Cardano Price Registers Positive Green Candle Over 2 Months

The post Cardano Price Registers Positive Green Candle Over 2 Months appeared first on Coinpedia Fintech News

Cardano (ADA) has managed to draw back traders’ focus after a year marked by significant losses in the market. The recent weeks’ performance of ADA coin shows improved Technical Combination with ADA ETF filing update, increased open interest commitments, and DeFi governance being the catalysts.

The impact can be seen with Cardano’s NIGHT token, a newly launched blockchain project that has entered the top 100 cryptocurrencies

Cardano Price is now at $0.3892 with a 24h growth 14.6% growth in a week. ADA is now under a test: Will this short-term recovery be turned into a sustained growth factor aligned with growing trader confidence and network infrastructure?

Cardano is printing strong bull candle patterns

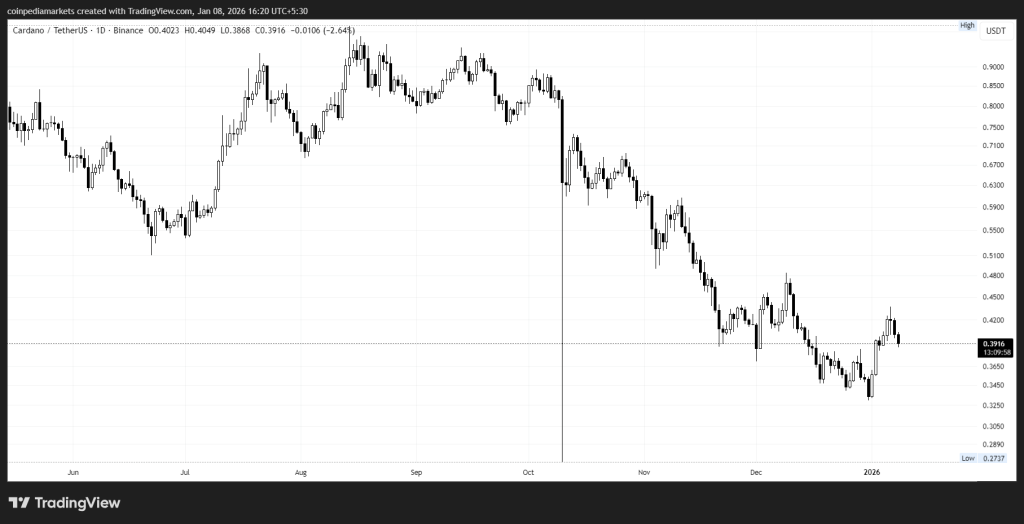

ADA/USDT price action changed upward following a 60% decline in 1 year. Interestingly, a golden cross is registered as short-term moving averages crossing the long-term moving averages in both two-hour and hour charts.

It is to be noted that the first positive green candle was registered after two months. Now trading near $0.3892, ADA price is capped by $0.401, a price spot of the 50 Day MA, and a resistance with multiple breakout rejections since late 2024.

A sustained move above $0.401 of ADA will register a historical breakout, golden cross, and bring in volume.

The 4-hour chart shows Cardano price in correction following recent highs, it is now moving to a demand zone ($0.3849–$0.3805). A rebound from this zone is expected as the external factors demand.

If there is a rebound, the near-term reaction is at $0.3718 with 2nd target sitting at $0.401, a resistance zone. In case of invalidation, $0.3834 is the support.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

BBNX Investors Have Opportunity to Join Beta Bionics, Inc. Fraud Investigation with the Schall Law Firm