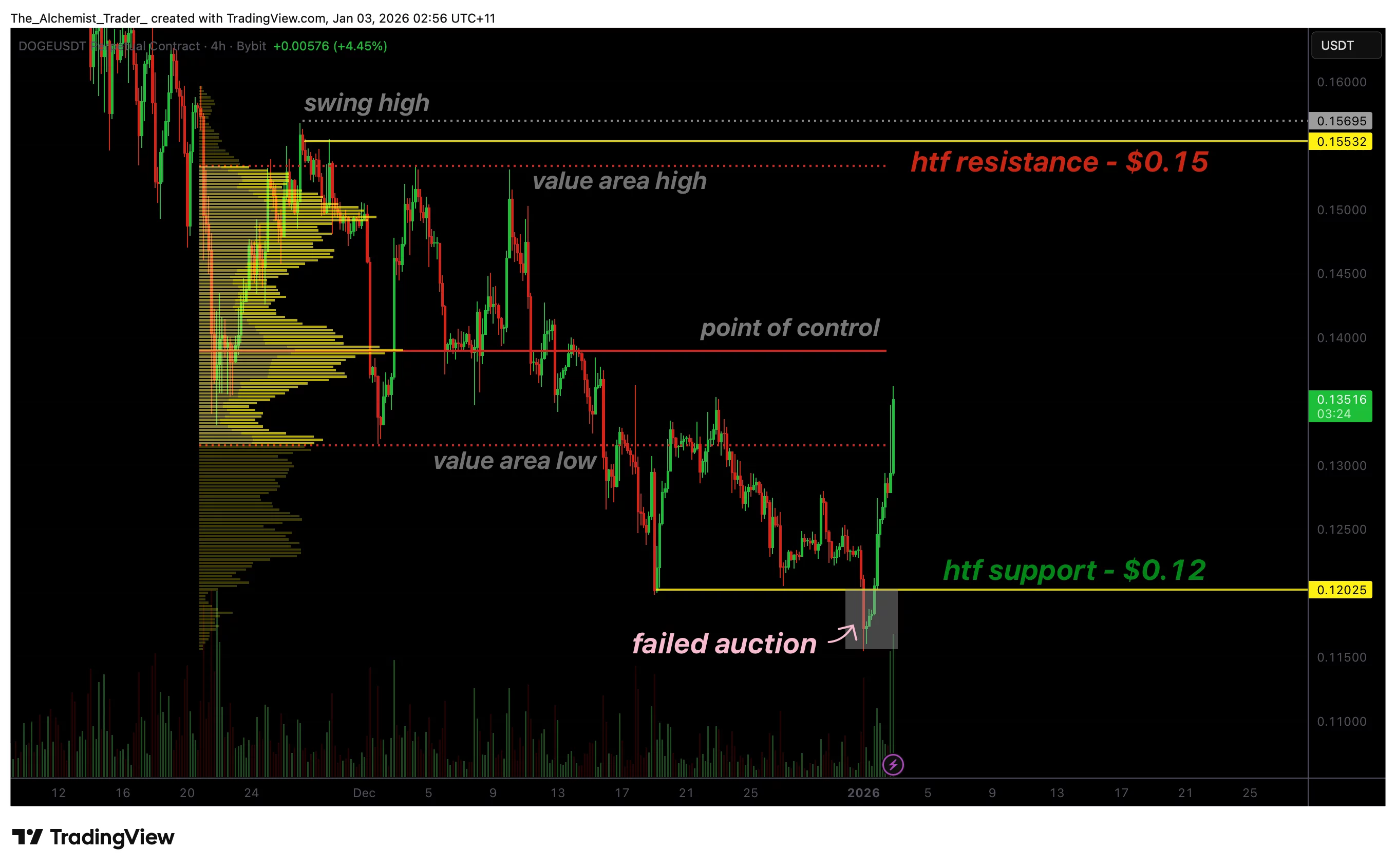

Dogecoin price reclaims $0.12 as failed auction hints at trend reversal

Dogecoin price has reclaimed the $0.12 level after a failed auction, signaling strong demand and raising the probability of a short-term trend reversal.

- A failed auction at $0.12 confirms strong buyer demand at support.

- Price has reclaimed the value area low, strengthening bullish momentum.

- A move above the point of control could open a rally toward $0.15 resistance.

Dogecoin (DOGE) price is showing early signs of a potential trend shift after reclaiming the key $0.12 level, following what appears to be a confirmed failed auction. This type of price behavior often marks an important inflection point, particularly when it occurs at high-time-frame support.

While Dogecoin has spent recent weeks trading within a broader corrective structure, the swift recovery back above $0.12 suggests that demand is actively absorbing sell pressure at lower prices. If this reclaim continues to hold, it could set the stage for a broader rotation higher within the current trading range.

Dogecoin price key technical points

- Failed auction confirms $0.12 support: Price briefly broke below support but failed to sustain acceptance lower.

- Value area low reclaimed: Acceptance above this level strengthens the bullish continuation case.

- Point of control is the structural trigger: A reclaim would signal a shift in market structure and trend direction.

The defining feature of Dogecoin’s recent price action is the failed auction around the $0.12 level. Price initially broke below this high-time-frame support, suggesting a potential continuation lower. However, that move was quickly rejected, with Dogecoin reclaiming $0.12 and returning back into its prior value area.

Failed auctions are an important concept in market profile and price action analysis, as they reveal areas where one side of the market lacks conviction. In this case, sellers were unable to sustain acceptance below $0.12, indicating that demand was strong enough to absorb sell orders aggressively. This type of rejection often acts as a catalyst for reversals, particularly when it occurs at established support.

Following the reclaim of $0.12, Dogecoin has also moved back above the value area low, which adds further technical significance to the move. Acceptance above the value area low suggests that price is no longer trading at a discount relative to recent value, increasing the probability of continuation toward higher levels within the range.

From a price action perspective, this reclaim indicates improving bullish control. Buyers are no longer defending price from below; instead, they are now supporting the market from within value. This transition often precedes a rotation toward the point of control, where the highest volume of recent trading has occurred.

Structurally, Dogecoin has been trading within a sequence of lower lows, keeping the broader trend biased to the downside, with DOGE showing concerning chart patterns as ETF momentum continues to stall. However, the failed auction and subsequent reclaim introduce the possibility of a structural change. If price can reclaim the point of control, it would break the pattern of lower highs and establish a higher high.

If Dogecoin continues to hold above the value area low and successfully reclaims the point of control, the next upside objective comes into focus near $0.15. This level represents high-time-frame resistance and aligns closely with the value area high, creating a natural magnet for price if bullish momentum persists.

What to expect in the coming price action

As long as Dogecoin continues to hold above $0.12 and maintains acceptance above the value area low, the technical outlook favors continuation higher in the short term. The failed auction suggests strong demand is present at current levels, increasing the probability of a rotation toward the point of control and potentially the $0.15 resistance zone.

You May Also Like

Why have Live Casino Games become so popular?

Pi Coin Price Prediction: New ‘Protocol v23’ Upgrade Goes Live – 100x Move?