Why Is the Shiba Inu (SHIB) Price Up Today?

The second-biggest meme coin started the year on the right foot, with one analyst suggesting it may post an explosive pump in the near future.

Nonetheless, some key factors hint that this could be a brief recovery that could soon be replaced by a renewed correction.

SHIB Enters Green Territory

The self-proclaimed Dogecoin killer pumped by 8% over the past 24 hours and is currently trading at around $0.000007593 (per CoinGecko’s data). Its market capitalization neared $4.5 billion, solidifying SHIB as the 35th-biggest cryptocurrency.

SHIB Price, Source: CoinGecko

SHIB Price, Source: CoinGecko

Perhaps the most evident catalyst for the rebound is the overall revival of the broader meme coin sector. Dogecoin (DOGE), the undisputed leader of the realm, is up 10% on a daily scale, while other popular tokens such as Bonk (BONK), Pudgy Penguins (PENGU), Pump.fun (PUMP), and Pepe (PEPE) have charted even more impressive gains.

Another factor that may have positively impacted SHIB’s valuation is the resurgence of the burning mechanism. Data shows that the team behind the meme coin and its community have scorched almost 200 million tokens in the past seven days, representing a 533% increase over the prior week.

The program aims to reduce the overall supply of SHIB, thus making the asset scarcer and potentially more valuable in time. The total amount of coins burned since the initiative’s introduction in 2022 is more than 410.7 trillion, meaning the circulating supply currently stands at roughly 585.2 trillion.

SHIB Supply, Source: shibburn.com

SHIB Supply, Source: shibburn.com

Touching upon the recent price rally of SHIB was X user Anup Dhungana. He suggested that the asset is now retesting a key long-term support, which in 2021 and 2024 was followed by “explosive pumps.”

The Bearish Scenario

Despite the solid gains, SHIB is not out of the woods yet (as some key indicators signal). The token’s Relative Strength Index (RSI) has climbed above 70, indicating the price has rallied too fast over a short period and could be due for a pullback. The technical analysis tool ranges from 0 to 100, and readings below 30 are typically considered bullish territory.

SHIB RSI, Source: RSI Hunter

SHIB RSI, Source: RSI Hunter

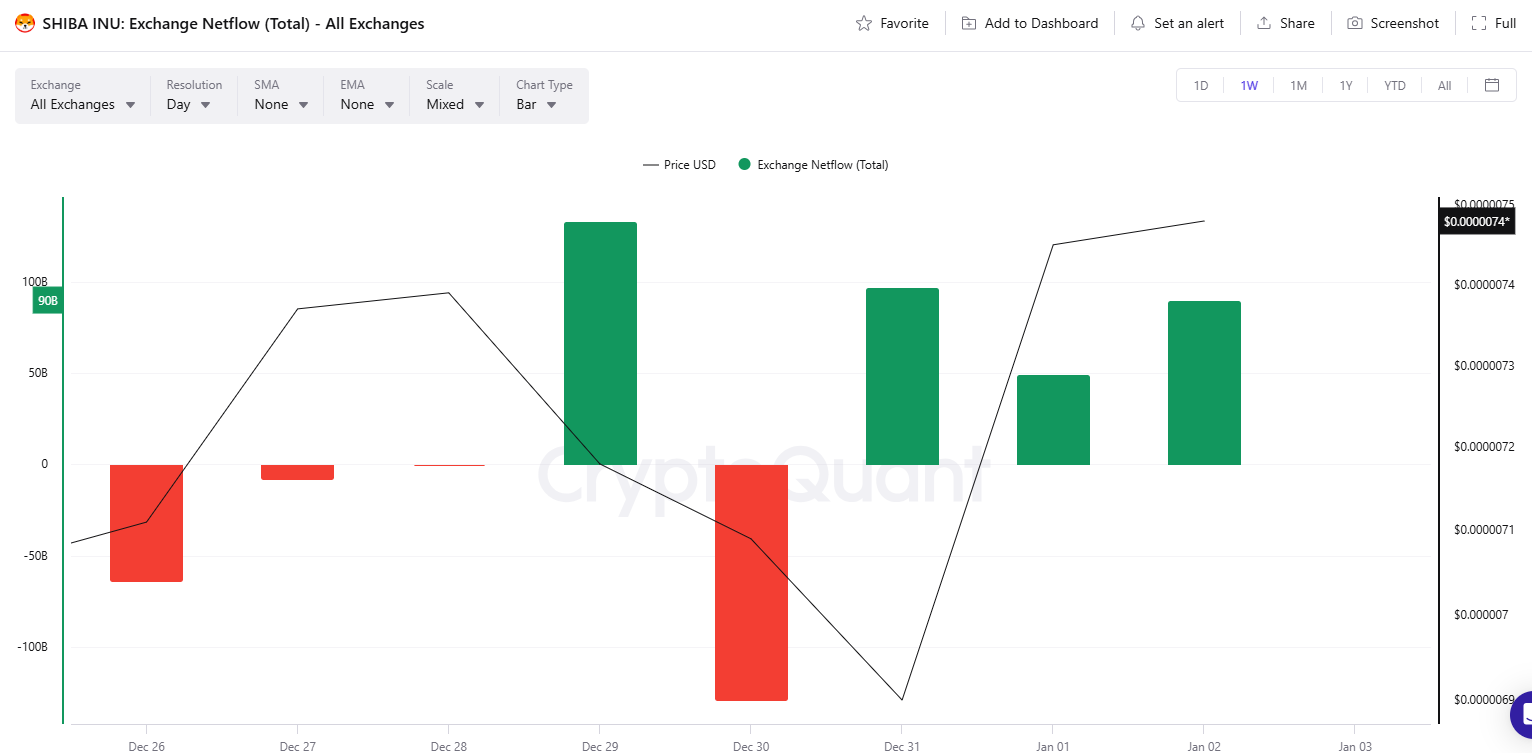

SHIB’s recent exchange netflow is also worth observing. Inflows have surpassed outflows over the past week, suggesting some investors may be positioning for a sell-off.

SHIB Exchange Netflow, Source: CryptoQuant

SHIB Exchange Netflow, Source: CryptoQuant

The post Why Is the Shiba Inu (SHIB) Price Up Today? appeared first on CryptoPotato.

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

US Treasury Backs Limited Framework for Crypto Mixers