Best Crypto to Buy Now: Expert’s Top Picks for January 2026

Every crypto cycle sparks the same question: are meme coins finished, or is the next 100x winner quietly forming? As 2026 approaches, many meme coins show weak prices and fragile sentiment. For cautious investors, this can feel discouraging.

Yet history shows that downturns often hide opportunity. Capital has not vanished; it has simply become selective. Bitcoin has once again become the default safe haven, while meme coins experience double-digit declines.

This rotation is not a death sentence for the sector. Instead, it often acts as a reset, creating fertile ground for the next generation of high-potential projects.

Source – Insidebitcoins YouTube Channel

From Memes to Utility: Best Crypto Presales to Buy in 2026

Meme coins are the purest expression of risk in crypto and are typically the first to fall when confidence wanes. While trading volume may remain high, much of it reflects capital exiting rather than new money entering.

Established names like Dogecoin, Shiba Inu, and Pepe maintain liquidity even during downturns, but smaller hype-driven projects often experience sharper declines.

Regulatory uncertainty has also dampened interest in politically themed coins. When the only value proposition is price appreciation, there is nothing to anchor demand during periods of caution.

This makes early-stage presales highly appealing, and identifying the best crypto presale to buy now can reward engagement and utility rather than passive holding.

Where Opportunity Shifts Quietly

During market downturns, many innovative projects quietly build their foundations. Presales benefit from reduced volatility, fixed pricing, and clear development timelines, allowing projects to grow without constant reliance on speculative inflows.

Savvy investors in 2026 are looking for token presales that combine utility, gamification, and strong community engagement. Among the most promising are Bitcoin Hyper, Pepenode, and Maxi Doge, each taking a unique approach to meme coins.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is designed to make Bitcoin more useful without requiring holders to sell it. The core idea is that Bitcoin owners can earn or use their Bitcoin while maintaining long-term exposure.

Instead of selling, users move their Bitcoin into a fast Layer 2 environment where staking, trading, and other activities are possible. The system uses Solana-inspired technology for high-speed, low-cost transactions, and users can transfer Bitcoin back to the main network when finished.

To ensure security, Bitcoin Hyper relies on a canonical bridge and zero-knowledge proofs, making deposits and withdrawals as trust-minimized as possible while reducing reliance on third parties.

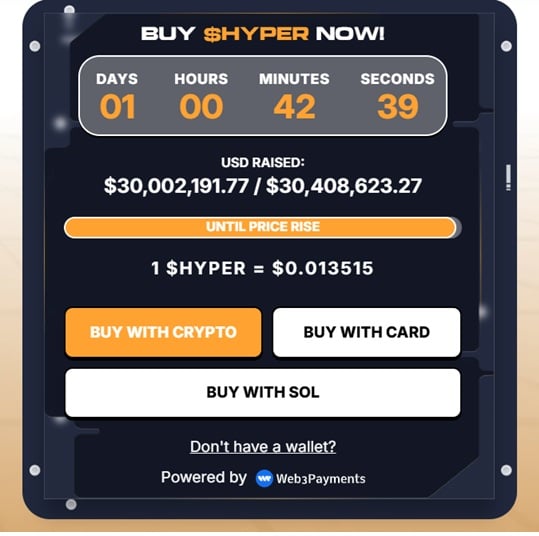

Market interest has been strong, with the presale reaching the $30 million milestone, signaling significant early demand. Staking rewards of around 40% APY are available before any exchange listing, attracting early participants.

Bitcoin Hyper appeals to holders who believe Bitcoin should be productive rather than idle. Its long-term success depends on widespread adoption and trust in the system, making early engagement a potentially rewarding opportunity.

Visit Bitcoin Hyper

Maxi Doge (MAXI)

Maxi Doge is built for traders who treat meme coins as a competitive game rather than a long-term hold. Instead of buying and waiting, users participate in trading challenges, weekly leaderboards, and performance-based rewards for strong returns.

Planned partnerships with futures platforms aim to deepen this competitive setup. In this model, the community is not an afterthought, the community itself is the main product.

The project positions itself as an aggressive challenger in the meme coin space, using bold branding and a trading-focused narrative to capture attention. Rather than relying on subtlety, Maxi Doge leans fully into visibility and momentum, which are often decisive in meme-driven cycles.

The presale has raised more than $4.3 million so far, and staking offers roughly 70% APY. This demonstrates that the project is designed around participation and activity, not passive holding. Compared to established names like Dogecoin, Maxi Doge represents a smaller, earlier-stage opportunity with higher upside potential.

Visit Maxi Doge

Pepenode (PEPENODE)

Pepenode takes a unique approach compared to typical meme coin projects. Rather than buying a token and passively watching price movements, it offers an interactive, game-style mining simulation.

Participants purchase virtual miner nodes and actively manage them, building infrastructure, optimizing hash rates, managing energy consumption, and improving rewards. The goal is to keep users engaged even during quieter market periods.

The platform combines play-to-earn mechanics with competitive features such as leaderboards, and planned rewards are tied to well-known meme coins like Pepe and Fartcoin, reinforcing its meme-focused identity.

Token upgrades require burning tokens, creating deflationary pressure over time. Interest in Pepenode has grown steadily.

The presale has raised over $2.5 million, with the current token price around $0.0012161, and staking offers an impressive 540% APY for early participants.

With the presale ending in less than a week, early access tools like Best Wallet make it simple for users to join and manage their tokens, even without advanced technical knowledge.

Visit Pepenode

The Rising Standard for Meme Projects in 2026

The next generation of meme projects in 2026 is evolving beyond viral branding. Success now requires a combination of memes, utility, gamification, and community engagement.

Some projects aim to make existing assets productive rather than idle, while others keep users active through challenges, simulations, and reward systems. In these models, the community is central to value, not just a side effect of speculation.

Projects that survive and thrive will engage users beyond price movements, actively foster their communities, and design token systems that reward participation rather than passive holding.

Meme coins are not finished, but the standard for success has risen.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

The United States Could Start Buying Bitcoin In 2026