FTX’s first round of repayments begins, and 11.2 million SOLs are about to be unlocked, triggering market selling pressure and anxiety. Is this an overestimated “wolf is coming”?

Author: Frank, PANews

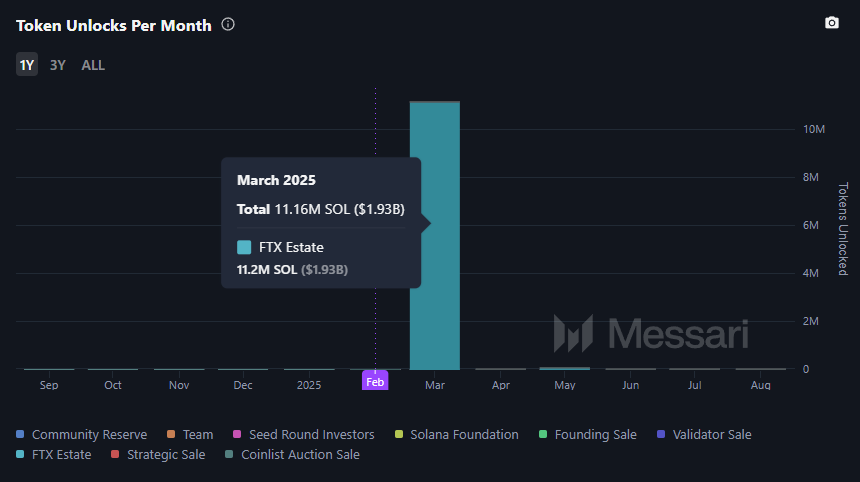

On February 18, 2025, the first round of FTX creditor compensation was officially launched, marking the critical stage of the two-year bankruptcy liquidation. However, the market is focused on another potential risk: on March 1, the 11.2 million SOL tokens auctioned by FTX in bankruptcy will be unlocked, with a value of up to US$1.9 billion. Although the settlement of compensation in fiat currency seems "mild", the expected huge circulation of SOL has caused market concerns, and the aftermath of FTX's asset sales will once again impact the crypto ecosystem. Is panic spreading too much, or are risks not yet fully priced?

There is still more than 5 billion outstanding in the first round

According to public information, the creditors who received compensation in this round are the initial beneficiaries, which refers to small creditors with claims of $50,000 or less. According to FTX's restructuring plan, they will be fully repaid and enjoy an annual interest rate of 9%. These users may eventually receive a 119% repayment in fiat currency.

According to FTX creditor Sunil, this round of repayments has paid about $800 million, covering 162,000 accounts, accounting for 35% of the estimated 460,000 eligible claim accounts. In addition, repayments greater than $50,000 will have to wait until after May 30.

Previous reports showed that the total repayment plan for the first phase involved an amount of $6.5 to $7 billion. This round of repayment is expected to last until March 4. However, FTX has not yet announced the actual amount of the first round of repayments.

From the perspective of repayment alone, since FTX has chosen fiat currency as the compensation method, the initial repayment may not cause too much turmoil in the crypto market, and may even bring some new funds into the market.

Nearly $2 billion worth of OTC SOL tokens unlocked

The market panic about FTX mainly comes from the auction of crypto assets such as Solana. Documents as of 2023 show that FTX's total assets are only $4.77 billion, a gap of $6.8 billion from the estimated $11.5 billion compensation at the time. As the crypto market ushers in a bull market in 2024, the crypto assets held by FTX will see a sharp rise.

Among them, Solana has given the most blood transfusion to FTX. The SOL token has increased by more than 28 times since December 2022. As one of Solana's major investors, FTX holds a large number of locked SOL tokens. According to the monitoring data of @ai_9684xtpa, FTX has sold 41 million SOL through three auctions as of February 17. Among them, 11.2 million will be unlocked on March 1.

According to reports, these 41 million tokens were not sold directly through the secondary market, but by Galaxy (25.52 million at $64), Pantera and other buyers (13.67 million at $95), Figure and other buyers (1.8 million at $102). In total, these tokens brought FTX $2.932 billion in revenue, becoming the largest category of liquidation income in the crypto asset class.

Regarding the unlocking of SOL tokens, this transaction should have been completed through auction before, and the unlocking is just a delivery. Of course, no matter who the final controller is, these tokens will enter circulation, and the cost of these known buyers is far lower than the market price. Therefore, there is indeed a risk of profit selling, but the number of SOLs to be unlocked only accounts for 2.3% of the current circulation.

Sui has repurchased its equity, and the disposal methods of APT, AVAX and other assets are unknown

In March 2024, FTX announced that it would sell its shares and tokens invested in Mysten Labs for $95 million. Mysten Labs is the developer of the Sui network. By the end of 2024, these sold shares and tokens are worth up to $4.6 billion. For the market, if FTX retains these tokens, the market for SUI will face greater pressure.

In addition to Solana and Sui, Aptos was also one of the public chains that FTX focused on investing in. According to media reports, in 2022, FTX Ventures and Jump Crypto led Aptos' $150 million financing. However, as of now, Aptos has not announced the final results of the disposal of this part of the equity. According to data provided by FTX in March 2023, the number of APT tokens held at that time was 5 million. However, in the FTX on-chain address of ARKM, no data information on APT tokens has been found. Calculated at the price on February 19, this part of APT is worth approximately US$31.65 million.

As of February 19, the largest token held by FTX on-chain addresses is FTT, with a total of 257 million tokens, worth approximately $505 million. The total market value of FTT is only $657 million. If it sells its holdings, price shocks may become the biggest risk. FTX once asked users to fill in the price of purchasing FTT, but FTT is temporarily counted as 0 in the legal currency-denominated compensation. It is not yet clear how FTT holders will be compensated.

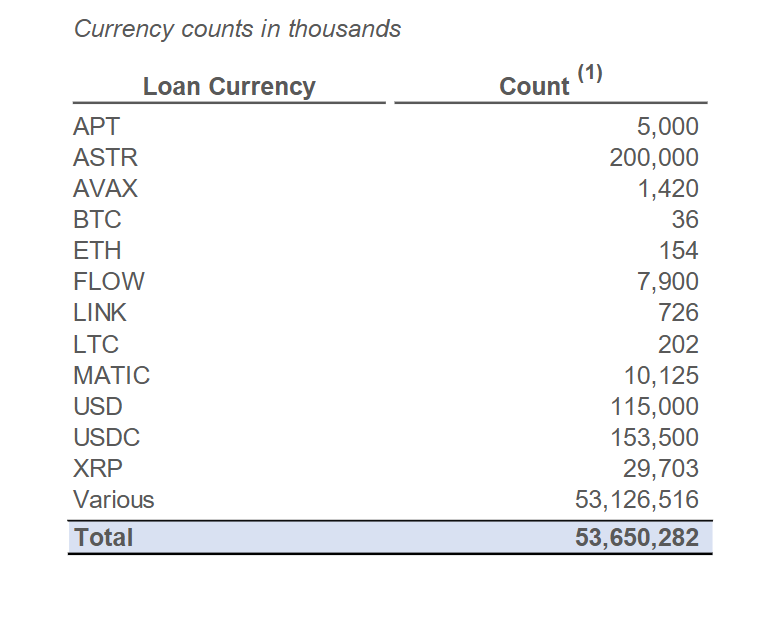

In the documents disclosed in 2023, it is shown that FTX also holds 1.42 million AVAX (worth $33.76 million), 36,000 BTC (worth $346 million), 154,000 ETH (worth $410 million), 29.7 million XRP (worth $76.32 million) and other major crypto assets. However, as of February 19, these assets are no longer visible on FTX's public wallet address, and have been sold during the liquidation period. As of February 19, FTX's on-chain address holdings are worth approximately $1.269 billion.

With the start of FTX's repayment, the FTX bankruptcy incident is finally coming to an end. After more than two years of transformation, the entire crypto industry has begun a new pattern, and FTX's impact on the industry has gradually become a part of history. The so-called recent market decline caused by FTX seems more like a figment of the imagination or a panic during the current market turmoil.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy