LiquidChain vs BlockchainFX: Smart Money’s Pick for the Best Crypto Presale in 2026

Crypto presales are everywhere right now. New projects launch daily, each promising utility, momentum, and upside. For most investors, the real challenge is finding a presale that actually matters and can do well long-term. In that crowded field, LiquidChain ($LIQUID) continues to stand out as a crypto presale built around core infrastructure.

That does not mean other projects lack ambition. BlockchainFX ($BFX) is one of the more talked-about alternatives, positioning itself as a Web3 “super app” for multi-asset trading. It targets convenience, access, and yield.

LiquidChain, however, targets something deeper: how liquidity itself moves across blockchains. This difference in focus is why smart money increasingly leans toward $LIQUID when comparing the two.

$BFX vs $LIQUID – What’s the Best Crypto Presale to Buy?

The main difference between BlockchainFX and LiquidChain comes down to what layer of the crypto stack they are trying to own. BlockchainFX operates at the application layer. It aims to aggregate markets and instruments into a single trading interface. That model depends heavily on user activity, volume, and competition with existing platforms.

LiquidChain operates one level below that. Instead of competing for traders, it builds the infrastructure that traders and applications rely on. Its goal is not to become a destination, but a coordination layer that connects liquidity across Bitcoin, Ethereum, and Solana. Infrastructure tends to scale differently from apps, especially over longer timeframes.

BlockchainFX’s value proposition is tied to adoption of its platform. If users trade actively, fees flow, staking rewards remain high, and buybacks support the token. LiquidChain’s value proposition is tied to usage of cross-chain execution itself. If liquidity moves across chains, the network remains relevant regardless of which applications sit on top.

There is also a sustainability angle. Very high APYs, like those promoted by many trading platforms, often depend on continued growth in volume. Infrastructure networks do not rely on constant user growth to remain useful. As long as fragmentation exists, coordination has value. That asymmetry is a key reason $LIQUID stands out as the better crypto presale to buy.

Finally, timing matters. Multi-asset trading apps tend to perform best in active bull markets. Infrastructure projects often gain traction before or during transitions, when inefficiencies become obvious. With markets still cautious in early 2026, smart money tends to prioritize foundational layers over consumer-facing platforms.

Why LiquidChain’s Model Fits the Next Market Phase

LiquidChain is built as a Layer-3 network designed to coordinate execution and liquidity across blockchains. It does not replace Bitcoin, Ethereum, or Solana. It allows them to work together in a more efficient way. That distinction is important, especially as liquidity spreads thinner across ecosystems.

Bitcoin contributes settlement security. Ethereum brings smart contract flexibility. Solana adds speed. LiquidChain connects these strengths into a shared execution framework, reducing the need for constant bridging and duplicated liquidity pools.

For developers, LiquidChain removes the need to deploy the same application multiple times across chains. One deployment can access liquidity from multiple ecosystems. For traders and users, capital can move where it is needed without managing several disconnected environments. During slow markets, that efficiency becomes a real advantage.

This design is why LiquidChain remains relevant even when volumes drop. It does not depend on speculative activity to justify its existence. It addresses a structural problem that persists regardless of market direction, which is exactly what long-term investors look for when evaluating the best altcoins to buy.

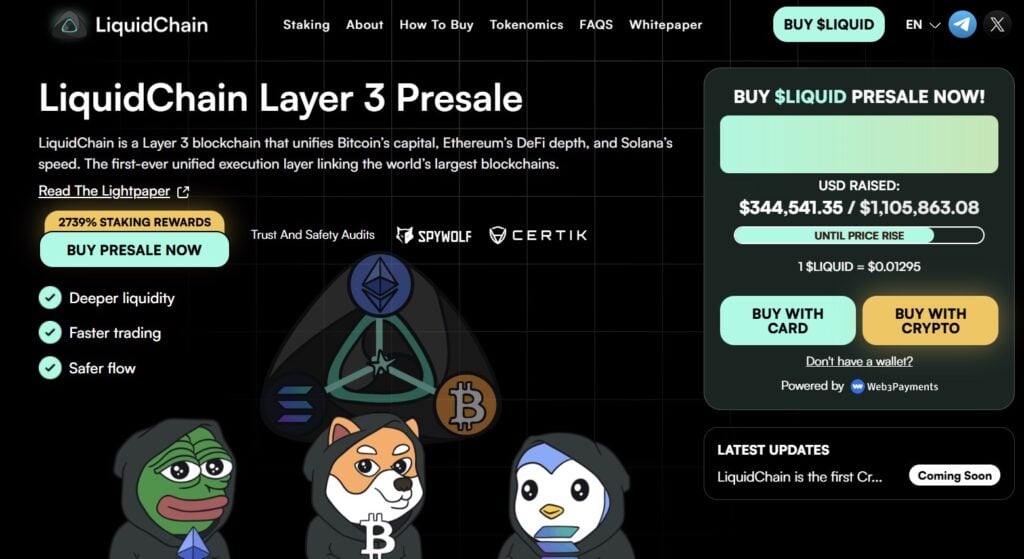

Inside the $LIQUID Crypto Presale

The $LIQUID crypto presale is already showing strong progress. More than $300,000 has been raised, despite broader market weakness. The current presale price sits around $0.0129, placing it firmly in early-stage territory compared to projects that launch after infrastructure is live.

Staking is available immediately during the presale. This means early participants can stake $LIQUID ahead of the network launch. Staking rewards are higher early on and gradually decrease as more tokens enter staking pools, which favors early positioning rather than late entry.

Presale pricing increases in stages every few days. These levels are not meant to stay flat, especially as development milestones are reached and attention around cross-chain scaling grows. This creates natural urgency without relying on exaggerated claims.

Combined with clear tokenomics, a fixed supply, and a roadmap aligned with a 2026 rollout, the presale structure supports long-term participation. That is a key difference compared to many high-yield trading tokens.

Why Smart Money Chooses $LIQUID Over $BFX

BlockchainFX offers convenience and yield, but it competes in a crowded space where user loyalty shifts quickly. LiquidChain operates at the infrastructure level, where adoption tends to be slower but stickier. Once liquidity coordination becomes embedded, it is hard to replace.

Smart money often positions early in infrastructure rather than chasing platforms that need constant user growth. That pattern has played out repeatedly across crypto cycles. Networks that solve foundational problems tend to see delayed but more durable upside.

With a live crypto presale, low entry pricing, immediate staking access, and a focus on cross-chain scaling, LiquidChain checks more long-term boxes than BlockchainFX. For investors looking for the best crypto presale to buy now, $LIQUID offers exposure to a core narrative affecting the next phase of crypto.

Explore LiquidChain and its ongoing crypto presale:

Presale: https://liquidchain.com/

Social: https://x.com/getliquidchain

Whitepaper: https://liquidchain.com/whitepaper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

XRP Delivers Impressive ETF Volumes But Digitap ($TAP) is the King of Cross-Border Payments in 2026

Crypto Exchange Fights Legal Fragmentation