Bitcoin hits new high for the third time in 2025, buoyed by regulatory clarity and treasury demand

- Bitcoin traded near $112,000 on Wednesday, marking the third time it has reached a record high in 2025.

- Bitcoin's growth follows development surrounding digital asset regulations, ranging from the CLARITY bill and GENIUS stablecoin bill.

- Increased accumulation from BTC ETFs and publicly listed companies adopting a Bitcoin treasury has also reduced its market supply.

Bitcoin (BTC) raced past its previous high of $111,980 on Wednesday and has entered price discovery mode at the time of publication. The new record marks the third time the top cryptocurrency has established an all-time high in 2025, following new highs on January 20 and May 22.

BTC/USDT daily chart

Bitcoin's record high comes on back of regulatory clarity and treasury acquisitions

Bitcoin's latest peak follows regulatory progress in the US around cryptocurrencies, with the House's Crypto Week, set for the week of July 14, drawing closer.

Lawmakers will deliberate on the GENIUS stablecoin bill, the crypto market structure CLARITY bill and the Anti-CBDC Surveillance State bill next week. The bills aim to provide clear regulatory environments for the issuance and use of cryptocurrencies and stablecoins.

Meanwhile, US spot Bitcoin exchange-traded funds (ETFs) have also contributed to increased demand for the asset, as they're on track to record five consecutive weeks of net inflows totaling $5.69 billion, per SoSoValue data.

The growing trend of publicly listed companies pulling a page from Strategy's (formerly MicroStrategy) playbook to launch BTC treasuries has also been another source of buying pressure. The number of public companies with a BTC reserve increased to 143 in 2025, with combined holdings of 858,850 BTC, valued at approximately $95.3 billion at the time of publication, per data from Bitcoin Treasuries.

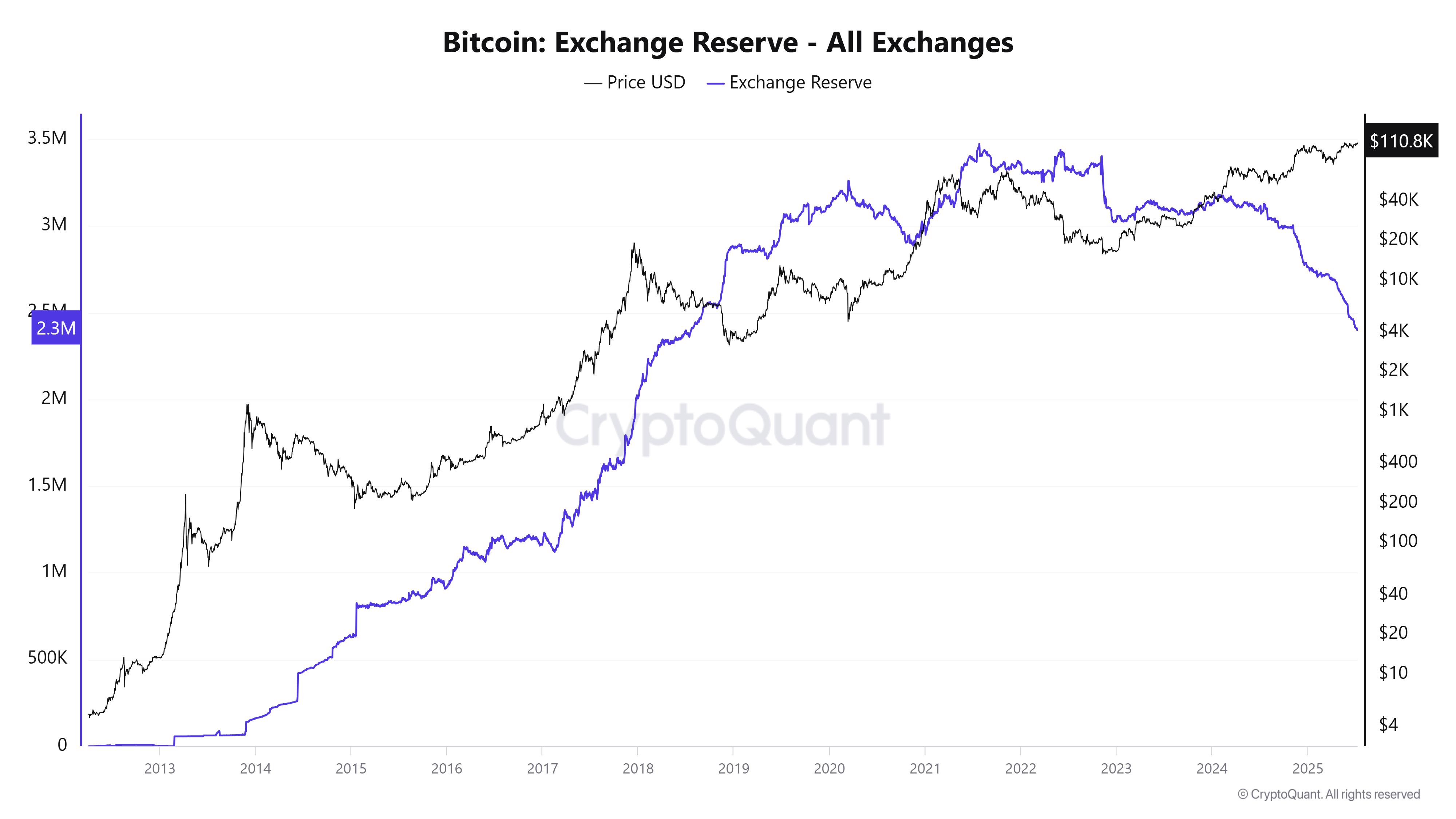

As a result, the available supply of BTC on exchanges has been plunging. According to CryptoQuant's data, Bitcoin supply on exchanges has fallen to 2.4 million BTC, its lowest level since 2018. This implies that only about 12% of its circulating supply is readily available for trading.

BTC Exchange Reserve. Source: CryptoQuant

The rise in Bitcoin follows a similar surge to new all-time highs in equities, with the S&P 500 and Nasdaq reaching new highs last week.

Despite President Trump's announcement of new tariff letters on international trading partners on Wednesday, risk assets have held up well, signaling a growing resilience to Trump-induced macroeconomic tensions.

Bitcoin is changing hands at $110,900, up 2% over the past 24 hours, at the time of publication.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail