Avalanche (AVAX) Hits $13 After 8% Jump: Will It Break Resistance or Hit a Pause?

- Avalanche rallied 8% and is trading at $13.

- AVAX’s trading volume has exploded by over 172%.

With the fear lingering in the market, the broader momentum is still in the hold of bears. Some of the major charts are in green with a brief spike, and a few hover in red. The largest assets like Bitcoin (BTC) and Ethereum (ETH) are attempting to escape the bearish zone, currently trading at around $89.3K and $3K, respectively.

Among the altcoins, Avalanche (AVAX) has registered an 8.84% surge in the last 24 hours. In the morning hours, the asset traded at a bottom range of $12.33, and with the bullish encounter, the price has managed to hit a high of $13.78. In between, certain resistance zones were broken to confirm the presence of the bulls.

At press time, Avalanche traded within the $13.42 mark, with its market cap settling at $5.75 billion. Meanwhile, the daily trading volume has exploded by over 172.55%, reaching the $596.74 million level. The Coinglass data has exhibited that the market has seen a liquidation of $1.48 million worth of AVAX during this period.

Is Avalanche Ready for Another Push Up?

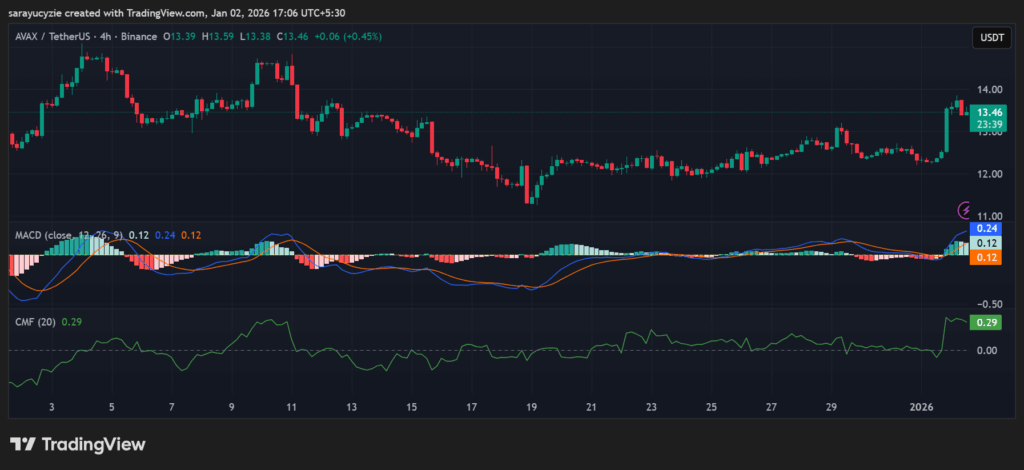

Avalanche’s price chart reveals the upward momentum, and it could climb toward the resistance at around $13.62. Assuming the bullish pressure strengthens, the golden cross might emerge and send the price up to test the $13.82 range.

If a reversal occurs, the bears might push down the Avalanche price to the support at $13.22. In case the downside correction gains more traction, the death cross could form, and likely drive the asset’s price to a low of $13.02 or even lower.

AVAX chart (Source: TradingView)

AVAX chart (Source: TradingView)

The Moving Average Convergence Divergence (MACD) line of Avalanche is found above the signal line, implying a positive outlook. Upon it staying as this, the trend may continue to move upward. Moreover, the asset’s Chaikin Money Flow (CMF) indicator at 0.29 points to strong buying pressure in the AVAX market. The capital is flowing into the asset, supporting the bullish trajectory.

Besides, AVAX’s Bull Bear Power (BBP) reading of 0.93 signals that bulls are in control, pushing the price above, outweighing selling pressure. The momentum tends to favour the upside as long as it is positive. Avalanche’s daily Relative Strength Index at 65.85 hints at a strong bullish sentiment. It may approach the overbought zone. If RSI moves above 70, it may cause a potential pullback.

Top Updated Crypto News

PEPE Rockets 27%: Is the Momentum Sustainable or a Classic Meme Coin Trap?

You May Also Like

Standard Chartered Predicts a $2 T Stablecoin Cap by 2028 as BTC Faces a Fair Value Gap 📊