Pi Network (PI) Price Predictions: Here’s Why It’s Hard to Stay Bullish

Unlike many leading cryptocurrencies, Pi Network’s native token failed to post a substantial uptick in the opening days of the new year.

It has been in a massive downtrend over the past several months, prompting some analysts to be quite bearish about the future. Meanwhile, certain indicators suggest a further pullback could be on the horizon.

‘Hard to Stay Bullish’

PI currently trades at approximately $0.20 (per CoinGecko’s data), representing a minor 2% increase on a weekly scale and a whopping 93% collapse since the all-time high of $3 observed in February last year.

X user pinetworkmembers, who has been quite critical of the project as of late, claimed it’s “hard to stay bullish” on PI at the moment. They noted that the asset had barely moved up when BTC bounced at the start of 2026, outlining several hurdles for the price.

The main ones include the lack of support from a major exchange, “no real open mainnet,” unclear supply, centralized control, locked balances, and others.

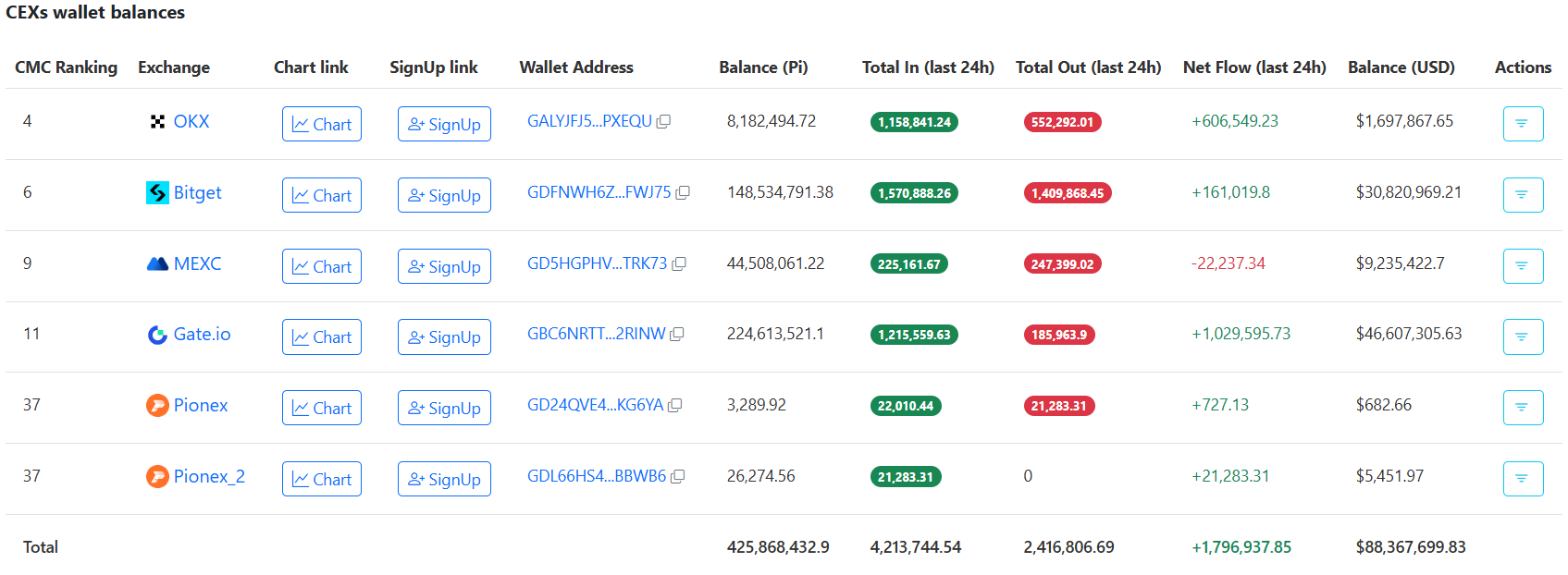

The increased exchange supply reinforces the bearish outlook. Almost 1.8 million tokens have been transferred to centralized platforms in the past 24 hours alone, which is often considered a pre-sale step.

As of now, more than 425 million PI are stored on exchanges, with roughly 52% of that amount held by Gate.io. Bitget comes in second with around 148 million coins.

PI Exchange Reserves, Source: piscan.io

PI Exchange Reserves, Source: piscan.io

Something for the Bulls

Some analysts refuse to wave the white flag, arguing that a resurgence could be knocking on the door. X user Vuori Trading claimed that PI has been breaking out from an eight-month downtrend, predicting the price might rise to $0.57 soon.

Prior to that, Aman assumed that the asset had been “consolidating tight under key resistance after trending higher.” The market observer forecasted new peaks should the valuation surge above $0.215.

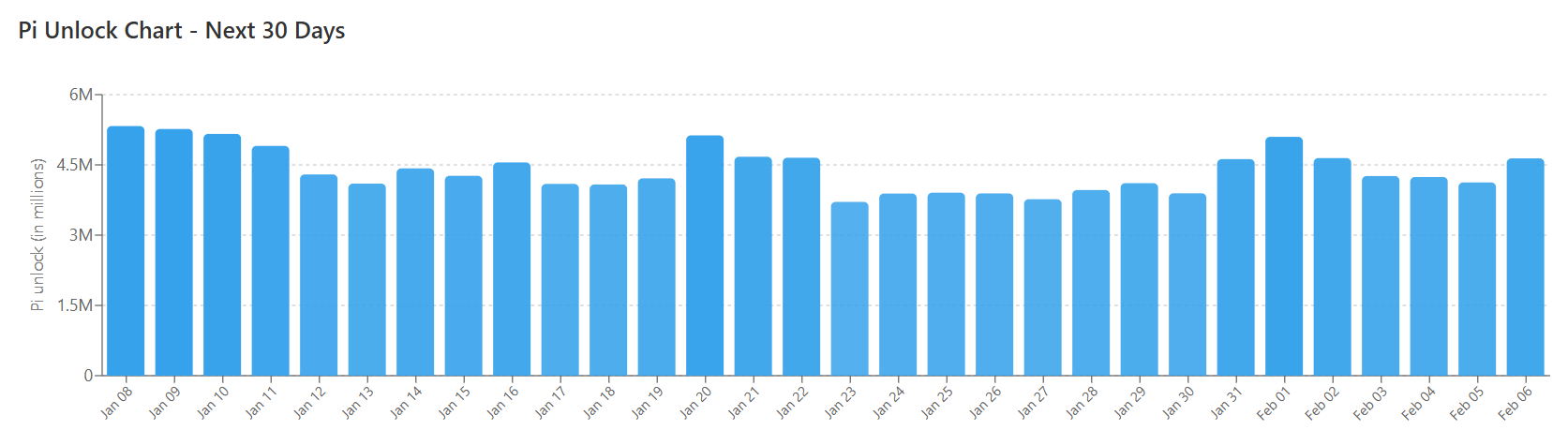

The upcoming token unlocks also deserve to be observed. Over 130 million PI are scheduled for release in the next 30 days, as today (January 8) is the record day, with 5.3 million coins freed up. The average daily unlock is around 4.36 million, which is less aggressive than in previous months and could provide some short-term price stability.

PI Token Unlocks, Source: piscan.io

PI Token Unlocks, Source: piscan.io

The post Pi Network (PI) Price Predictions: Here’s Why It’s Hard to Stay Bullish appeared first on CryptoPotato.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026