Florida Revives Bitcoin Reserve Plan for 2026 – But With a Major Cutback

The Florida legislators are taking steps to revive a state-funded Bitcoin reserve to be launched in 2026, although the new attempt has a much more limited scope than previous ones that failed in 2021.

The most recent bill, introduced at the close of December, looks more like a restart than a follow-up, removing ambition but increasing the regulations around what the state can have, in fact.

Florida Pushes Bitcoin-Only Approach in State Crypto Reserve Plan

Senate Bill 1038 is sponsored by Republican Senator Joe Gruters and was submitted on Dec. 30, 2025, and officially registered in committee review on Jan. 7, 2026.

Legislative records show the bill has been referred to the Senate Banking and Insurance Committee, the Appropriations Committee on Agriculture, Environment, and General Government, and the Appropriations Committee.

It must clear those hearings before advancing to the Senate floor, and if adopted alongside related legislation, the measure would take effect on July 1, 2026.

The proposal would authorize the creation of a Florida Strategic Cryptocurrency Reserve to be administered by the state’s Chief Financial Officer.

Under the bill, the CFO would be permitted to purchase, hold, manage, exchange, and liquidate cryptocurrency using standards similar to those applied to public trust assets.

While the legislation avoids naming specific tokens, it sets a strict eligibility rule: any cryptocurrency acquired must have maintained an average market capitalization of at least $500 billion over the previous 24 months.

That requirement effectively limits the reserve to Bitcoin and marks a sharp contrast with Florida’s earlier attempts.

Crypto Reserve Plan Gets a Reset in Florida’s 2026 Legislative Session

During the 2025 legislative session, House Bill 487 and Senate Bill 550 sought to establish a broader framework for digital asset reserves but were indefinitely postponed and ultimately withdrawn.

Those bills did not advance out of committee, ending the effort entirely rather than trimming it back. The 2026 proposals, including SB 1038 and related measures such as SB 1040, restart the process with new bill numbers and tighter guardrails.

The bill lays out detailed rules for custody, oversight, and reporting as it defines key concepts such as forks, private keys, and qualified custodians. It requires the use of secure custody systems with encryption, geographic redundancy, multiparty authorization, and regular security audits.

The CFO would be allowed to contract with regulated third parties, including auditors, liquidity providers, and custody technology firms, and could also use approved derivative instruments if deemed beneficial to the reserve.

Spending from the reserve would be limited to authorized investments, temporary cash management, and reasonable administrative costs.

If required by law or ordered by the governor, the CFO could liquidate assets and temporarily transfer funds to the state treasury, with the expectation that those funds and any earned interest would be returned to the reserve.

An advisory committee would also be formed, chaired by the CFO and supported by four appointed experts in cryptocurrency investment and digital asset security.

Bitcoin Reserves Gain Traction Across U.S. States

Beginning at the end of 2026, the CFO would be required to submit a biennial report to the legislature detailing holdings, valuation changes, and management actions.

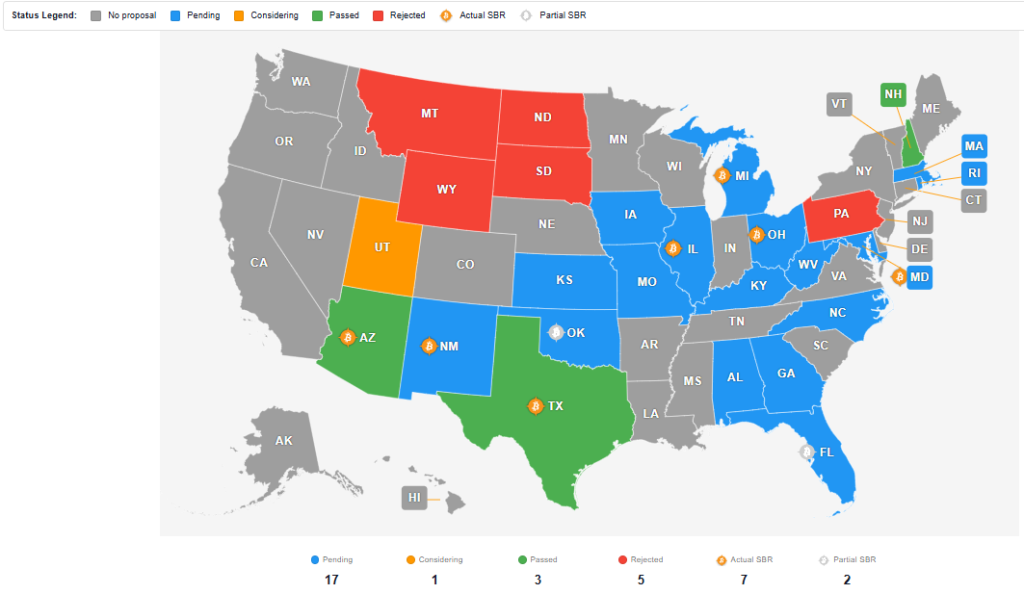

Florida’s renewed push comes as several U.S. states experiment with Bitcoin reserve strategies.

New Hampshire became the first to pass such a law, allowing investments in digital assets with market capitalizations above $500 billion.

Texas has taken a donation-based approach, operating its reserve through a dedicated fund rather than direct state buying.

Source: Bitcoinreservemonitor

Source: Bitcoinreservemonitor

More than a dozen other states have introduced similar proposals, many of which remain in committee. Oklahoma and Utah have advanced their bills, while Pennsylvania’s effort stalled.

You May Also Like

The Best Crypto Presale in 2025? Solana and ADA Struggle, but Lyno AI Surges With Growing Momentum

What to Look for in Professional Liability Insurance for Beauty Professionals