Memecoin Market Rebounds From Historical Lows as Major Tokens Post Double-Digit Gains

TLDR:

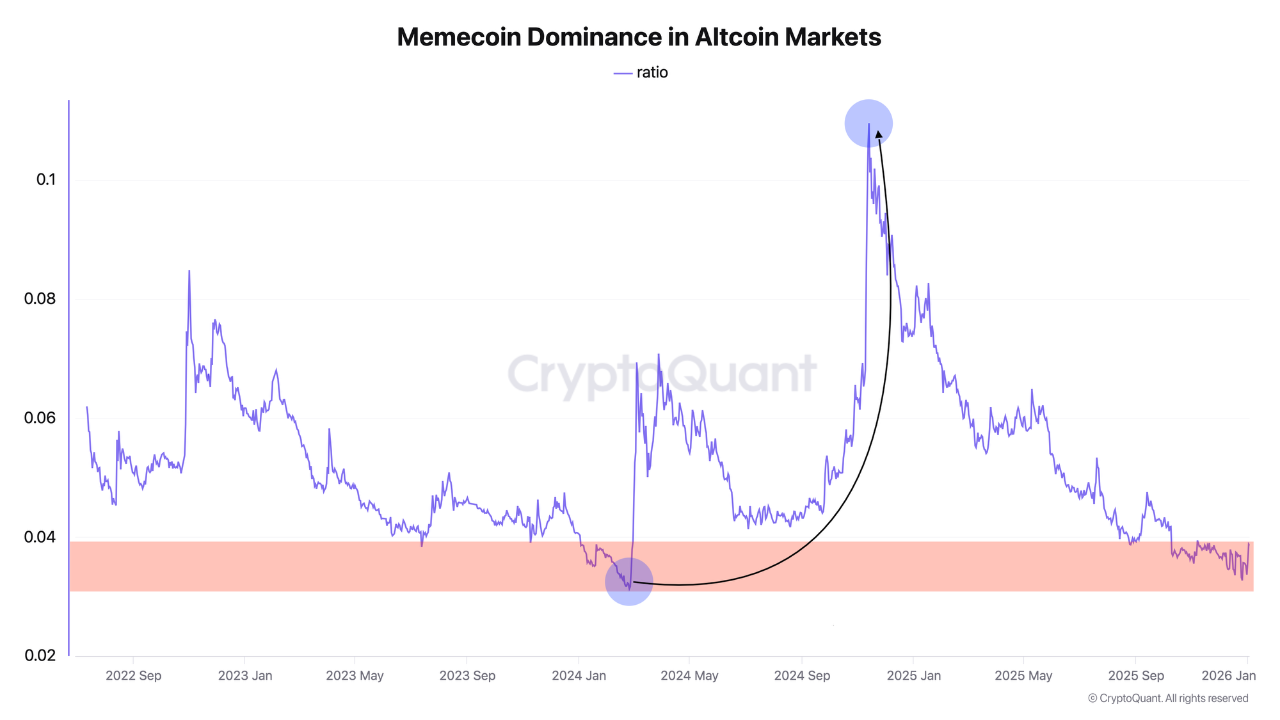

- Memecoin dominance fell to 0.032 ratio in December 2025, down from 0.11 peak in November 2024 rally

- PEPE surged 64% in seven days while BONK gained 59% and PENGU rose 34% during the market recovery

- Total memecoin market capitalization exceeded $45 billion, marking a 20% increase within one week

- Historical patterns suggest large-cap memecoins move first before capital rotates to smaller caps

Memecoins are showing renewed strength after reaching their lowest market share in December 2025. The altcoin segment, which peaked during November 2024’s speculative rally, has begun reversing its prolonged decline.

Recent trading sessions indicate growing investor interest in major memecoin assets. This development follows a year-long period of market contraction and reduced dominance within the broader cryptocurrency landscape.

Market Dominance Shifts Signal Potential Reversal

The memecoin sector experienced substantial contraction following the November 2024 rally peak. Market dominance within the altcoin space fell dramatically over the subsequent months.

Source: Cryproquant

By December 2025, the ratio between major altcoins and leading memecoins reached 0.032. This figure represents just 3.2% of total altcoin market capitalization.

The decline marked a sharp reversal from earlier periods of market strength. During November 2024, memecoins commanded 11% of altcoin market capitalization with a ratio of 0.11.

Historical patterns suggest such extreme lows often precede renewed memecoin activity. Previous cycles demonstrated similar compression phases before major rallies materialized.

Market observers note the current levels mirror conditions that preceded earlier memecoin seasons. The compression in market share created a technical setup some analysts view as favorable.

However, the early stage of this potential reversal requires careful monitoring. Confirmation of sustained momentum remains pending across multiple trading sessions.

Price Performance and Historical Patterns Emerge

Recent price action across major memecoins shows coordinated strength returning to the sector. Analyst commentary from @Ucan_Coin highlights PEPE gaining 64% over seven days.

BONK advanced 59% during the same period while PENGU posted 34% gains. These movements coincide with Bitcoin reclaiming the $91,000 level.

Total memecoin market capitalization surpassed $45 billion, representing a 20% weekly increase. The performance mirrors historical cycles where large-cap memecoins move first before capital rotation occurs.

Previous market cycles in 2021 demonstrated similar patterns with DOGE and SHIB. Initial skepticism preceded substantial price appreciation in both cases.

The current setup draws comparisons to earlier phases of memecoin market development. Liquidity flows typically begin with established tokens before spreading to smaller projects.

Volume expansion in major memecoins often signals broader sector interest developing. Early-stage projects with community support may benefit from this rotation pattern.

Risk management remains essential given the speculative nature of memecoin investments. Market participants are advised to exercise caution despite improving technical indicators.

The recovery phase is still nascent and requires validation through sustained trading activity.

The post Memecoin Market Rebounds From Historical Lows as Major Tokens Post Double-Digit Gains appeared first on Blockonomi.

You May Also Like

Nvidia Partners with Former Crypto Miner Nscale for UK AI Infrastructure Project

Tokenized Assets Shift From Wrappers to Building Blocks in DeFi