Shiba Inu Price Near Inflection Point as Supply Shifts Hint at a Bigger Move

The post Shiba Inu Price Near Inflection Point as Supply Shifts Hint at a Bigger Move appeared first on Coinpedia Fintech News

Shiba Inu (SHIB) entered 2026 with mixed momentum as fresh on-chain signals paint a nuanced short-term outlook for the memcoin favorite.

After kicking off the year with a modest rebound from deep consolidation, Shiba Inu price has lost its recent gains and slipped back toward the key support zone of $0.000008300 around the 20 day EMA zone.

At press time, SHIB trades around $0.000008560, displaying muted performance in the past 24 hours.

SHIB Price Outlook: Consolidation With Potential for Breakout

In the past few sessions, Shiba Inu price has showcased retracement and stays close to the 20 day EMA zone around $0.000008560. Amidst low trading volume support, SHIB has struggled to maintain upward momentum despite brief recovery attempts.

Following a rebound from the recent lows of $0.00000680-$0.00000720 zone, the memecoin has failed to extend the gains and displayed range bound moves.

The zone around $0.00000800- $0.00000900 has emerged as a congestion zone, with buyers defending dips but lacking the strength to push price decisively higher.

Meanwhile, SHIB price continues to face resistance near $0.00000900-$0.00000980, a zone that has repeatedly capped upside moves.

On the downside, support around $0.00000750-$0.00000800 remains crucial. A break below this floor could expose SHIB to deeper corrections, while a clean move above resistance may trigger short-term bullish momentum.

While the momentum indicators outlook remains mixed. The Relative Strength Index (RSI) hovers near the neutral mark, showing neither overbought nor oversold conditions.

Moreover, the ADX suggests consolidation rather than a clear trend, reinforcing the idea that SHIB is in a “wait-and-watch” phase for traders.

Whale Activity and Exchange Supply Send Mixed Signals

Besides the technicals, SHIB’s on-chain data is painting an interesting picture. Large holder activity has surged sharply, with whale transactions rising, indicating that the big players are controlling the liquidity.

In parallel, notable SHIB withdrawals from centralized exchanges suggest some investors are moving tokens into long-term storage.

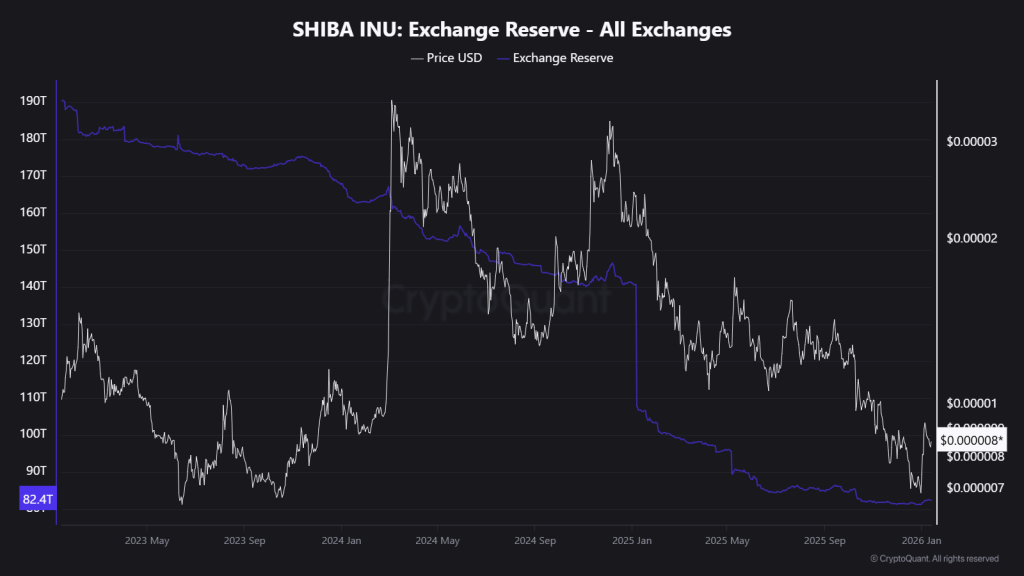

Adding to this, the exchange reserves have shown a gradual decline, a signal often associated with reduced immediate sell pressure.

When fewer tokens sit on exchanges, the available supply for sudden sell-offs tightens. This shows a structurally positive sign over time.

What Comes Next For SHIB?

In the short-term, SHIB appears locked in consolidation,with whale accumulation and declining exchange supply providing a supportive backdrop, but price confirmation is still missing. A sustained breakout above the resistance zone of $0.00000900-$0.00000100 could trigger a positive sentiment in favor of bulls.

Until then, SHIB is likely to move sideways, with volatility building beneath the surface.

You May Also Like

The Channel Factories We’ve Been Waiting For

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.