South Korean crypto traders sent $110 billion to overseas exchanges in 2025

South Korean crypto investors sent ₩160 trillion (about $110 billion) to overseas exchanges during 2025, keeping trading activity high, according to a joint report by CoinGecko and Tiger Research.

More than 10 million people in South Korea trade crypto, a small difference from the 14 million stock investors and equal to roughly 20% of the country’s entire population.

CoinGecko claims that Korean won-based trades often match or even surpass U.S. dollar volumes among global fiat pairs, an unusual and highly impressive position for a single national currency.

Source: Kaiko

Source: Kaiko

Why are Korean investors redirecting trading activity from domestic exchanges to global platforms?

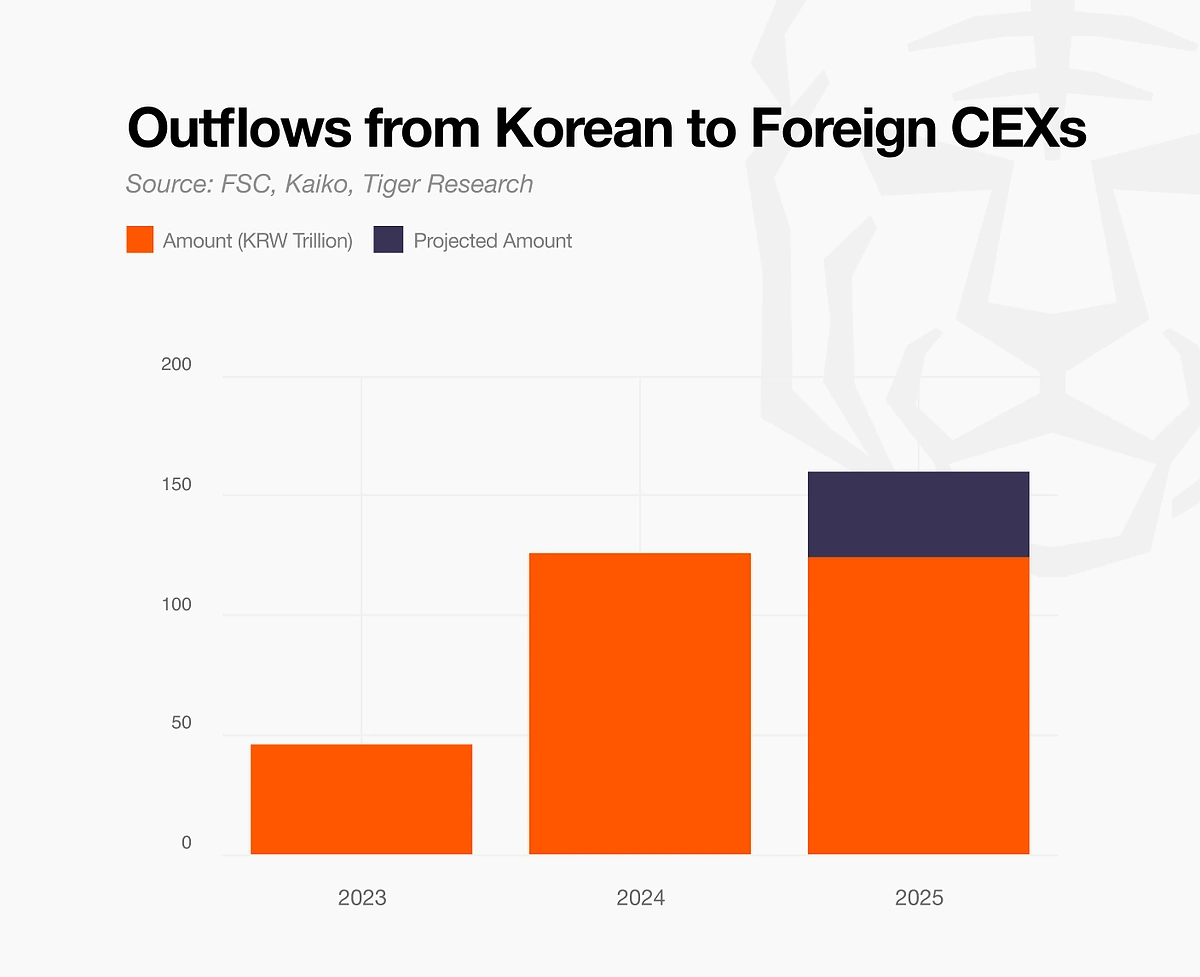

Between January and September 2025, around ₩124 trillion flowed out of Korean exchanges to overseas ones, nearly three times the outflows seen in 2023. According to the report, total outflows for the year were estimated at ₩160 trillion.

Moreover, the estimated 2025 fee income tied to Korean users reached about ₩2.73 trillion at Binance, ₩1.12 trillion at Bybit, ₩580 billion at OKX, ₩270 billion at Bitget, and ₩70 billion at Huobi, cumulatively making ₩4.77 trillion, or $3.36 billion, from Korean traders.

That sum equals 2.7 times the combined operating revenue of Upbit, Bithumb, Coinone, Korbit, and Gopax last year, which is ₩1.78 trillion, according to the report.

South Korean regulators have been increasing pressure on crypto markets

Regardless of the government’s restrictions, South Koreans moved ₩2.7 trillion from exchanges to personal wallets like MetaMask in the first half of 2025.

CoinGecko said:-

The report claims that its researchers combined exchange trading records with Arkham Intelligence and Dune, using both top-down and bottom-up methods. One approach allegedly relied on a benchmark showing Korean traders made up 13 percent of Binance volume in 2023, mostly in futures.

With Binance’s 2025 futures volume at $27.5 trillion, an average fee of 0.035 percent, and an exchange rate of ₩1,420, estimated annual fees ranged from ₩2.05 trillion under conservative assumptions to ₩3.417 trillion under aggressive ones.

The second method tracked real fund flows. About 57.7 percent of the ₩160 trillion outflow went to Binance, around ₩92.3 trillion. Korean investors held about ₩98.9 trillion in assets and traded roughly twice their holdings each month, or 24 times a year.

Futures trades on Binance occurred 2.3 times more often than spot trades and were 1.5 times larger, lifting volume by 3.52 times. Applying these figures produced an annual fee estimate of ₩2.73 trillion, according to CoinGecko.

The crypto market in South Korea has long leaned toward altcoins, which make up for 70% to 80% of domestic trading volume, far above the global average near 50%. Traders once made money buying small, volatile tokens early, even after their token generation events.

Join a premium crypto trading community free for 30 days - normally $100/mo.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

The United States Could Start Buying Bitcoin In 2026