Bitcoin holds $90k as jobless claims signal cooling as top Fed official pushes for rate cuts

Bitcoin steadied near $90,000 on Thursday as fresh U.S. labor data reinforced a familiar 2026 theme: fewer layoffs, fewer hires, and a cooling economy that refuses to crack.

- Bitcoin price has retreated by over 5.

- Stephen Miran, a top Fed official, supports 150 basis points interest rate cuts this year. Such a rate cut would be highly bullish for Bitcoin and other cryptocurrencies.

- Jobless claims data suggest the U.S. labor market has settled into a “low-hire, low-fire” equilibrium, where employers are reluctant to lay off workers but equally hesitant to add new ones.

Initial jobless claims edged up only modestly in the first week of the year, with 208,000 Americans filing for unemployment benefits in the week ended Jan. 3, up from 200,000 a week earlier, the Labor Department said. The figure came in below economists’ expectations of 210,000, underscoring the labor market’s resilience even as growth momentum fades.

Bitcoin (BTC) was trading around $90,464, up 1.2%, around the time of the release and briefly fell to its lowest level since January 3 — over 5% from its highest level this week.

The drop comes as American investors continue selling ETFs. Data show that spot Bitcoin ETFs lost more than $486 million on Wednesday, following a loss of more than $243 million the day before.

These ETFs have had cumulative inflows of $57 billion, down from last year’s high of over $65 billion. They now hold over $118 billion in assets, equivalent to 6.5% of their market capitalization.

Jobless claims

Continuing claims, which track people receiving benefits beyond an initial week, rose to 1.91 million in the week through Dec. 27 from 1.86 million, indicating increasing difficulty in finding new work. Seasonal distortions around the holidays have added volatility to the data, but claims remain near the low end of their range over the past year.

Other indicators paint a less tranquil picture. A report from Challenger, Gray & Christmas showed U.S. employers announced 1.206 million job cuts in 2025, a 58% increase from the prior year and the highest total in five years, driven largely by federal agencies and technology firms restructuring around AI. Hiring plans fell 34% to their lowest level since 2010.

Job openings have also thinned, falling to a 14-month low in November, with just 0.91 openings per unemployed worker — the weakest ratio since March 2021. Attention now turns to Friday’s nonfarm payrolls report, where economists expect job growth of 73,000 and an unemployment rate of 4.5%, a key test of whether the labor market is stabilizing or slipping further into slowdown.

Fed officials say…

Stephen Miran, a senior Federal Reserve official, continued to make the case for additional cuts this year. He hopes that the other officials will agree to 150 basis points cuts to boost the labor market. He said:

Miran, whom President Donald Trump appointed, has become one of the most dovish central bank officials, supporting 50-basis-point cuts at each of the three meetings.

Still, it is unclear whether Miran’s request for more cuts will become a reality, as more officials have been reluctant to implement them. The dot plot from the last meeting showed that officials expect to deliver one more cut this year.

Miran’s 150 basis point cuts would be bullish for Bitcoin price as it normally does well in an era of easy money. Additionally, the cut will come as the U.S. government delivers further stimulus, particularly in the form of tax refunds.

The average tax refund for individuals will be about $3,167, up from $3,138 in 2024. More refunds, tax cuts, and the rising M2 money supply will be bullish for Bitcoin and other altcoins

Bitcoin price technical analysis points to more gains

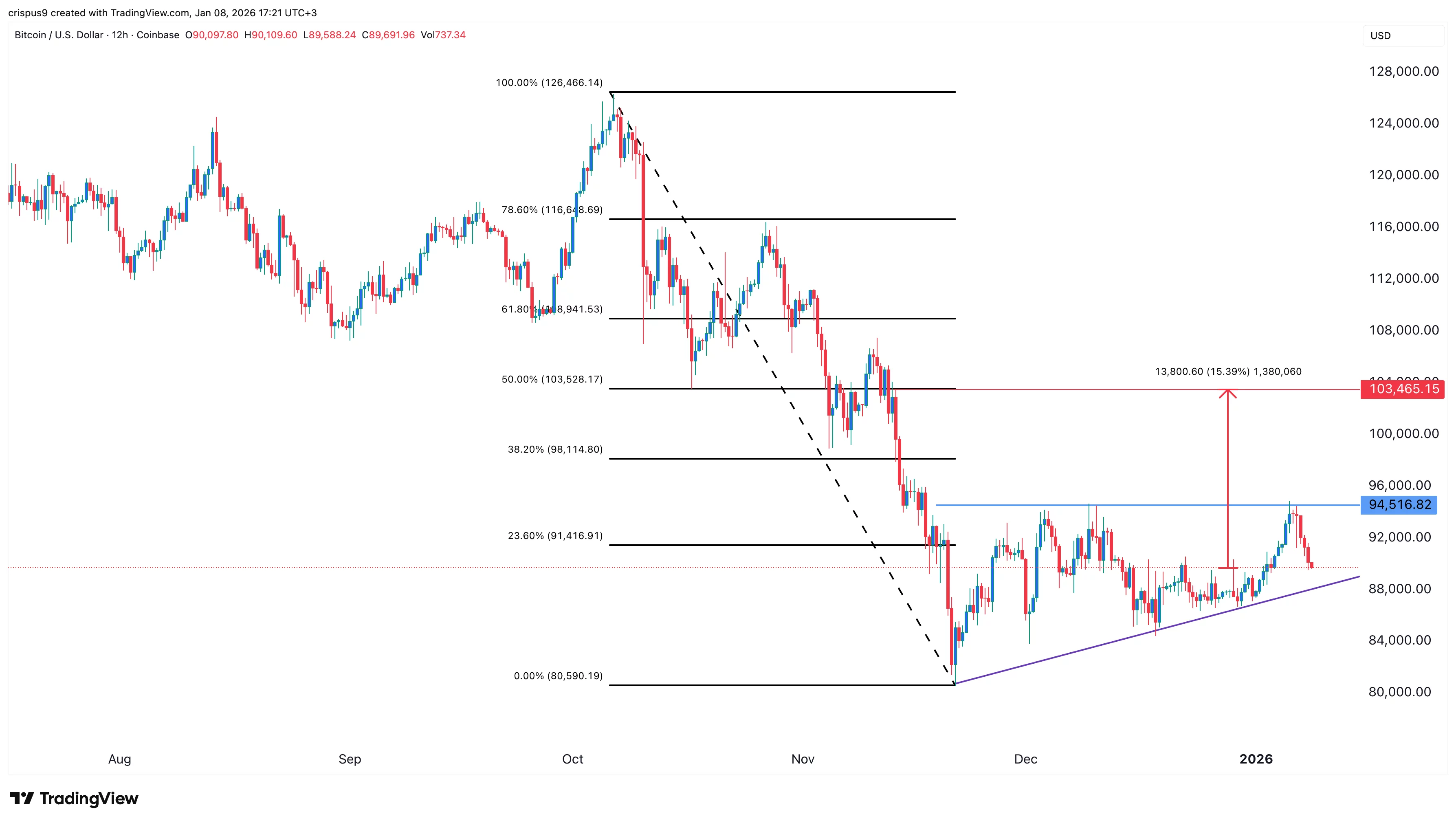

The 12-hour chart shows that Bitcoin price has continued rising in the past few months, moving from a low of $80,590 in November to a high of $94,516.

It has now formed an ascending triangle pattern, whose resistance level is at $94,516, and the diagonal trendline connects the lowest swings since November.

Therefore, the most likely BTC price prediction is bullish, with the next key target being at $103,465, the 50% Fibonacci Retracement level. This target is about 15% above the current level.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For