Best Crypto to Buy 2026: Why Analysts Predict Digitap ($TAP) at $2 by Midterms

The post Best Crypto to Buy 2026: Why Analysts Predict Digitap ($TAP) at $2 by Midterms appeared first on Coinpedia Fintech News

The 2026 crypto outlook is entirely different from previous cycles. Meme projects and speculative tokens are no longer in focus as traders search for utility-based altcoins to buy with working products, high upside potential, and a large target market.

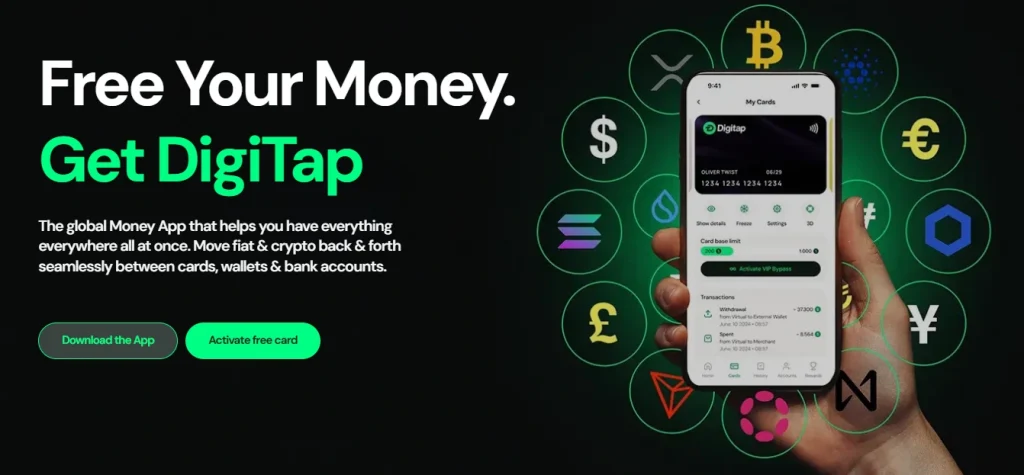

Among the available cryptos to buy in 2026, the Digitap ($TAP) crypto presale is emerging as a standout. The financial superapp is already available on iOS and Android with full omni-bank functionality. Its delivered utility and unique market positioning have prompted analysts to suggest a $2.0 valuation by midterms.

The Market Is Rotating Toward Utility And Capital Protection

The broader crypto market has entered a phase in which capital is no longer allocated to speculative tokens that have not delivered meaningful value to users. Investors are placing more weight on capital protection and downside buffers. Projects without clear utility are struggling to hold attention. Dogecoin, for example, is down nearly 60% this past year.

Shiba Inu, the second-largest meme token by market cap, is likewise down nearly 60%. This is likely because the environment favours infrastructure over experimentation, with a focus on utility and portfolio defense as opposed to hoping for speculative moonshot multipliers.

As a result, many analysts believe the next wave of outperformers will come from utility-backed crypto presale projects. These are increasingly viewed as the best cryptos to buy for those positioning early while reducing exposure to pure hype.

Among the available sectors, payments, settlement, and banking are beginning to stand out. Users always need to move money, pay bills, and manage liquidity. Tokens tied to these functions are less dependent on hype cycles, with relevance regardless of the current market phase.

Digitap: A Global Omni-Bank With Flexible Access

Digita is positioned as a full omni-bank that integrates crypto and fiat in one system. Users can spend, transfer, swap, and store value through a single app. The platform is already live, which removes the execution risk seen in many early-stage projects. This is the risk that the platform won’t actually deliver anything to investors. Another defining feature is Digitap’s tiered KYC structure.

Users can select different access levels depending on their needs, from minimal onboarding to advanced offshore-style banking features. This flexibility supports a global user base, including freelancers, remote workers, and small businesses. It means there is no real ceiling as the app is immediately available for anybody, regardless of their location.

Entry barriers have been made as low as possible, without sacrificing security or privacy. The platform has undergone two smart contract audits from Coinsult & SolidProof. Transactions are private, with 24/7 stealth mode and bank-level encryption for transfers.

It balances compliance with user preferences to cater to a huge market and remain within the ambit of the relevant legal jurisdictions.

This is a unique offering and comes at a time when billions of people cannot get access to financial services, and many more have had their accounts closed without warning.

$2.0 Analyst Target Based On Adoption And Utility

Analysts pointing to a potential $2.0 valuation are focusing on addressable markets rather than short-term price action. Digitap targets large segments such as global remittances, underbanked users, and crypto payments.

Even limited adoption across these sectors can result in huge multipliers, which is partially why the crypto presale has already seen over $4M of whale investment.

The token structure is also proving attractive to investors, with a fixed 2B $TAP supply to prevent value dilution. A 50% platform profit distribution encourages long-term price appreciation and user engagement. Users can earn as they spend at Visa-compatible terminals worldwide, with earnings deposited directly into their accounts.

The current price for $TAP is $0.0427, rising in the next round to $0.0439 and at each round thereafter. This price predictability reassures investors and provides a means of portfolio stability. While the market trades sideways, $TAP will continue to rise steadily before listing on an exchange, after its fundraising is completed.

And if Digitap becomes a staple in the payments industry like Wise or Revolut, it could far exceed its $2.0 target. It has already delivered the technology as an omni-bank offering deposits, withdrawals, payments, transfers, invoicing, payroll, 24/7 support, global IBANs, staking APY, tiered KYC, and more. The main hurdle left is mass adoption.

Why Digitap Is Viewed As The Best Crypto To Buy For 2026

Digitap stands out for combining early-stage pricing with a mature product. Users can already interact with the platform, while investors gain exposure before broader adoption. This is an exceedingly rare balance and explains why whales seeking discounted altcoins to buy have already allocated $4M to the newly launched crypto presale.

$2.0 might be the floor, not the ceiling, for $TAP — it could become the best crypto to buy in 2026 if it gains global adoption. There are very few viable contenders in the omni-bank arena, while billions remain underserved by legacy finance.

Discover how Digitap is unifying cash and crypto by checking out their project here:

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Why Is Crypto Up Today? – January 13, 2026