Zcash Split Deepens: Bootstrap Blames Nonprofit Rules as ZEC Plunges 16%

The divide within the Zcash ecosystem increased this week as the nonprofit organization that manages the Electric Coin Company, Bootstrap, openly resolved the governance conflict that already shook markets and sent ZEC plummeting.

The conflict has been fought in boardrooms, developer teams, and token charts, revealing long-term tensions around nonprofit limitations, control, and the way projects that focus on privacy ought to be funded by crypto.

Bootstrap Says Nonprofit Law Drove Zashi Fallout

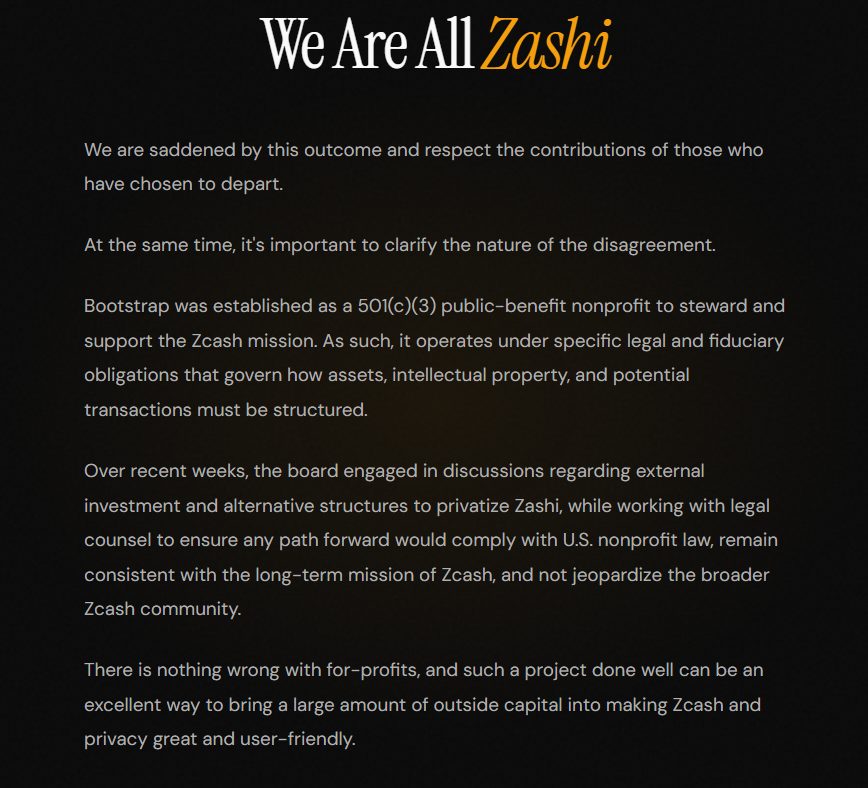

In a statement shared Thursday by Bootstrap board member Zaki Manian, the nonprofit said the fallout stemmed from its legal and fiduciary duties as a U.S. 501(c)(3) organization, not from any disagreement over Zcash’s mission.

Bootstrap said it had engaged in weeks of discussions around external investment and potential restructuring tied to Zashi, the mobile wallet developed by Electric Coin Company and launched in early 2024.

According to the board, those talks ran into hard limits imposed by nonprofit law, which governs how charitable assets, intellectual property, and transactions must be handled.

Bootstrap warned that privatizing Zashi could expose the organization to donor lawsuits or regulatory scrutiny or even force transactions to be unwound, potentially requiring assets to be transferred back to ECC.

The board said those risks could extend beyond the immediate parties and threaten the broader Zcash ecosystem.

Source: Weareallzashi.org

Source: Weareallzashi.org

While acknowledging that for-profit structures can attract capital and accelerate development, Bootstrap said urgency and good intentions were not enough to override nonprofit obligations.

The statement followed a dramatic break earlier in the day, when the core development team behind Zcash severed ties with Electric Coin Company.

ECC CEO Joshua Swihart said the relocation was a result of weeks of growing tension with most of the Bootstrap board, which he claimed had changed the terms of employment in such a manner that it became impossible to carry on with their work.

Swihart called it a constructive discharge, as the rest of the ECC team had resigned on January 7 and intended to start a new independent company to keep on with the work of creating privacy-safe digital money.

Zcash Dispute Weighs on Price, as Whales Buy the Dip

Swihart stressed that the split was about governance, not abandoning Zcash. The protocol’s codebase remains open source and permissionless, meaning the network continues to function regardless of disputes among its supporting organizations.

Zcash founder Zooko Wilcox also sought to reassure users, saying the conflict does not affect network security or privacy guarantees, and noting that no criminal conduct has been alleged by either side.

Markets reacted quickly as the governance crisis became public, as ZEC fell as much as 16% at its lows before recovering some ground amid heavy trading.

The token is currently trading around $422, down roughly 12.4% over the past 24 hours, with trading volume surging more than 200% to about $1.43 billion.

Blockchain data shows mixed positioning during the selloff, as Nansen data points to large holders increasing exposure, with whale wallets buying roughly $914,000 worth of ZEC, while newly created wallets accumulated about $1.74 million over the same period.

The dispute has drawn attention back to Zcash’s unusual governance structure, as it was born out of academic research into zero-knowledge cryptography. The project has long tried to balance decentralization with organized development.

ECC was formed in 2015 to build the protocol, the Zcash Foundation followed in 2017, and ECC later became a nonprofit subsidiary under Bootstrap in 2020.

That structure was designed to distribute power, but disagreements over funding, control, and strategy have persisted, particularly as the current development fund approaches its 2025 expiration.

You May Also Like

Nasdaq and CME Launch New Nasdaq-CME Crypto Index—A Game-Changer in Digital Assets

CME to launch Solana and XRP futures options on October 13, 2025