Story Protocol (IP) Rallies 26% Over 24 Hours As Asian Demand Surges

The price of Story Protocol’s IP token rose by more than 26% over the previous 24 hours to peak at $2.90, beating the cryptocurrency market and signaling the token’s largest intraday increase since October 2024.

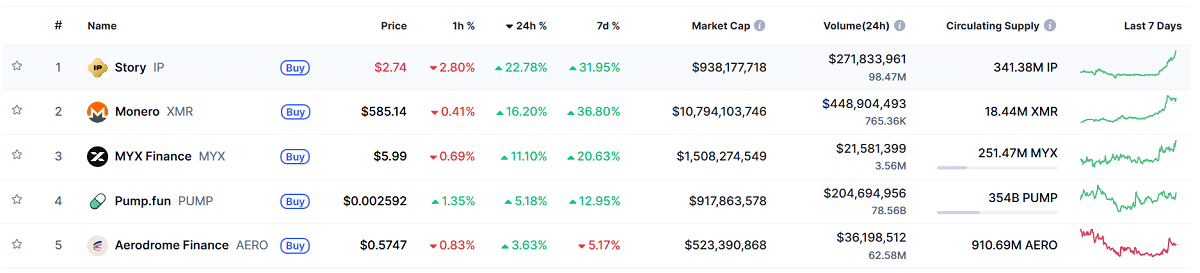

According to data from CoinMarketCap, IP IP $2.83 24h volatility: 25.1% Market cap: $965.74 M Vol. 24h: $293.19 M has settled to $2.75 as of the time of this article’s publication. This follows a 24-hour period during which the token saw nearly $272 million in trading volume. South Korean cryptocurrency exchange Upbit reportedly drove 45% of this volume, propelling an overall bullish sentiment for IP as the second full week of trading for the year gets underway.

IP claims the top slot as highest gaining cryptocurrency by 24-hour price increase. Source: CoinMarketCap

Community Sentiment Drives Price Activity

With nearly half of the volume coming from activity on Upbit, it’s difficult to pinpoint a general market driver for the token beyond geography. Despite entering the week as crypto’s strongest performer, IP’s activity appears to be largely driven by community sentiment.

Story recently announced a renewed interest in setting community standards around rewarding its longest serving members or, “OGs” as they’re referred to.

The timing of the community engagement campaign coincides with IP’s recent price flip. After peaking at around $13.72 in September 2024, the token experienced an extended downturn.

From a technical perspective, the daily chart shows IP breaking out of a prolonged downtrend. The token’s price has crossed above its moving averages, signaling potential trend reversal momentum. The RSI indicator has surged into positive territory after spending months in oversold conditions, reflecting renewed buying pressure. This technical breakout, combined with the price reclaiming the $2.50 support level that held during December 2025, suggests growing momentum, though traders should watch for confirmation of sustained volume above key resistance levels.

Story rallied more than 25% over 24 hours to kick off the week | Source: TradingView

While current sentiment for IP appears to remain bullish following this technical breakout, the token’s sustainability hinges on broader market participation. The heavy concentration of trading volume on Upbit raises questions about whether this momentum can extend beyond regional interest. Without greater indication of diverse market engagement to push prices decisively above the $2.60 resistance threshold, the current price point of $2.77 represents a cautiously optimistic but unconfirmed signal for the next 24-hour cycle.

nextThe post Story Protocol (IP) Rallies 26% Over 24 Hours As Asian Demand Surges appeared first on Coinspeaker.

You May Also Like

WIF price reclaims 200-day moving average

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise