Here’s Why the SUI Price is Rising Today: On-Chain Activity and DeFi Flows Signal Real Demand

The post Here’s Why the SUI Price is Rising Today: On-Chain Activity and DeFi Flows Signal Real Demand appeared first on Coinpedia Fintech News

The SUI price is trading sharply higher today, outperforming several major altcoins as on-chain activity and DeFi participation picked up over the past few hours. The move is being supported by rising transactions, stable liquidity, and expanding trading volumes, suggesting this is more than a short-lived speculative spike.

SUI is currently hovering near the $1.9–$2.0 zone, with over a 25% jump in the past 24 hours. The market cap increased above $7.44 billion, while the trading volume surged by over 85%, reaching over $1.65 billion. Sui always ranks among the coins that experience significant growth whenever the market recovers. The buying power of SUI is currently very strong and overwhelming, which has helped the price to surpass the previous peaks.

Now the question arises, will the SUI price continue to rise and mark new highs?

On-Chain Transactions Rise as Network Usage Accelerates

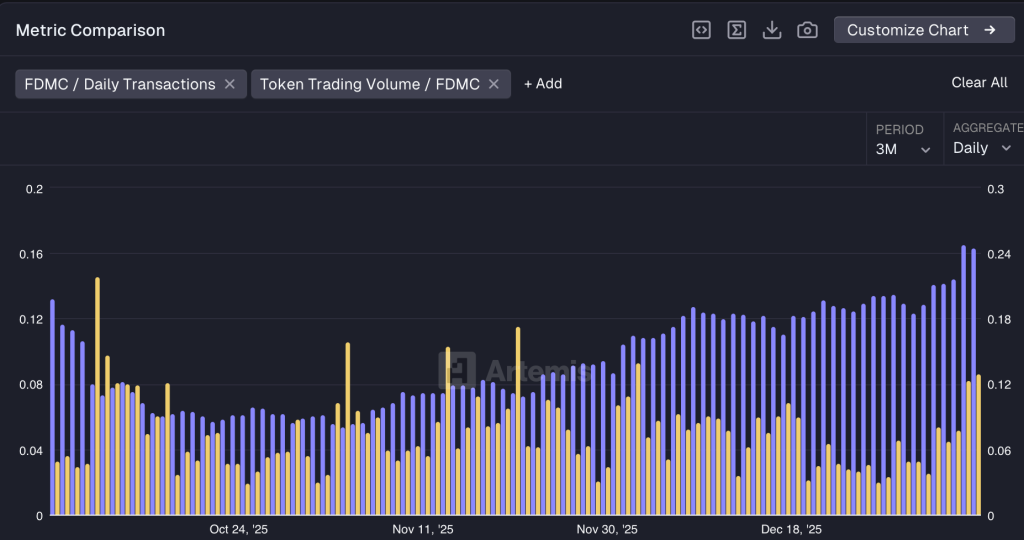

As SUI trades higher, on-chain data offers critical insight into whether the rally is driven by speculation or real network demand. This chart from Artemis displays a comparison of Sui’s daily transactions relative to its fully diluted market cap (FDMC) with token trading volume relative to FDMC over the past three months, highlighting how usage and market activity are evolving together.

The data shows a steady increase in transaction intensity, particularly since late November, suggesting that network activity is growing faster than SUI’s valuation. This points to expanding real usage across the ecosystem, including higher smart contract and application-level interactions.

Meanwhile, trading volume relative to FDMC remains volatile and largely range-bound, marked by brief spikes rather than sustained expansion. This divergence signals that recent price strength is not being fueled by excessive speculative trading.

Overall, the decoupling between rising usage and contained speculation supports the view that SUI’s current price trend is backed by organic adoption rather than short-term hype.

TVL and DEX Volumes Remain Stable Despite Price Rise

Blockchain data shows a visible pickup in transaction activity during the same period SUI’s price gained momentum. Despite the price surge, capital has not exited the Sui ecosystem. Total Value Locked has remained stable to slightly positive, indicating that investors are holding positions rather than selling into strength. Moreover, DEX activity on Sui has increased meaningfully, with the volumes rising in tandem with price.

This alignment between price and usage often reflects genuine demand, not just exchange-driven trades. Higher transaction counts point to increased smart contract interactions, more active wallets and stronger short-term ecosystem usage. This behavior also contrasts with typical short-term pumps, where liquidity drains quickly. In SUI’s case, capital commitment remains intact, reinforcing the bullish structure.

What’s Next for the SUI Price Rally?

SUI has entered 2026 with a notable rebound after a prolonged downtrend, putting focus back on its daily structure. The chart highlights a recovery from a clearly defined base formed in December, with price now attempting to reclaim key levels. Importantly, this move comes as trend and volume indicators begin to show early signs of improvement, suggesting the bounce may have follow-through. With Supertrend and OBV in focus, traders are now assessing whether SUI can extend toward higher resistance zones.

The daily chart shows SUI rebounding from the $1.4–$1.6 demand zone after a prolonged decline from above $3. Price is now pushing toward the Supertrend level, making $2.10–$2.20 the first upside target. A decisive Supertrend flip could open the door toward $2.35–$2.50, with $3.0 acting as a major resistance if momentum strengthens. Meanwhile, OBV has flattened and started to curl higher, signaling reduced selling pressure. A breakdown below $1.45 would invalidate this recovery setup.

The Bottom Line!

SUI’s recent rebound is showing early signs of structure rather than a random relief bounce. The combination of a defended demand zone, price pressing toward the Supertrend, and improving OBV suggests selling pressure is easing. As long as SUI holds above the $1.45–$1.50 base, upside attempts toward the $2.2 and $2.5 resistance zones remain valid. However, a sustained trend reversal will only be confirmed if the price can flip the Supertrend and maintain higher volume participation. Until then, the move should be viewed as a developing recovery rather than a confirmed uptrend.

You May Also Like

Landmark Court Ruling Rejects Terrorism Financing Claims

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!