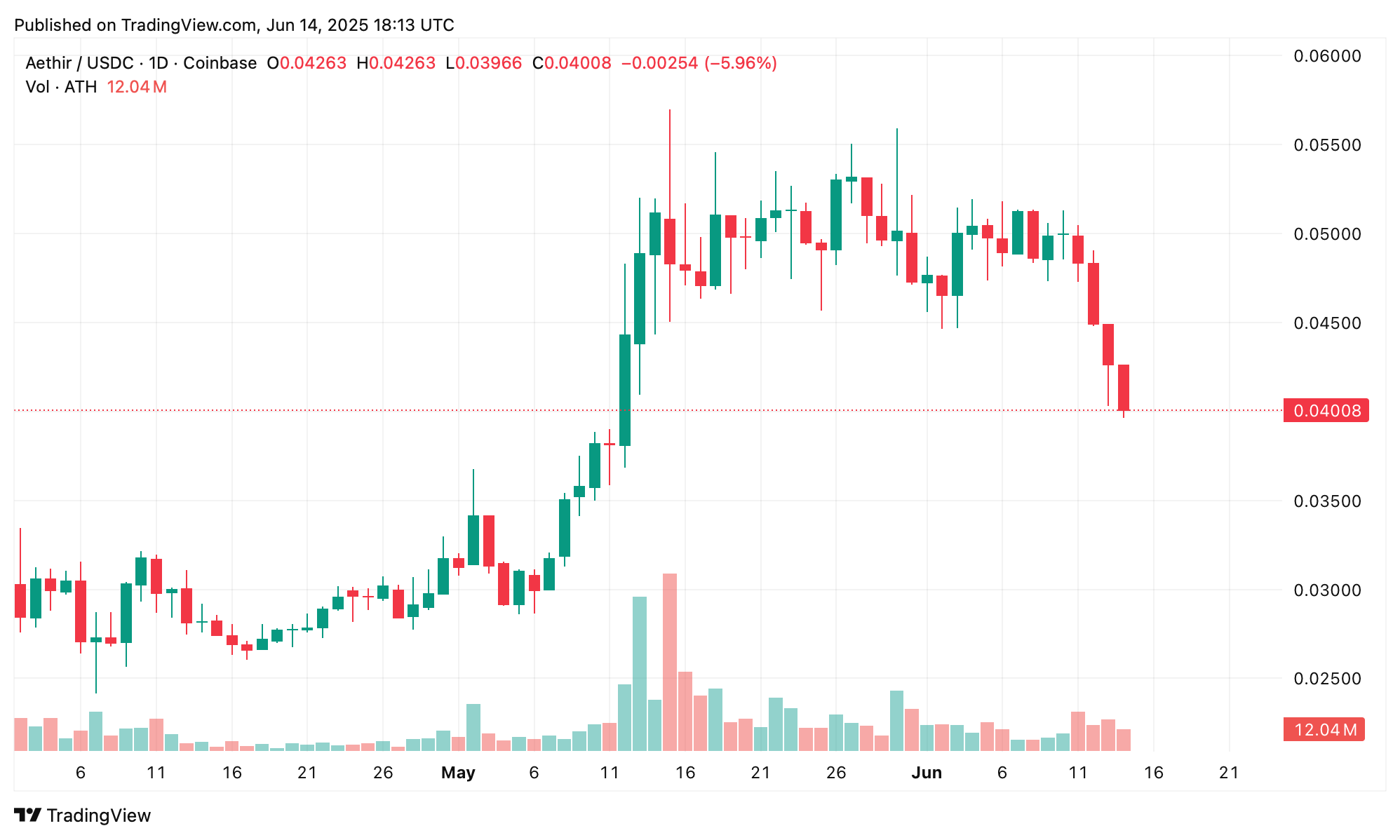

Other double-digit winners included CHEX, WBT, COMP, and MKR. Over the past week, a number of cryptocurrencies also took a hard fall. Leading the pack is aethir (ATH), which tumbled 20.91% to $0.040118.

Not far behind, ai16z (AI16Z) slid 20.08% to $0.172066. Dog (Bitcoin) wasn’t spared either, plunging 19.19% to $0.00354. Zebec network (ZBCN) dropped 18.39%, landing at $0.004079, and kaspa (KAS) slipped 16.85% to $0.073355.

ATH/USDC

ATH/USDC

Meme coin brett (BRETT) pulled back 15.47% to $0.043664, while helium (HNT) wrapped up the list with a 15.12% fall to $2.50. The mixed performance across digital assets suggests that while market sentiment remains shaky amid the conflict in the Middle East, speculative appetite hasn’t vanished entirely.

Traders appear to be navigating volatility with selective conviction, chasing momentum in specific tokens. As geopolitical uncertainty lingers, the coming days may test whether optimism can hold ground or give way to caution.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail