Aave Price Jumps Amid Revenue Sharing Plans With Token Holders

Aave is preparing for a major governance vote, as the platform will explore sharing part of its off-protocol revenue with AAVE token holders and submit a formal proposal to the community.

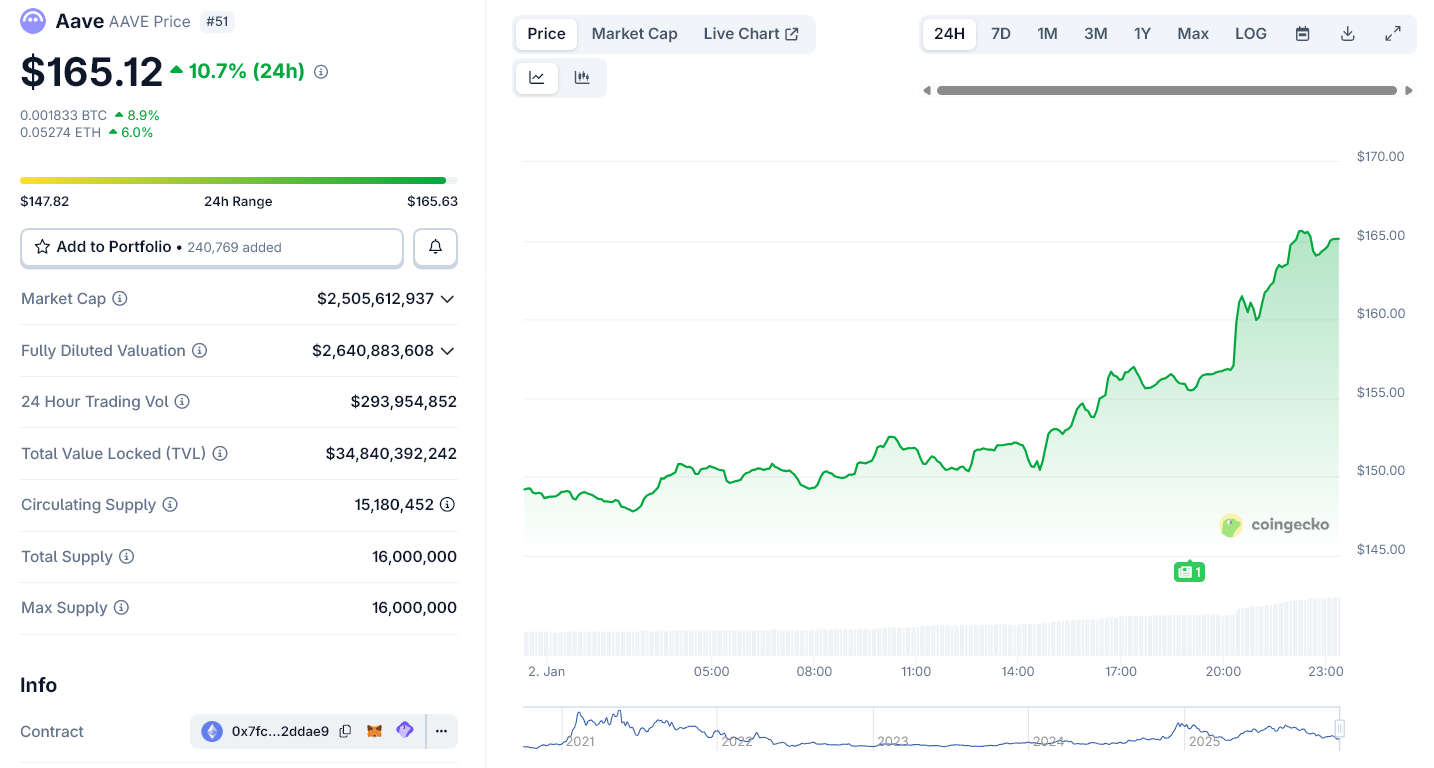

The update, posted on January 2, 2025, immediately lifted market sentiment. AAVE jumped more than 10% on the day as traders reacted to signs of improved alignment between the development team and the DAO.

What the New Aave Proposal Will Cover

According to Aave Labs founder, the upcoming proposal will explain how revenue made outside the core lending protocol could be shared with AAVE holders.

This revenue usually comes from the official Aave app, front-end swap integrations, and future consumer or institutional products built on top of Aave

It will also include safeguards to protect the Aave DAO and prevent sudden changes that could harm tokenholders.

Post from Aave Founder Stani Kulechov. Source: Aave Governance

Post from Aave Founder Stani Kulechov. Source: Aave Governance

Another key focus will be control of the Aave brand and user gateways. This includes websites, domains, and social media accounts that act as the public face of Aave.

The proposal is expected to outline who owns these assets, how they can be used, and what limits exist on monetizing them without DAO approval.

Also, the proposal will shape Aave’s long-term direction. Aave Labs argues the protocol must grow beyond crypto-only lending and move toward real-world assets, consumer products, and institutional use cases.

These efforts would rely on future upgrades such as Aave V4 and expanded use of GHO, Aave’s stablecoin.

AAVE Price Rallies After Revenue Sharing Plan. Source: CoinGecko

AAVE Price Rallies After Revenue Sharing Plan. Source: CoinGecko

Why This Matters to the DAO

The move follows weeks of public disagreement inside the Aave ecosystem.

Recently, some delegates accused Aave Labs of having too much control over revenue sources and communication channels. They warned that uncertainty around governance and ownership contributed to a sharp drop in AAVE’s market value in recent weeks.

In a response, DAO representatives welcomed the change in tone but stressed that clear and enforceable commitments are essential. They said vague promises are not enough and called for precise rules covering ownership, revenue sharing, and accountability.

Aave Among the Top 15 Crypto Platforms In Terms of Revenue in 2025. Source: X/Phoenix

Aave Among the Top 15 Crypto Platforms In Terms of Revenue in 2025. Source: X/Phoenix

The upcoming DAO vote will decide whether this new framework moves forward.

If approved, it could reduce internal tension and reset how Aave balances growth with governance. If not, the debate over control and alignment is likely to continue.

You May Also Like

The Channel Factories We’ve Been Waiting For

Onyxcoin Price Breakout Coming — Is a 38% Move Next?