Russian Pension Fund Flooded With Crypto Questions as Mining Income Debate Heats Up

Russia’s Social Fund received around 37 million calls in 2025, with crypto-related inquiries among the most popular requests, alongside traditional social benefit inquiries.

According to a local report, citizens wanted to know whether pensions could be paid in digital assets and whether mining income would count toward social benefit calculations, prompting officials to clarify that all state payments remain exclusively in rubles, while crypto taxation falls under the Federal Tax Service’s jurisdiction.

The unusual volume of crypto queries reflects Russia’s growing appetite for crypto, where mining now generates roughly 1 billion rubles daily, and regulatory frameworks continue to take shape ahead of mid-2026 implementation deadlines.

Mining Income Recognition Gains Political Momentum

Last month, senior Kremlin official Maxim Oreshkin pushed to classify crypto mining as export activity in Russia’s official trade accounts, arguing that mined digital assets effectively flow abroad even though they never cross physical borders.

Speaking at the Russia Calling investment forum, Oreshkin called mining “a new export item” that Russia “doesn’t value very well,” citing how these transactions influence foreign-exchange markets and balance of payments outside formal statistics.

Industry estimates support his case for recognition, with the Social Fund noting that “many people are interested in whether it’s possible to receive a pension in cryptocurrency and whether mining income will be taken into account when calculating social benefits.“

Experts from the fund “politely explained that all payments from the SFR are made exclusively in rubles, and that taxation of digital assets falls under the jurisdiction of the Federal Tax Service.“

Russia’s mining operations account for over 16% of global hashrate last year, ranking second worldwide, while corporate operations now face 25% tax rates following the November 2024 legalization.

Shortly after Oreshkin, Central Bank Governor Elvira Nabiullina also acknowledged that mining contributes to the ruble’s strength but emphasized that quantifying its impact remains difficult, as significant portions of the industry operate in gray areas.

Despite legalization requiring Federal Tax Service registration for legal entities and exempting household miners using less than 6,000 kWh monthly, illegal operations continue costing Russia billions annually through stolen electricity and unpaid taxes.

Regulated Trading Infrastructure Takes Shape

Late last month, Moscow Exchange and St. Petersburg Exchange confirmed readiness to launch crypto trading once Russia’s legislative framework takes effect by July 1, 2026, following the Bank of Russia’s December 23 regulatory concept release.

St. Petersburg Exchange emphasized that it already has the necessary technological infrastructure for trading and settlements, while Moscow Exchange stated that it is actively working on solutions to serve the cryptocurrency market.

The regulatory framework sharply divides market access between investor classes.

Non-qualified investors face annual purchase caps of 300,000 rubles through single intermediaries, limited to liquid cryptocurrencies on defined lists after passing mandatory knowledge tests, while qualified investors encounter no volume restrictions but must show risk understanding and cannot purchase anonymous tokens that conceal transaction data.

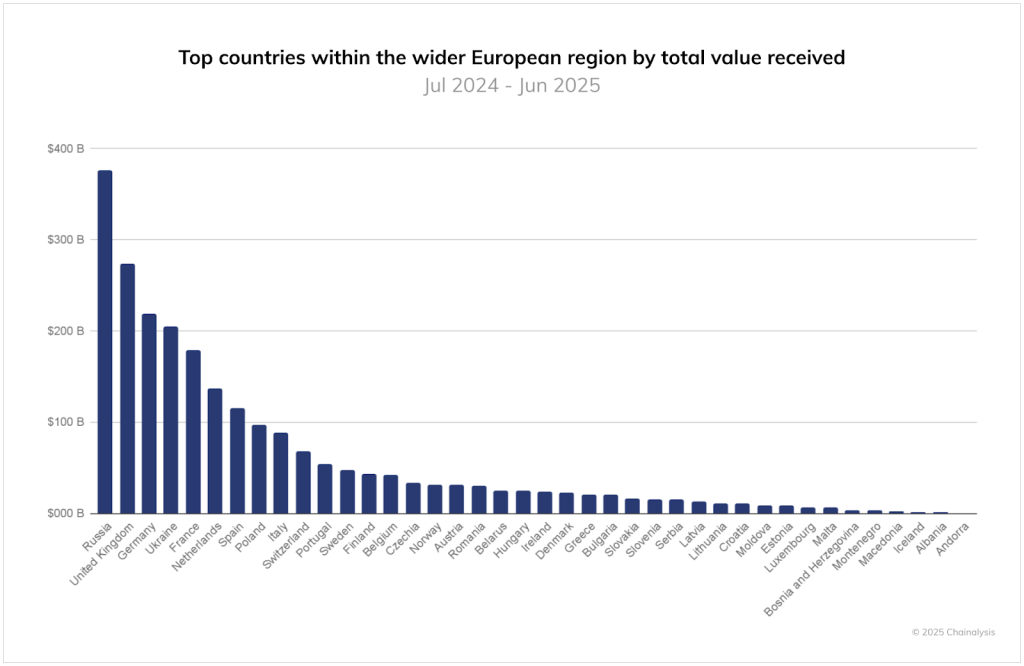

Russia recorded $376.3 billion in crypto transaction volume between July 2024 and June 2025, surpassing the UK’s $273.2 billion to become Europe’s largest crypto market by transaction volume.

Source: Chainalysis

Source: Chainalysis

Large-scale transfers exceeding $10 million grew 86% during this period, nearly double the 44% growth across Europe, while DeFi activity surged eightfold in early 2025 before stabilizing at three and a half times mid-2023 levels.

Banking Sector Embraces Digital Assets

In December as well, Sberbank, Russia’s largest lender, announced it now offers regulated crypto-linked investments totaling 1.5 billion rubles in structured bonds and digital financial assets tied to Bitcoin, Ethereum, and broader crypto portfolios.

Deputy Chairman Anatoly Popov confirmed active dialogue with the Bank of Russia and Rosfinmonitoring on integrating crypto services within regulated frameworks while building proprietary blockchain infrastructure for issuing and managing digital financial assets.

Meanwhile, earlier today, it was confirmed that Tether has also registered its asset tokenization platform Hadron trademark in Russia after filing in October 2025, with Rospatent approving the application in January 2026 for trademark protection valid until October 2035.

The trademark covers blockchain-based financial services, crypto trading and exchange, crypto payment processing, and related advisory services, as Tether’s USDT maintains a roughly $187 billion market capitalization as the world’s third-largest crypto asset.

Despite adoption and infrastructure expansion, State Duma Committee Chairman Anatoly Aksakov recently reinforced payment restrictions, declaring cryptocurrencies “will never become money within our country” and can only function as investment instruments requiring all domestic payments in rubles.

The regulators are now preparing for a strict crypto regulation framework and new penalties this year.

You May Also Like

Vitalik Buterin Reaffirms Original 2014 Ethereum Vision With Modern Web3 Technology Stack

Fed Decides On Interest Rates Today—Here’s What To Watch For