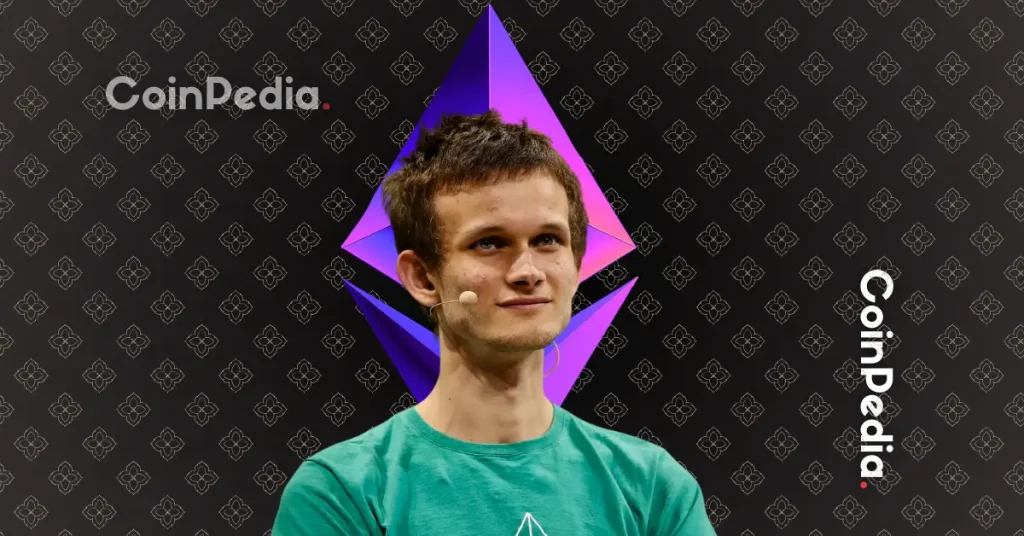

Ethereum Founder Vitalik Buterin Says Crypto’s Stablecoin Model Is Not Built to Last

The post Ethereum Founder Vitalik Buterin Says Crypto’s Stablecoin Model Is Not Built to Last appeared first on Coinpedia Fintech News

Vitalik Buterin has pushed back against the direction of much of the crypto industry, saying Ethereum is deliberately taking a very different path from what most venture capital investors are funding.

His comments came in response to a claim that Ethereum has become a contrarian bet in crypto, standing against trends backed by major crypto VCs. Those trends include gambling-style platforms, centralized DeFi products, custodial stablecoins, and crypto-powered “neo-banks.”

Instead, the argument said, Ethereum is doubling down on its original mission: breaking concentrated power and enabling sovereign individuals.

Why Ethereum Is Pushing Back on the VC Playbook

Reacting to that view, Buterin said the crypto industry urgently needs better decentralized stablecoins, but admitted the hardest problems are still unresolved.

He explained that today’s stablecoins are deeply tied to the U.S. dollar, which works for now but creates long-term risk. If the dollar faces inflation or instability over time, crypto systems that depend on it could inherit the same problems.

Buterin also raised concerns about oracle systems, which feed price data to blockchains. He said many oracles are not truly decentralized and can be influenced by large pools of capital, undermining trust and security.

A third issue, often overlooked, is staking yield. Ethereum staking offers attractive returns, which makes holding ETH more appealing than locking it up to support decentralized stablecoins. As long as staking pays more, stablecoins struggle to compete.

A Different Vision for Decentralized Finance

Buterin’s response made it clear that Ethereum is not trying to compete with crypto casinos, custodial finance apps, or VC-backed banking models. Instead, the network is focused on long-term resilience, decentralization, and user sovereignty.

He argued that systems controlled by financial incentives alone tend to extract value from users and become unstable over time. This is why he continues to defend decentralized governance models, even as many in the industry move toward more centralized structures.

The Staking Trade-Off Still Looms

Buterin acknowledged there is no easy fix for the staking problem. Potential solutions include lowering staking rewards, redesigning staking models to reduce risk, or finding safer ways to use staked ETH as collateral. Each option comes with downsides and would require careful design.

He also warned that extreme events, such as sharp ETH price drops or network attacks, make stablecoin design even more complex.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For